Why Comcast wanted Sky so badly

- Published

Almost three decades after Rupert Murdoch founded the broadcaster, which includes Sky News, three American companies fought over its future

It ended with a blowout offer. After years of scrutiny from regulators, bids and counter-bids, the winning offer for majority control of British broadcaster Sky came in above expectations.

Comcast's winning £17.28-a-share bid for Sky smashed the £15.67 Disney were prepared to go up to. Why were Comcast prepared to pay so much? Because they are desperate and Sky is too juicy to ignore. Let's take those in reverse order.

Sky's remarkable valuation, at £30bn, is the loudest endorsement of a British media company in recent history. As Lex notes,, external "the premium Comcast is offering over the Sky market price just before [Fox's offer for the 61% it doesn't own, in December 2016] is an incredible 124%."

Sky has around 27 million subscribers across Europe. Crucially, this means that it is not primarily an ad-funded broadcaster, and has data about its customers' interests.

Think of Netflix, the most valuable and fastest growing TV and film company in the world. You don't see adverts on Netflix, and the company doesn't have a daily schedule to fill, with peaks and troughs according to different times of the day. It just buys in or makes programmes and films, and then charges you for it.

Charging customers obviously allows you to grow revenues just by growing your base, rather than haggling with advertisers. It also means that by gathering a trail of data about their tastes, and quite possibly where they live and when they generally watch shows, you can target them with stuff you know they'll like.

This is the huge advantage that Sky have over ad-funded terrestrial broadcasters. TV advertising is relatively stable just now, but as eyeballs shift online, so too are advertising dollars (often to just two companies, Google and Facebook). Better and safer in the long-term to rely on subscription income - with the mine of rich data that brings.

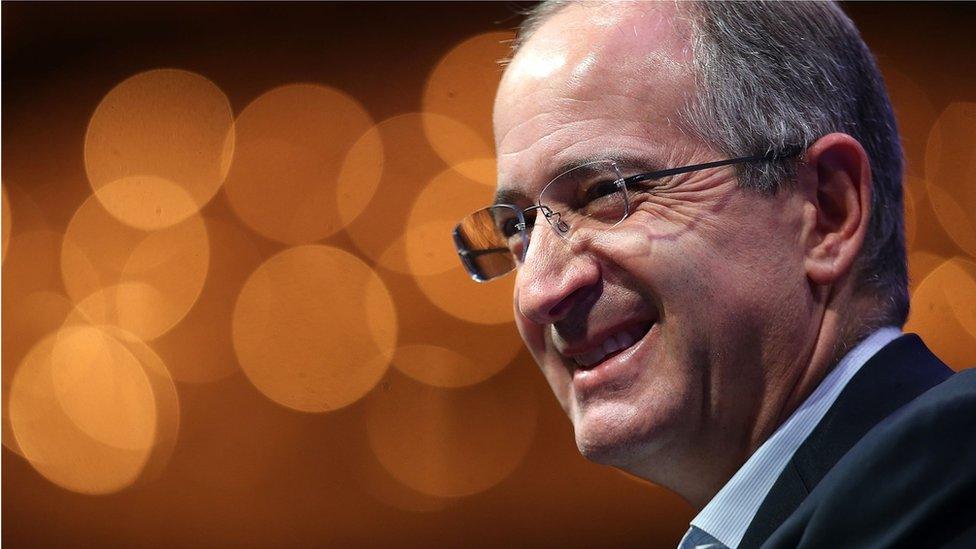

Comcast CEO, Brian Roberts, surprised many observers with the size of his final bid for the British broadcaster

The other, often neglected aspect of the deal is technology. Brian Roberts of Comcast relayed with glee an anecdote about visiting a Sky store in Westfield Shopping Centre in West London, where he saw a demonstration of the Sky Q kit. He was impressed by the user experience, and his gut instinct was to pursue the company.

This creates the interesting situation in which an American media company will treat the technology of a British one as an education.

Sky has had a strong couple of years, with growing revenue, earnings per share, and EBITDA; a series of major sports rights deals; and significant partnerships with BT Sport, Netflix, and Spotify. It is also creating world-class, slick productions with the world's most sought-after names. Benedict Cumberbatch's performance as Patrick Melrose came at a useful time.

And Sky is a media mega-power in a territory, Europe, which various US giants feel exposed in. Comcast is currently America's biggest provider of cable and broadband services. It is unheard of in much of Europe. Buying Sky transforms it from US giant to international giant at a stroke.

Provided, that is, they can make it work.

Investors are sceptical. Comcast shares fell 8% - the most for three years - on worries that Roberts had overpaid.

Has he? We won't know for a while. But back to that gut instinct. The final bid made for Sky, in a dramatic finale to this deal, took place in an environment which was not altogether conducive to sober contemplation.

Mr Roberts and his senior team spent Saturday in a 5-star hotel. They were surrounded by bankers from Evercore, Bank of America and Robey Warshaw. It would be interesting to know if these financial wizards, whose advice was so precious to Mr Roberts, dined together on Saturday evening, once they'd won.

Such a tense and intense atmosphere can foster over-zealous behaviour. Particularly when you throw in the egos involved. As this analysis, external in the Murdoch-owned Wall Street Journal makes clear, Roberts and Murdoch have had an at-times fraught relationship. Roberts and Bob Iger of Disney have been arch-rivals for years.

Disney Chairman and Chief Executive Officer Bob Iger has spent months persuading Rupert Murdoch to part with his entertainment assets. Losing Sky will therefore be a blow

And who could forget that in 2004, Comcast made a hostile bid for, yes, Disney - which ended in ignominy. As Simon Duke wrote, external in the also Murdoch-owned Times, "For Brian Roberts, landing Sky will be a moment of sweet revenge. The Comcast boss has seen his ambitions thwarted twice before by Disney." Perhaps pinching Sky from under the mouse's nose was a case of unfinished business.

The main driver of the three American bids for Sky (from Comcast, Disney and Fox) was of course the mad scramble for eye-balls in an industry ripped asunder by technology giants such as Netflix and Amazon. Their enormous budgets, and fast-swelling customer bases, are re-shaping the sector. Their rivals need to grab as much land as possible while they can.

But the adrenaline-fuelled nature of the final bid, the clashing egos involved, the backstory of Comcast's pursuit of Disney, and above all that share price slide yesterday suggests that for all the immense merits of Sky, it will take a superhuman performance to justify the final price.

If you're interested in issues such as these, you can follow me on Twitter, external or Facebook, external; and subscribe to The Media Show podcast, external from Radio 4.