Children's TV 'in long-term decline' says Teletubbies creator

- Published

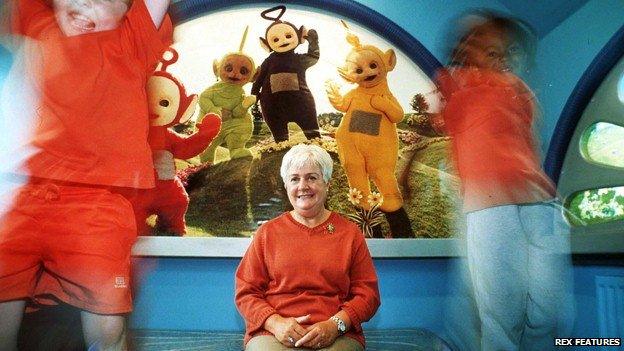

Anne Wood was made a CBE for her role in creating Teletubbies

Home-grown children's television programming is now in long term decline according to the creator of the Teletubbies, Anne Wood.

Speaking to BBC Radio 4's World This Weekend, Wood said the industry had been "struggling for many, many years".

Despite many more channels, "the number of people who commission in a serious way have disappeared", she added.

Earlier this month, the head of TV regulator Ofcom said children's TV is "not as good as it would ideally be".

Jo Killingley - who created the shows Big Cook, Little Cook and Get Squiggling! - agrees the market has become tougher.

"I think in the past channels like Channel 4, Channel 5, ITV had quotas they had to meet," she said. "Now they have gone.

"It would be brilliant if they were brought back as it would bring the kids' industry to life again."

Killingley said her company Dot-To-Dot had been "lucky" this year - they are about to start filming a new live-action series called Art Ninja - but she has experienced periods when "literally nothing" was being commissioned.

More repeats

Since Teletubbies was created 18 years ago, the amount of new children's TV programmes aired by public service broadcasters has dropped dramatically.

In 1998, repeats made up 38% of all children's programmes. In 2011, the figure was 91%, according to Ofcom, external.

Some argue that the ban on junk food advertising has decreased the revenue available to commercial broadcasters - but the BBC is also forecast to cut its spending.

The Teletubbies were seen in 120 countries and translated into 45 languages

Big Cook, Little Cook has been a success for production company Dot-To-Dot, but its director says years can go by without new commissions being made

Pact, the industry body for independent television producers, has recently called for a tax break, external for children's programmes.

"Our children's television production is respected worldwide and we hope that ministers will agree that this is a special part of cultural heritage that is worth government's support," said chief executive John McKay.

Pact says a tax relief scheme would boost co-production opportunities, particularly with the US market, and would improve exports of home-grown shows.

The body claims that only one in five of all children's programmes aired on British TV is made in the UK.

Ann Wood agrees that a "frightening proportion" of children's TV is now imported.

But for her, tax breaks are only part of the solution. She says a fundamental re-examination of the market is required.

"The health of the sector requires there to be more places where you can be properly commissioned - so if one channel doesn't take your work, you have at least got somewhere else to go with it because children are not getting diversity".

ITV says it continues to commission homegrown series, including animation Horrid Henry

ITV rejected the criticisms, saying that "whilst new commissions are commercially challenging, we do commission original UK children's content as part of our programming mix".

The broadcaster pointed out that its children's series this year have included "a 14-week run of Scrambled!, a fifth series of Fort Boyard: Ultimate Challenge and a further series of Horrid Henry, which will air later this year."

The BBC added: "BBC Children's works hard to support UK creative industries and is by far the biggest commissioner of UK kids' content from UK producers.

"Our television channels and websites continue to champion home-grown output and around three quarters of our output is British-made."

The government says it is committed to supporting the creative industries and it has already introduced three new tax reliefs for animation, video games and high-end television.

On the issue of tax breaks for children's programming, the Treasury says that: "Any proposal for new relief must be assessed for its effectiveness, wider economic impact, ability to stand-up against abuse and the cost to the exchequer."

- Published3 February 2011

- Published4 July 2014

- Published17 June 2014

- Published19 June 2014