Inflation drop will raise hopes of December interest rate cutpublished at 08:57 GMT

Ben King

Business reporter

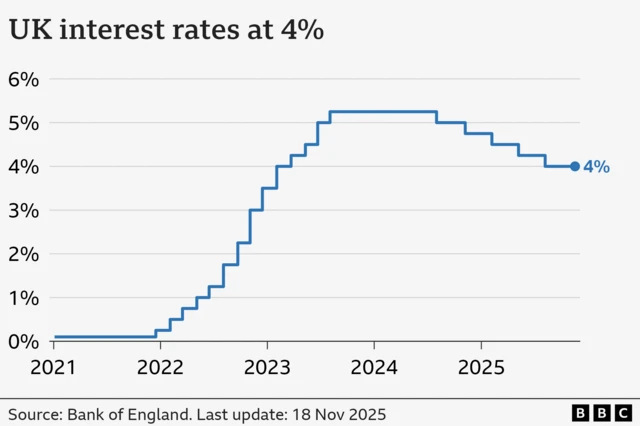

The Bank of England held interest rates at 4% in November, bringing a cycle of regular quarter-point cuts every three months to an end.

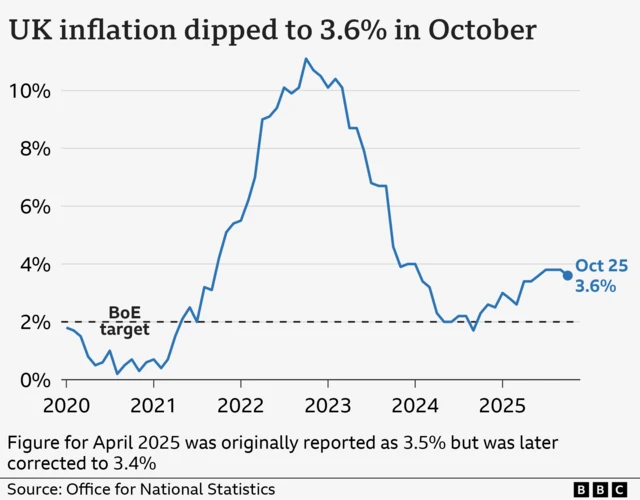

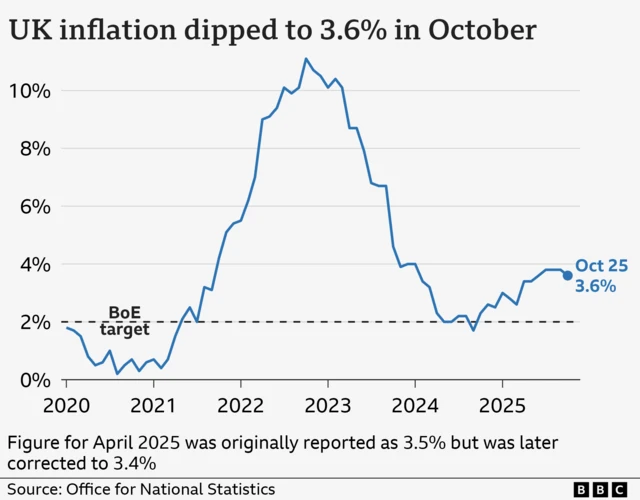

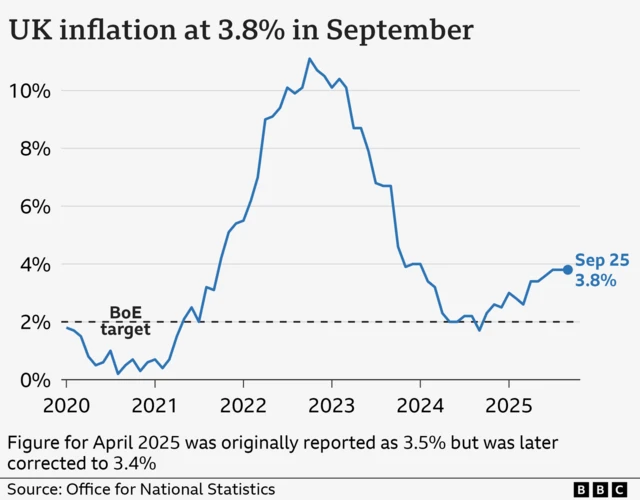

But today's news of a fall in inflation in October - to 3.6% - will raise hopes that the Bank might cut interest rates in December.

In particular the rise in the price of services, at 4.5%, was smaller than expected. This is a closely-watched measure of underlying inflationary pressure in the economy, and this will boost the case for a cut.

But there's lots still to happen before we get that decision on 18 December - not least the Budget next week.

We're ending our live coverage now - you can read more in our story.