What is VAT and how does it work?

- Published

Chancellor Rishi Sunak's cut to the rate of value added tax (VAT) on hospitality and tourism from 20% to 5% has now started.

It lasts until 31 March 2021 (it was originally due to end on 12 January, but the period has been extended) and applies to food and non-alcoholic drinks as well as accommodation and admission to attractions across the UK.

Mr Sunak said the move is designed to "get the sectors moving and to protect jobs", but what is VAT and how does it work?

What is VAT?

Value added tax, or VAT, is the tax you have to pay when you buy goods or services.

The standard rate of VAT in the UK is 20%, with about half the items households spend money on subject to this rate.

There is a reduced rate of 5% which applies to some things like children's car seats and home energy.

The lower rate also currently applies to sanitary products, although in the March 2020 Budget, the government announced it will stop charging VAT on these goods from 1 January 2021.

When you see a price for something in a shop, any VAT will already have been added.

There are also various items for which you do not have to pay any VAT, such as most supermarket food, children's clothing, newspapers and magazines.

How much money does VAT raise?

The Office for Budget Responsibility (OBR) predicted in March that VAT would raise £136.6bn in 2019-20., external

That is equivalent to around £4,800 per household and represents 16.8% of all the money the government receives from taxes.

VAT accounts for around 6.2% of GDP, the total value of goods and services produced in the economy.

How does this compare to other taxes?

In 2018-19 VAT was the third biggest income generator for the UK government, after income tax and national insurance contributions.

These three taxes together raise more than half of government tax receipts., external

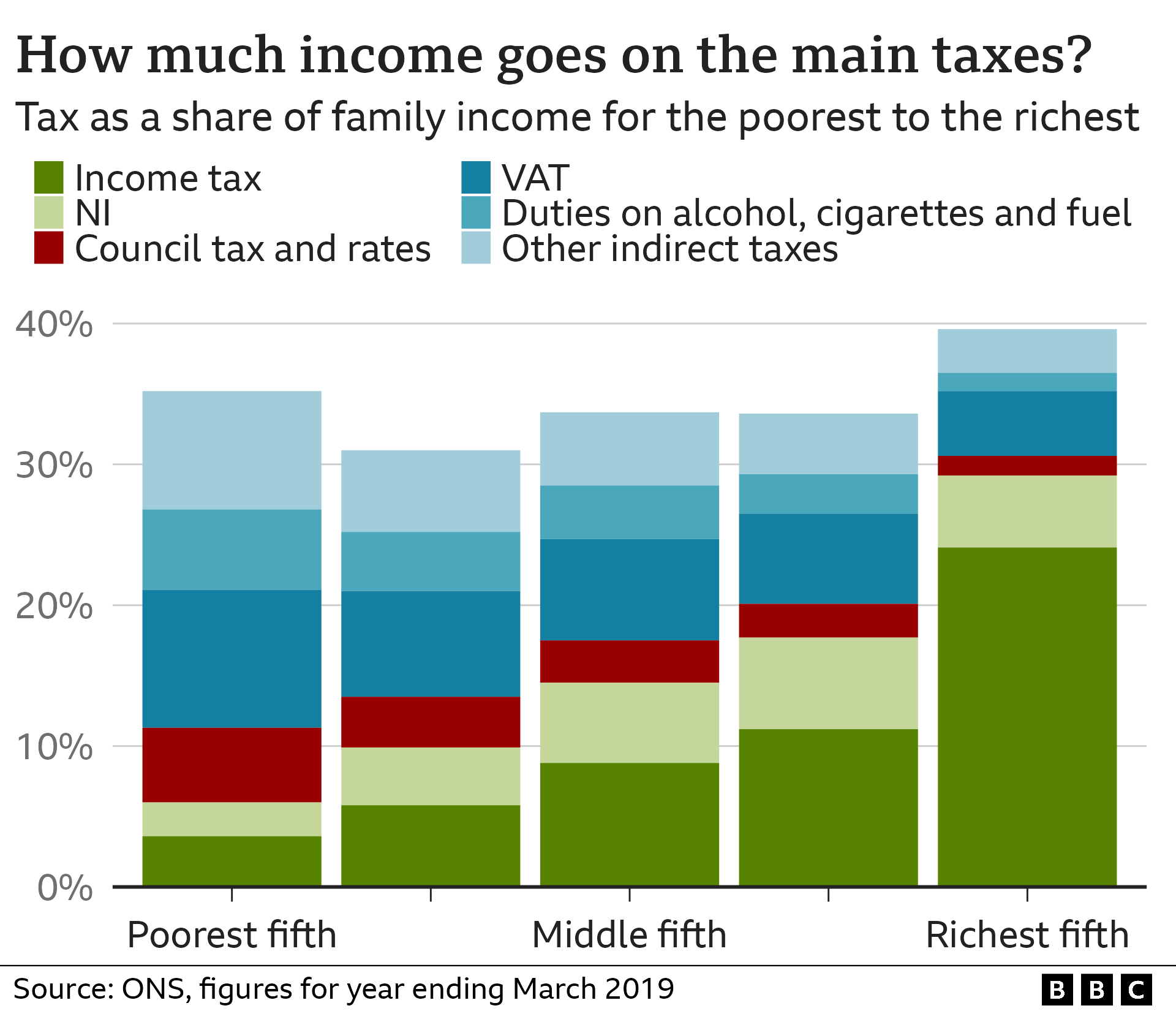

For most families in the UK, income tax is the single biggest tax they pay. You can see that in the dark green bars in the chart below.

But poorer households tend to pay a bigger share of their taxes through taxes on spending: VAT and duties - the blue areas in each bar. Those are known as indirect taxes.

For the poorest fifth of households, VAT is the biggest single tax that is paid.

How has VAT changed over time?

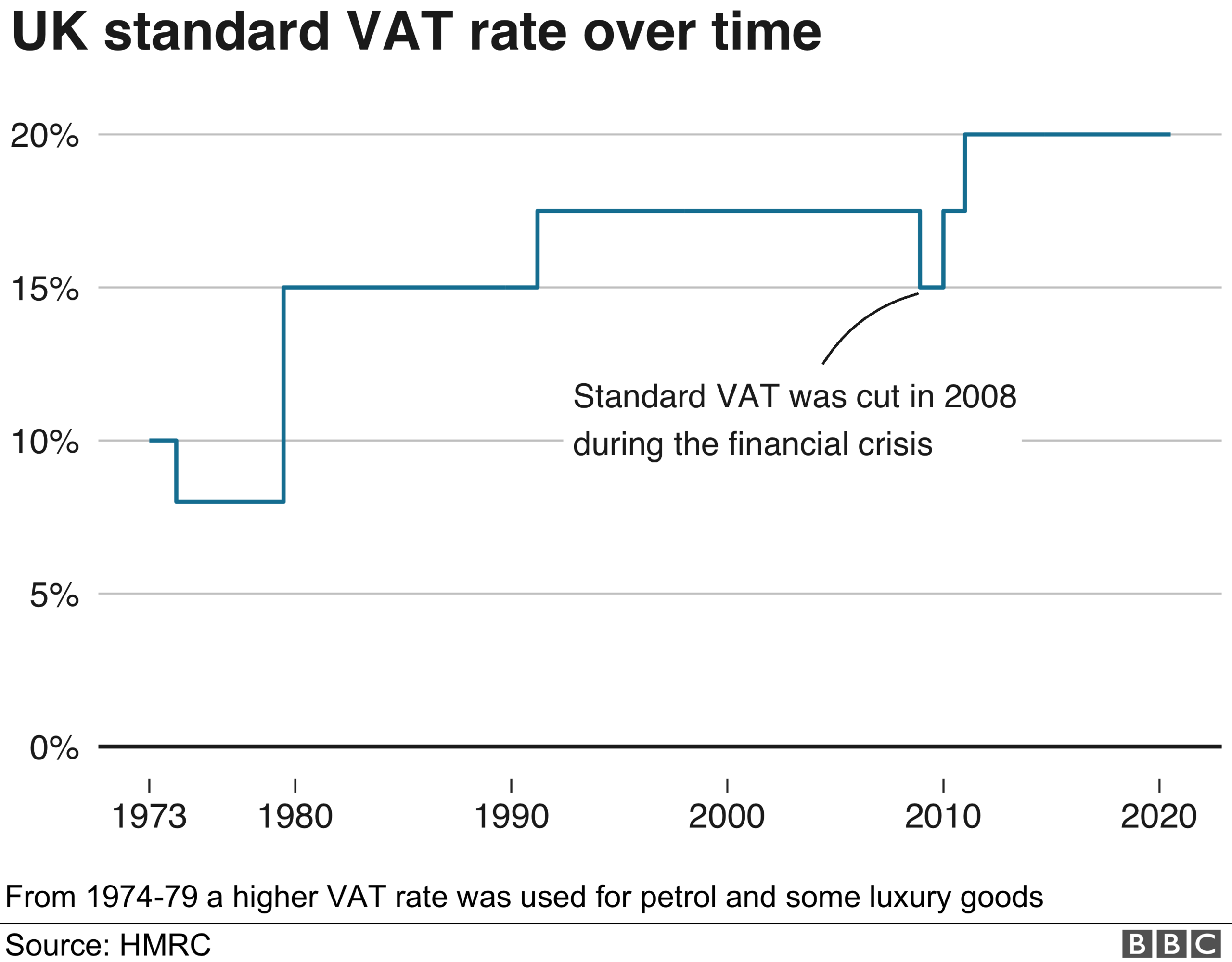

The standard rate of VAT increased from 17.5% to 20% on 4 January 2011.

In 2008, following the financial crash, the government introduced a temporary cut in the rate of VAT to 15%.

The rate cut lasted from 1 December 2008 to 31 December 2009 and cost the government £12.4bn in lost revenue., external

The aim of the cut was to boost consumer spending with retailers expected to pass the reduction on to customers.

At the time, opinion was divided about the policy with then Conservative leader David Cameron calling it an "unbelievable and expensive failure".

The Institute for Fiscal Studies was more supportive. It predicted a growth in sales of about 1%, external and said a VAT cut compared well with other incentives.

Measuring the overall impact proved challenging, because no-one could know what would have happened without the rate cut.

Mr Sunak's six-month cut for hospitality and tourism is set to cost the government £4.1bn.

Are companies passing on the VAT cut to customers?

The Treasury estimates households could save £160 a year on average, but not all firms will pass on the benefit.

Many companies are expected to use the windfall to shore up finances hit by the lockdown, rather than cut prices.

For example, Malcolm Bell, chief executive of Visit Britain, said the chancellor's move was to support business, not help holidaymakers.

And many attractions such as museums, parks and zoos, might also not pass on the reduction.

However, Starbucks has said it will pass on the full 15% discount on coffee served in company-operated stores.

McDonald's has recommended that its franchisees cut prices on an array of products, and pub chain Wetherspoon said it would reduce prices on meals, coffee and soft drinks.

How does the UK compare to other countries?

The UK's VAT rate of 20% seems to be roughly in the middle when compared with European Union countries.

- Published8 July 2020

- Published8 July 2020