Election 2017: Older age - the white hot issues not even being discussed

- Published

Social care is one of a handful of issues that have dominated the election campaign so far. But the UK's ageing population faces many other challenges.

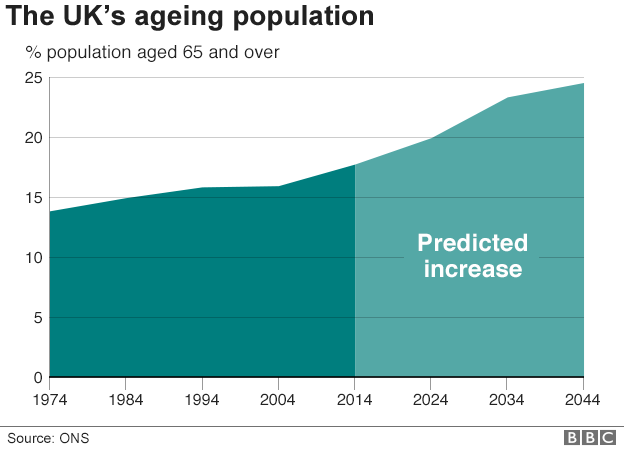

Leave them and they could become even more problematic. Today one in six of the population is over the age of 65. Within three decades that will rise to one in four.

Among the rarely, if ever, discussed issues facing older people, listed below, are the £3bn+ of unclaimed benefits and the anachronous division between social care and health care.

The plague of loneliness

Loneliness is a word that does not seem to have been mentioned during the election campaign, but it is one of the most pressing issues for older people.

More than one million over 65s - about one in 10 - are said to be "chronically lonely". That is they feel so alone that it is a risk to their wellbeing.

Research suggests those who suffer extreme loneliness are 30% more likely to die prematurely and are higher users of GP and social care services.

Another three million report they feel isolated to such an extent that their main form of company is the TV.

The cause? People are living longer, families are more dispersed and traditional services such as lunch clubs have been cut.

Charities such as Age UK and the Campaign to End Loneliness have been seeking to raise attention about the issue.

But there are no easy solutions. Ailing health and mobility problems make it difficult for some of the oldest members of society to get out.

However, loneliness is not a condition the NHS can treat. Instead, councils and charities have invested in befriending schemes to link up older people with younger community members. But with budgets tight these have remained pretty small-scale.

The unclaimed benefits conundrum

Pension Credit is a top-up benefit for older people on low incomes. However, only six out of 10 households entitled to claim it, do.

That's about 1.4 million families missing out, according to figures from the Department for Work and Pensions (DWP) published last year.

The same data reveal that up to £3.1bn in Pension Credit went unclaimed - the equivalent of about £2,000 per year for each family entitled to receive Pension Credit which did not claim it.

The take-up level has been stubbornly similar for a number of years. The DWP says that a lack of awareness of these entitlements and the perceived stigma of claiming benefits are thought to be among the reasons people failed to make a claim.

This has been echoed by charity Age UK, which points out the total of unclaimed benefits among pensioners rises to £3.5bn when housing benefit is taken into account.

The Conservatives have raised the possibility of winter fuel payments being means-tested. The Lib Dems have suggested entitlement could be limited. One possible way of means testing is by linking entitlement to Pension Credit.

So, for those who fail to claim, the losses could potentially be higher than now.

Another missed opportunity for pensioners are the millions of pension savings pots lying dormant. These are often small pots of savings from workplace pensions when employees spent a short time in jobs and have moved on since.

The NHS is getting scraps

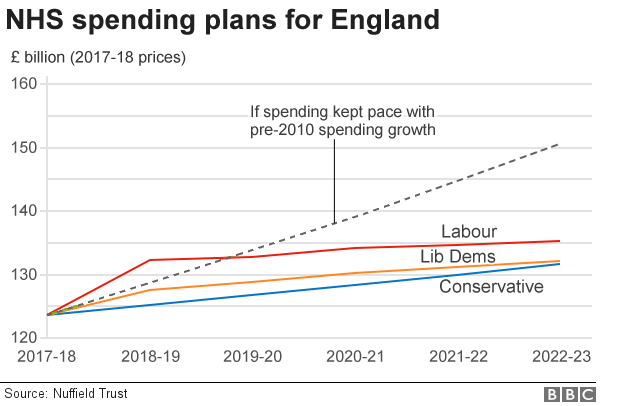

The manifestos mention how much more money each party wants to give the NHS. The Tories are promising an extra £8bn a year in England, Labour even more, while the Lib Dems want to raise income tax by a penny-in-the-pound.

But this could be said to be small change. Why? Well, take a look at the graph below. It has been produced by the Nuffield Trust think-tank.

The trust has estimated how the budget would rise under all three main parties (it's not an exact science because the manifestos do not give precise details of how and which bits of the budget are due to go up).

As you will see there is not much difference between the three parties. By the end of the next Parliament, in 2022, just £3bn separates them.

Despite all three pledges representing a rise even after inflation, they are still a long way short of what the health service has traditionally received.

Prior to 2010, the NHS was getting the equivalent of an extra 4% a year above inflation. As you can see, if it got that in the coming Parliament the parties would need an additional £18bn to £21bn a year by 2022.

The Nuffield Trust concluded none of the parties were prepared to spend enough on the NHS - not something you're likely to catch them saying.

The current system is past its sell-by date

The NHS and social care system was launched after World War Two as part of a "cradle to the grave" welfare state.

A new national structure was established for the health service to provide care free at the point of need, while councils were left to provide means-tested support to the elderly with day-to-day tasks.

But back then people reached the "grave" much quicker. Life expectancy was 66 for men and 70 for women. Today it is 79 and 83 respectively.

Not surprisingly, the ageing population has started to take its toll on the public purse.

Almost 30p of every £1 spent on public services goes on health alone, nearly treble the amount that was spent in the 1950s.

Despite the ever-rising demands, the two care systems remain largely the same.

Why not try something completely different? Merging the two systems? Social insurance? Charging?

Clearly any changes along those lines would prove controversial, but with them not being discussed the debate remains pretty narrow.

Delay in tackling pension fraud

Pension fraud in not always a crime against pensioners, In fact, those who are younger than 55 often have the biggest losses. Generally, it is when con-artists trick people into releasing money saved for a pension, persuading them to invest in shady ventures.

For those under 55, the tax charge for doing so is high, whatever the victim's age.

Savers can now take pension pots as cash from the age of 55, subject to the normal rates of tax.

Fraudsters want to get their hands on this money, so they make offers of investments in hotels in exotic locations or "ethical" projects offering massive returns.

Those returns never materialise. Sometimes con-artists simply steal the money.

City of London Police figures suggest that £42m has been lost to this kind of fraud since the pension rules were changed in April 2014.

The irony is that action on this issue has been postponed by politics. The general election delayed a plan to ban pension cold calling of this kind, and little - if anything - has been said of it during the campaign.

Ex-pensions ministers, legitimate companies and consumer campaigners have argued a ban is needed as soon as possible. One said that fraudsters would "go into overdrive" until this route to victims is cut off.

Pensioner poverty

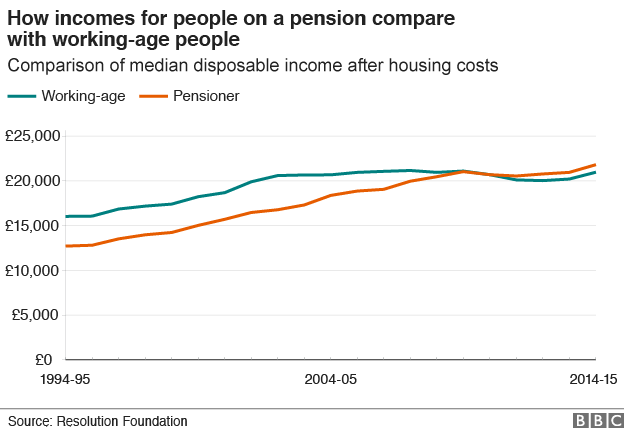

Much has been said about pensioner incomes growing faster than the incomes of working-age households.

And this graph from the Resolution Foundation shows that the typical pensioner household is now better off than the typical working-age household.

However, the graph shows incomes after housing costs have been paid. They are usually higher for working-age households. It also does not take care home fees into account.

While average pensioner incomes are rising, there remains a group of older people who are in poverty, and have been for some time.

The latest official figures show, for most years since 2008, the proportion of 65s or over in persistent poverty has been higher than any other age group.

Persistent poverty is defined as experiencing relative low income in the current year, as well as at least two out of the three preceding years, the Office for National Statistics (ONS) says.

In 2014 - the latest available figures, external - some 9.1% of the 65 and overs were in persistent poverty. Although falling since 2010, this was a higher proportion than working age people.

The figures also show 41% of those aged 65 or over were at risk of poverty at least once between 2011 and 2014, compared with 29% of those aged 18 to 64 and 34% of under-18s.

Many of the worst-off do not have internet access, blocking them off from some of the cheapest deals on energy, banking and insurance.

That is why some charities say, even though pensioners on average have done better than most in recent years, it would be wrong to think pensioner poverty has been eradicated.

Additional reporting by Kevin Peachey

- Published8 February 2017

- Published26 May 2017

- Published18 May 2017