What's in Donald Trump's tax returns?

- Published

On 23 September 1952, vice presidential candidate Richard Nixon gave a speech laying out "everything I have earned, everything I have spent and everything I own".

He concluded by challenging the Democratic candidate for president, Illinois Governor Adlai Stevenson, to do the same. Governor Stevenson took the challenge one step further, releasing his personal tax returns - the clearest account of an individual's income for the year.

The move was not reciprocated by Nixon or his running mate for president, Dwight Eisenhower.

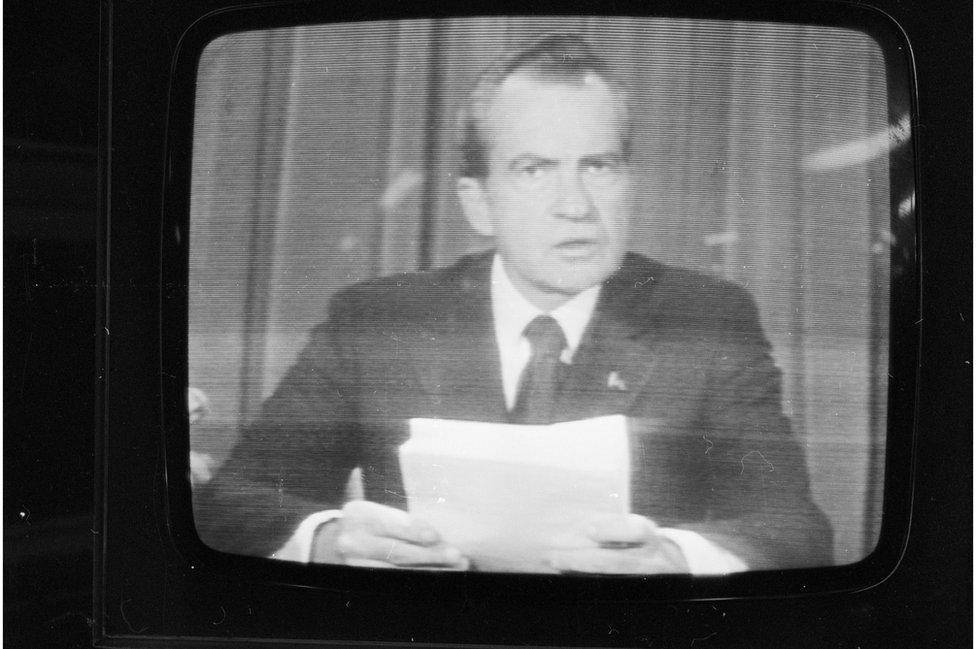

Two decades later though, at the height of the Watergate scandal and under audit by the US tax authority - the Internal Revenue Service (IRS) - then-President Nixon made his tax returns public in hopes of clearing the air.

President Richard Nixon was the first sitting president to release his tax returns

The move did not work, but it set a precedent for making tax filings public.

"It's proof you have nothing to hide," says Joe Thorndike, a tax historian at Tax Analyst.

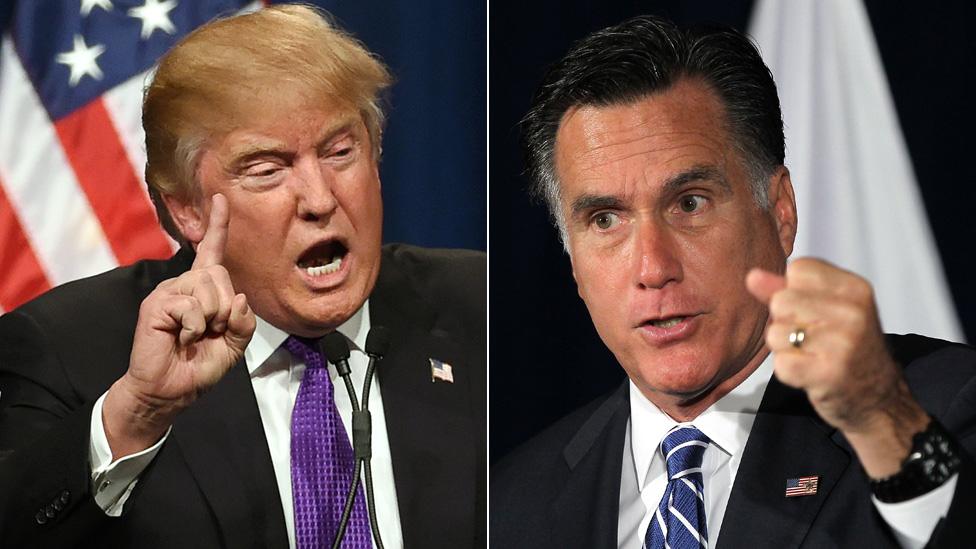

Donald Trump says he needs no such proof.

Claiming to face his own audit the presumptive Republican nominee has refused to release his tax returns, even as public pressure mounts for him to do so.

Every US presidential candidate since 1976 has released their tax returns, but there is no law requiring it.

Donald Trump tweeted a picture of himself signing his tax return but no actual tax information

What's in the returns?

Mr Trump's refusal to release them has led to mounting speculation about what he could possibly be hiding.

"Tax returns are sort of black and white and you sign your name to say this is accurate. It's not open to interpretation," says Mr Thorndike.

The first thing the public would find is what tax rate Mr Trump pays. The candidate has bragged about paying a very low tax rate and taking advantage of the complex US tax code with its many loopholes.

Donald Trump with his three oldest children

"Mr Trump is proud to pay a lower tax rate, the lowest tax rate possible," one of his top aides has said.

An investigation by the Telegraph newspaper found Mr Trump was involved with a deal to evade $20m (£13.5m) in US taxes.

It's possible his returns may hold similar bombshells, but Mr Trump's admission that he does his best to avoid taxes will likely make these less explosive.

Net worth

One line of thinking has it that the returns would give a better sense of how much Mr Trump is worth. The New York billionaire has given several different figures for his net worth, which have all been higher than estimates by financial experts and publications like Forbes magazine.

But discovering whether Mr Trump is inflating his net worth may not be as easy as some hope from his tax returns.

Tax forms focus on income for the year, not total worth.

It may be possible to tell how much income Donald Trump made in a given year, but the complex way his companies earn money will still make this difficult. US real estate professionals can take tax losses based on the depreciation and other expenses for their buildings. This could allow Mr Trump to report having less income and therefore place him in a lower tax bracket.

Business sense

While we may not get an exact number for Mr Trump's wealth, it is likely the returns would give a more detailed picture of his businesses.

The forms would show how much profit and loss the companies he owns distributed to him in a year. It would not give a full account of the worth of those businesses because not all profit is distributed to the owners - some is put back in to grow the business - but it would give a sense of the activity.

One thing a tax return would definitely show is how much Mr Trump gives to charity.

Section of standard US tax form for claiming charitable donation deductions

Mr Trump claims to give millions to charitable causes and organisations; if true, his tax form would prove that. Americans are allowed to deduct charitable donations of over $250 (£170) from their tax bill. If the real estate mogul donated as much as he claimed, it should appear on his tax deductions form.

Scandals

Mr Trump has said he will release the returns after the audit, but doing so before would hurt his interaction with the IRS.

A person is not prohibited from releasing their tax returns during an audit - President Nixon was facing an audit when he released his - but many tax professionals do advise against it.

"Everyone is going to look at them and find something suspicious. If the statute of limitations is open the IRS might feel pressured to do an audit," says Robert Kovacev, from the law firm Steptoe.

The IRS has three years in most cases to decide whether to audit a person. Mr Trump claims to have faced audits on a continuing basis for nearly a decade.

But others argue Mr Trump would have to be particularly unlucky or bad at filing his taxes to come under the IRS's microscope so often.

The IRS uses a computer program which scores tax filings. If there are a number of unusual signals on a particular form, it is then evaluated by a human who decides whether to do an audit.

Individuals who are audited are also typically given a pass in the following year if the same issues are flagged by the computer, because IRS officials have already looked into them.

As audits can take months, and even years, Mr Trump's tax returns may not be made public until after the election - if at all.

The bombastic candidate has bucked most political precedents until now, and it's possible releasing his tax returns could be yet another.

- Published25 February 2016