Tax rises needed 'to prevent NHS misery'

- Published

- comments

Taxes are going to have to rise to pay for the NHS if the UK is to avoid "a decade of misery" in which the old, sick and vulnerable are let down, say experts.

The Institute for Fiscal Studies and Health Foundation said the NHS would need an extra 4% a year - or £2,000 per UK household - for the next 15 years.

It said the only realistic way this could be paid for was by tax rises.

It comes as ministers are arguing behind the scenes about NHS funding.

Join our Facebook group on the NHS and share your views., external

The prime minister has promised a long-term funding plan for the NHS.

This is expected to cover the next decade and could be announced as soon as next month, in time for the 70th anniversary of the creation of the NHS.

It has been announced that an 'NHS assembly' will be set up where national and local stakeholders can discuss progress on achieving plans for the NHS's future.

The Treasury is believed to want to keep average rises at about 2% a year, but other ministers are arguing for more, the BBC understands. Health and Social Care Secretary Jeremy Hunt is believed to want at least 3% a year.

If you can't see the NHS Tracker, click or tap here, external.

As those discussions continue, the IFS and Health Foundation have revealed the findings of their review, commissioned by the NHS Confederation, which represents NHS trusts.

It warned the ageing population and rising number of people with long-term conditions, such as diabetes and heart disease, meant the health service needed more than it had been getting in the past decade.

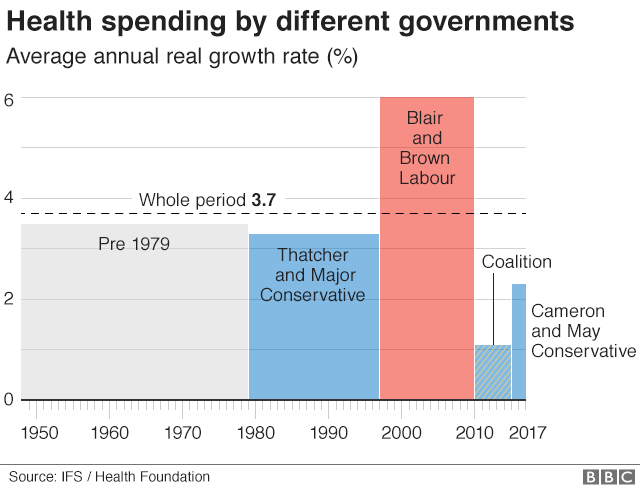

In recent years the annual rises once inflation is taken into account have been limited to just over 2%.

But continuing in this vein would lead to a continued deterioration in performance, the report warned.

Instead, it said, 5% extra was needed in the next five years, and then just under 4% for the following decade if it was going to improve.

That would work out at an average of 4% a year over the period, while 3.3% would simply maintain services.

On top of that, extra money would also be needed to fund council-run social care for the elderly.

That would mean spending as a proportion of national income rising from 8.4% currently to 11.4%.

Ministers still wrestling with long-term cash needs

By Laura Kuenssberg, BBC political editor

Theresa May is grappling with ministers over NHS funding

There's no coincidence at all that the independent number crunchers, the Institute for Fiscal Studies and the Health Foundation, have come forward with calls for significantly more cash for NHS England today.

It matters right now because behind closed doors in Whitehall, the Department of Health, Downing Street and the Treasury are grappling to agree, not just how much the NHS really needs, but also what the government can really afford.

Any eventual long term settlement involves extra billions of taxpayers' money - but if the government falls short, there's a heavy potential cost.

What to do next is an intensely political choice.

The report said it was "hard to imagine" raising that sort of money without increases in taxes.

NHS Confederation chief executive Niall Dickson urged ministers not to rush into a quick fix, but warned any attempts to limit rises to 2% would backfire and lead to a "decade of misery".

"It is now undeniable that the current system and funding levels are not sustainable," he said.

The Department of Health and Social Care said plans were being put in place to agree a multi-year settlement.

What does £2,000 buy you in the NHS?

The extra £2,000 in tax per household seems an eye-watering amount. But there is some context.

That is the amount that would be needed by 2033 - and the economists were quick to point out that this has to be seen in the context that households will become richer.

The forecast is that household wealth will rise by over £8,000 a year. So paying for the NHS would gobble up just under a quarter of that.

Add in social care and it will be over a quarter.

To increase tax income by that amount, it would require rises of 3p in the pound on each of income tax, VAT and National Insurance.

Although the report said other options, including taxes on property and businesses, could be explored too.

Even so, that would leave the UK as a relatively low-tax country.

In terms of what that buys in the health service, £2,000 does not go very far.

It will pay for a month of a staff nurse's salary, or cover 16 visits to A&E or eight ambulance journeys to hospital.

- Published13 June 2019

- Published24 May 2018

- Published13 February 2018

- Published26 December 2017

- Published21 December 2017