Eight reasons Facebook has peaked

- Published

On the surface, Facebook is one of the most successful commercial propositions in the history of business. Its market capitalisation is today over half a trillion dollars. Shares are six times more valuable today than five years ago. Though they trade at a lower price to its forward earnings multiple than at any time since Facebook went public, in 2012, the overall picture is one of astonishing growth and wealth.

As the unmissable Miles Johnson, external wrote in the Financial Times this week: "The social network… is increasing revenues at more than 50 per cent a quarter and earnings per share at more than 70 per cent, making its profitability and growth light-years ahead of the average US-listed company".

That analysis comes in an article which suggests that, for now, Facebook, external is "valued at a discount to the wider market despite giddy growth". As short-term advice for investors, this strikes me as correct.

Yet the medium and longer-term picture look very different. In fact, Facebook is accumulating enemies and challenges at such a rate that its horizons have suddenly become somewhat clouded.

A bruised Mark Zuckerberg on the cover of the March edition of Wired magazine. The photo-illustration was created by Jake Rowland, a New York City-based artist.

It may seem madness, or voguishly contrarian, to argue that Facebook is a declining power. But here are eight reasons to think that, in terms of influence if not wealth, Facebook has indeed peaked.

1. A drop in users

In its latest earnings call, Facebook revealed that - for the first time - the number of active daily users in the US and Canada (its biggest market) dropped. This is remarkable. The drop was small, external: 184 million rather than 185 million. But it was a drop, and the first time there has been a drop, and the drop preceded the changes Mark Zuckerberg announced about making the news feed prioritise "meaningful interactions" and de-prioritise content from news publishers.

2. A drop in engagement

Perhaps even more worryingly for the social media giant, it wasn't just the absolute number of users that dropped in that key market. It was also the amount of time they spent - in other words, engagement dropped too. Facebook reported that the amount of time users spend on Facebook had fallen by 50 million hours, external every day. That is a whopping drop. It suggests that the experience of the news feed had become less sticky, or addictive. But that would also make it less attractive to the advertisers who fund Facebook.

3. Advertiser enmity

Talking of which, Facebook's greatest vulnerability could be a massive retreat from advertisers. Just this week, Unilever's chief marketing officer, Keith Weed, said that consumer trust in social media has plummeted. He threatened to pull money out of not just Facebook but Google too. What if other big advertisers followed? There is already a remarkable enmity between some advertisers and big tech firms, over the latter's alleged secrecy about the users being targeted by ads. Many senior figures in advertising who I have spoken to say they despise what they see as a lack of transparency from the big firms. On top of all this, Facebook has been forced to admit in the past that it wildly over-estimated, external how much time viewers spend watching videos on its platform. All this adds up to a potential flight of advertisers from Facebook, which could eventually be terrible for its business model.

4. Disinformation and fake news

Justifying his position, Keith Weed said "people are becoming increasingly concerned about the impact of digital on wellbeing, on democracy - and on truth itself". I've written before about whether democracy can survive Facebook. It is very clear that the investigation into Russian involvement in the election of Donald Trump will look at the use of the platform by those around the Kremlin. Moreover, Hillary Clinton argued last year that Facebook had been a fundamental cause of her narrow defeat. If Facebook, which sets itself up as a mission-driven company that wants to make the world more open and connected, becomes known as the bad guy whose disinformation undermined the will of the American people, well, that's bad for its reputation.

5. Former executives speak out

Also terrible for the company's reputation is the sustained attack it has come under from former senior executives. In recent months, they have really turned against it. Chamath Palihapitaya, external, former vice-president of user growth, said: "The short-term, dopamine-driven feedback loops that we have created are destroying how society works. No civil discourse, no co-operation, misinformation, mistruth." He followed many others doing the same, including Sean Parker, founding president. The reason this matters isn't just the bad headlines it leads to. If Facebook's reputation in Silicon Valley takes a hammering, it may be a barrier to the acquisitions (Instagram, WhatsApp etc) that can power future growth.

Margrethe Vestager, the European Commissioner for Competition, has the tech firms in her sights

6. Regulatory mood is hardening

In both Europe and America, regulators are waging a kind of war of attrition against Facebook, which could become much more explosive very quickly. There is a lot of talk of using current competition law better to break up Big Tech, in just the way Teddy Roosevelt took on Big Oil. In Brussels, competition commissioner Margrethe Vestager has tech firms in her sights. In Germany, hate speech laws are being used to impose very heavy fines against Facebook, as the claim that it is a platform rather than a publisher is given short shrift. Everywhere the mood is hardening, and that's before we get onto the subject of data…

7. GDPR

I've written a bit in the past about the emergence of the data economy. The new superpowers in the world of business are a new kind of media-technology giant who monetise personal data. And with the evolution of the data economy comes the evolution of data regulation. GDPR, the European Union's incoming data protection regulation, is due to come into force on 25 May and will have a massive impact on companies such as Facebook, who could face huge fines for breaches. Facebook COO Sheryl Sandberg has said the company has already adjusted privacy settings, external in anticipation. At its recent earnings call, Facebook specifically warned that GDPR could be an impediment to future growth.

8. Antagonism with the news industry

The news industry has been turning against Facebook for some time, partly - though of course not entirely - because of disgust at the rate at which Facebook and Google are gobbling up advertising dollars. The dominance of these two companies limits the ability of traditional publishers to make money online and, as such, could be fatal to their prospects. But for many senior news industry figures, Facebook's recent changes to its news feed add insult to injury: they could radically reduce the amount of traffic to websites producing shareable content. The likes of BuzzFeed, which depend heavily on journalism being shared on social media, have announced job cuts recently. This double hit to the news industry - gobbling up advertising dollars, and then tightening the taps on traffic from its news feed - ensures an antagonistic relationship with headline writers across the world.

+++

Aside from all the above, there are other worries for Facebook too, such as: whether it is reaching capacity in the English-speaking world; whether its mobile platform is equipped well enough to take advantage of the forthcoming doubling of the internet population; whether Chinese tech giants will beat it to the growth markets of Africa; and whether the culture at the company is healthy enough to withstand all these pressures.

But those are future or emerging threats, as opposed to the ones I've highlighted which (GDPR included) are having a very serious current impact on the company.

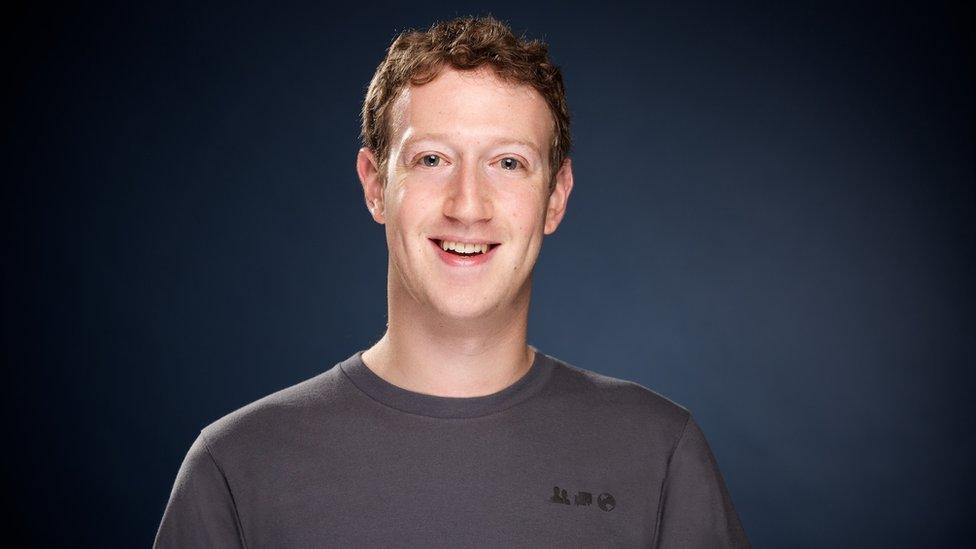

Mark Zuckerberg: Facebook Founder, Chairman and Chief Executive Officer of one of the most profitable and innovative companies of all time.

Without wanting to make this blog post feel like a stroll through caveat city, I should remind you that Facebook is one of the most innovative companies in all history, has amassed astonishing wealth through immense hard work, has probably added to the total sum of human happiness, and provides a service which is enjoyable and free (if you discount paying with your personal data).

Nevertheless, suspicions are growing that Mark Zuckerberg and his team have unleashed something that they cannot control, and that after a dizzying 14-year rise, their influence on our global, public domain may just have peaked.

If you're interested in issues such as these, please follow me on Twitter, external or Facebook, external; and also please subscribe to The Media Show podcast, external from Radio 4. I'm grateful for all constructive feedback. Thanks.

- Published6 February 2018

- Published5 February 2018

- Published1 February 2018

- Published30 January 2018