What is the energy price cap?published at 07:51 BST 22 May 2024

Image source, Getty Images

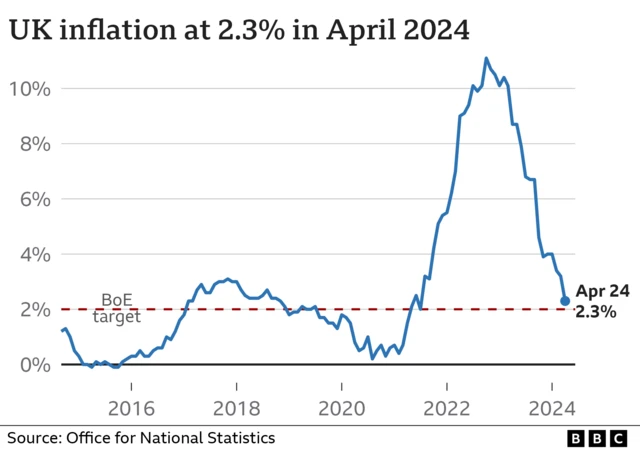

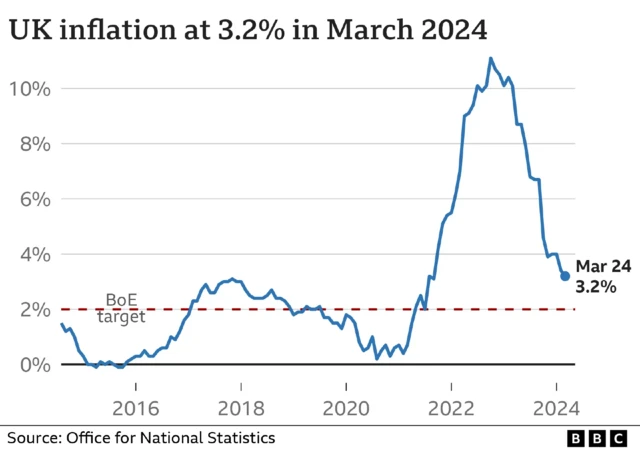

Image source, Getty ImagesAs we've been reporting, a fall in the energy price cap at the start of April has been described as a key reason for the drop in the inflation figure for April.

So, let's recap - what exactly is the energy price cap?

It covers 29 million households in England, Wales and Scotland and is set by the energy regulator Ofgem every three months.

It fixes the maximum price that can be charged for each unit of energy on a standard - or default - tariff for a typical dual-fuel household which pays by direct debit.

In April, the new level set meant that an average household paying by direct debit for dual fuel (gas and electricity) would pay £1,690 a year - a drop of £238 from the previous cap.