Reality Check: How would Lib Dems fund NHS plans?

- Published

The main political parties have all announced commitments for extra NHS spending in their manifestos. Reality Check takes a closer look at the Liberal Democrats' plans.

What's the policy?

The Liberal Democrats say they would increase NHS and social care spending in England by £6bn a year by 2022. This is money on top of the government's existing plans.

Out of that £6bn, £2bn has been earmarked for social care - leaving an additional £4bn for the NHS.

Extra money would start to go into the health service from 2018, with the full increase taking effect from 2022.

Outside of England, it will up to the devolved governments in Wales, Northern Ireland and Scotland to choose whether to spend the money on health or elsewhere.

How would it be funded?

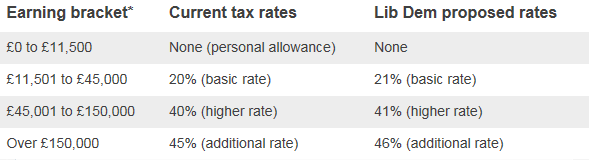

The Lib Dems say they want an extra penny on each existing income tax band - that's the basic, higher and additional rates. The party says this would raise £6.3bn a year.

*This excludes Scotland, which has different income bands

Rather than all going into the Treasury's coffers, this extra money would be ring-fenced so that it's only spent on NHS and social care. This is known as a hypothecated tax.

In the longer-term, the party would replace its income tax rise with a "health and care tax", possibly based on a reform of National Insurance contributions.

Under this new system, deductions would appear on workers' pay-packets, setting out the proportion of tax going to the NHS and on social care.

What does it mean for pay packets?

As the independent Institute for Fiscal Studies (IFS) observes, the tax plans would affect all the 30 million adults who pay income tax in the UK.

That still leaves a considerable number who won't be affected.

The IFS says 45% of adults currently pay no income tax at all, as their incomes are below the personal allowance, which currently stands at £11,500 a year.

The Lib Dems says their plans will mean that someone earning £15,000 would pay an extra £33 a year in tax, with someone on £50,000 paying an extra £383.

According to party leader Tim Farron, the policy will mean an average person paying an extra £3 a week.

"A pint of beer a week to pay for a health and social care service that will last us from cradle to grave," Mr Farron said.

Those towards the bottom of the income scale may still stand to benefit, despite the increase in the basic rate of tax.

That's because the Lib Dems are also planning to cancel a number of welfare cuts that are planned over the next few years.

The IFS believes the £6bn the Lib Dems expect to raise is much more certain than the extra revenue forecast by Labour's income tax rise.

The reason, according to the IFS, is that the Lib Dem plans are less dependent on the income group at the very top.

This group is more likely to take measures to avoid paying extra tax (eg putting more money into their pension pots, leaving the country).

Previous 1p pledges

It's not the first time that the Lib Dems have called for a 1p tax rise.

In their 1997 and 2001 manifestos, the Lib Dems pledged to put an extra penny on the basic rate of income tax to pay for their education plans.

Is this a lot of money in the context of health spending?

According to the Nuffield Trust, health spending in England - after being adjusted for inflation - is currently set to rise from £123.7bn this year to £126.5bn in 2021.

This works out, according to Nuffield Trust analysis, at an average increase of 0.75% a year above inflation.

By comparison, the Lib Dem plans work out at a 1.4% increase a year above inflation, according to separate IFS calculations.

While this is certainly more than the current spending plans imply, it is still less than the historical average.

According to the Office for Budget Responsibility (OBR), external, since 1978 UK health spending has grown at an average of 3.8% a year after inflation is taken into account.

Going forward, the OBR also says that pressure on the budget will grow at 4% a year as a result of a growing and ageing population.

- Published6 May 2017

- Published26 April 2017

- Published19 May 2017