Hwyl fawrpublished at 14:30 GMT 5 November 2024

Eluned Morgan’s seventh session as first minister comes to a close.

Image source, Senedd Cymru

Image source, Senedd CymruEluned Morgan is quizzed by opposition party leaders and other MSs during First Minister's Questions

By Alun Jones

Eluned Morgan’s seventh session as first minister comes to a close.

Image source, Senedd Cymru

Image source, Senedd CymruOn election day in the United States, with Donald Trump and Kamala Harris vying to become the next president, the first minister says "we’ll all be watching with bated breath the outcome of that election, which will have a profound effect on Wales and the world."

She adds, in response to a question on "the nature crisis" by Labour MS Joyce Watson, "there will be an impact on climate change, depending on who wins, and it will impact on all of us. So, the importance of our protecting nature in Wales is well understood. I do hope that the people of the United States understand their responsibilities as well in that space."

Donald Trump and Kamala Harris

Labour MS Hannah Blythyn highlights the work of the charity Fighting With Pride regarding the historical treatment of people who were sacked or forced out of the military for being gay.

It was illegal to be gay in the British military until 2000.

Campaigners remain focused on winning compensation from government for those affected, one of 49 recommendations of an independent review, external.

Hannah Blythyn says "the LGBT veterans compensation scheme is reckoned at £50 million, but that works out around £2,500 per veteran, which really doesn't go as far as it needs to."

She asks "what discussions Welsh government has had with the new UK government on this, and if you would raise this further with the UK government to right these historical wrongs for people that wanted to serve their country, but were badly let down by it?"

The first minister replies "the UK government plans for a redress compensation scheme are due to be published in the new year, and I think that will be an important milestone".

Image source, Senedd Cymru

Image source, Senedd CymruHannah Blythyn

Conservative Laura Anne Jones says "we should be here safeguarding our family-run farms that operate on modest incomes. Labour are hitting the working people of the countryside."

The first minister replies, "I do think that many people in agricultural communities have been misled, so even after the budget, the first £1 million of combined businesses and agricultural assets will continue to receive 100 per cent relief in most cases. After this, they're going to have to pay inheritance tax at 20 per cent, compared to the rest of us, who have to pay 40 per cent. A married couple owning a farm together can split it in two, so that means they've got £2 million—not £1 million; £2 million—of agricultural property relief, plus another £500,000 for each partner if property's involved. So, you get up to about £3 million."

Image source, Senedd Cymru

Image source, Senedd CymruLaura Anne Jones

Plaid Cymru's deputy leader Delyth Jewell stands in for Rhun ap Iorwerth.

She says the inheritance tax changes announced in the budget "threaten the future of family farms" and calls for an immediate assessment "of the effect this decision will have on the sector in Wales, how it will affect efforts to strengthen food security, tackle the nature and climate emergencies? And, to those running a family farm in Wales, asking themselves whether they have a future in the sector, what does the first minister say?"

The first minister replies "our initial assessments is that the vast majority of farms in Wales will not have to pay" inheritance tax.

She adds, "the fact is that the rest of the population have to pay inheritance tax, and there is a huge allowance when it comes to the agricultural community. And what we're talking about here is extremely large and wealthy farms, and obviously we will work through the detail of this, but, obviously, as a Labour Party, we are very interested also in making sure that the support is there for people who work on farms. That's why things like increasing the living wage is significant. It'll affect not just the agricultural community but people across our nation, and that will be a significant change for many people in our communities."

Delyth Jewell also says "there was no commitment to fair funding, and so Wales's day-to-day spending settlement is less generous than that of Scotland and Northern Ireland. There was complete silence on HS2 consequentials, with Wales's comparability factor for transport shrinking from 80.9 per cent in 2015 to 33.5 per cent in 2024. And calls for the devolution of the Crown Estate were ignored again. Why are we consigned to further austerity, and why did the first minister fail her first test to fight for what is right for Wales?"

The first minister reminds members that the chancellor announced an extra £1.7bn for Wales.

Eluned Morgan says "that is going to help to rebuild our public services, and it is important, I think, to recognise the difference that that will make to the lives of people across Wales. Austerity has ended."

Image source, Senedd Cymru

Image source, Senedd CymruDelyth Jewell

Image source, Senedd Cymru

Image source, Senedd CymruAndrew RT Davies

Andrew RT Davies, leader of the Welsh Conservatives in the Senedd, says the budget was one of "broken promises and brutal betrayal".

He highlights the "anger, the concern and the fear that farmers and those dependent on the agricultural industry feel when they have been so bitterly betrayed by your party", regarding the Labour UK government's scrapping of inheritance tax exemption for farms worth more than £1m.

The first minister says the Conservatives left a "£22 billion black hole", and warns against "scaremongering" because "a very small proportion of farmers in Wales will be impacted by that inheritance tax".

In the budget, Chancellor Rachel Reeves announced that, while there would continue to be no inheritance tax due on combined business and agricultural assets worth less than £1m, above that there would be a 50% relief, at an effective rate of 20%, from April 2026.

For years, the APR tax relief has enabled small family farms – including land used for crops or rearing animals, as well as farm buildings, cottages and houses - to be handed down through the generations.

Davies also refers to the "uplift in national insurance that will have such a devastating impact - an employment tax, a jobs tax that the chancellor highlighted in opposition and so did the business secretary. We know that many businesses will be affected by it, but also... those in the charitable sector, such as hospices, and those who provide many of the primary functions in the health service, such as GPs, optometrists and pharmacists."

The first minister says "this is a UK government budget and they had to make some very, very tough choices. And those tough choices include the need to fix the foundations of our communities and our societies, including the economy, but more importantly public services, after 14 years of Tory neglect."

Image source, PA Media

Image source, PA MediaChancellor Rachel Reeves announced tax rises worth £40bn to fund the NHS and other public services.

Several opposition MSs criticise the rise in national insurance paid by employers announced in the budget, particularly the impact on third sector organisations - charities, community groups, and social enterprises.

There are about 40,000 voluntary organisations operating across Wales.

Plaid Cymru's Peredur Owen Griffiths says "the National Council for Voluntary Organisations has estimated it could be as much as £1.4 billion a year across the UK. It has been described by them as the biggest shock to the sector since the COVID-19 pandemic."

Conservative Joel James warns that the third sector "will be considerably weakened and there will be considerably less support for some of the most vulnerable in our communities".

The first minister replies, "in order to recognise and to protect the smallest businesses and charities, they [the UK government] doubled the employment allowance to £10,500. So, half of businesses with national insurance contribution liabilities will either gain or see no change next year. So, my guess is that there will be less of an impact on those third sector organisations, but, obviously, we need more time to analyse that impact. What I do know is that the calculations being made is that about 2 per cent of businesses will be paying three-quarters of the amount raised through those national insurance hikes."

At the moment businesses pay a rate of 13.8% on employees' earnings above a threshold of £9,100 a year.

In the budget Chancellor Rachel Reeves said this rate would increase to 15% in April 2025, and the threshold would be reduced to £5,000.

The employment allowance - which allows companies to reduce their NI liability - will increase from £5,000 to £10,500.

In total Reeves said the changes would raise £25bn a year by the end of the period covered by the budget.

Image source, Senedd Cymru

Image source, Senedd CymruEluned Morgan

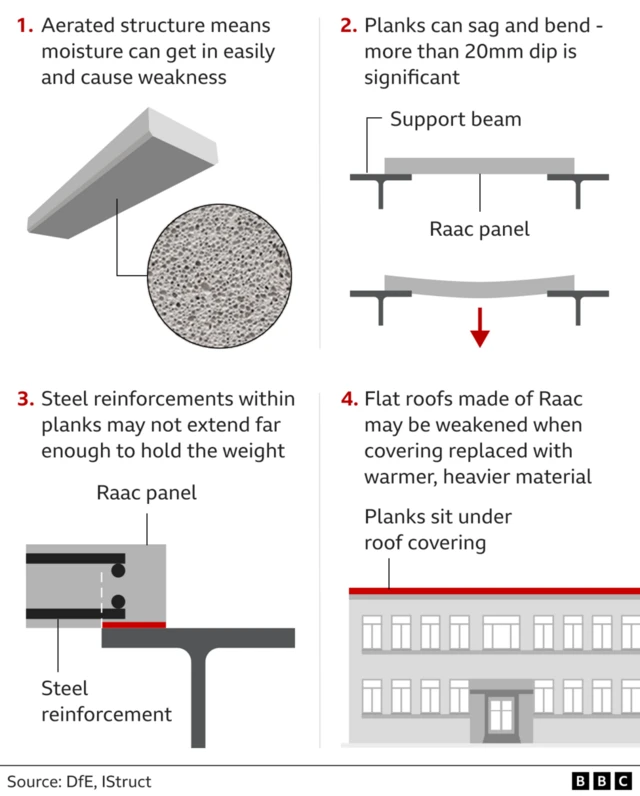

Plaid Cymru MS Heledd Fychan seeks “an update on the progress of the government's recovery programme for RAAC” (reinforced autoclaved aerated concrete).

First Minister Eluned Morgan replies "all schools that have been affected by RAAC have completed the mitigation work that’s necessary, and wards have reopened at Withybush hospital, and also, mitigation works have already been completed at Nevill Hall Hospital".

Heledd Fychan highlights the case of "residents who are private homeowners on the Gower estate in Hirwaun, where there is RAAC in the ceilings. They are mainly elderly people, all from low-income households. In order to make their homes safe, they are facing bills of thousands of pounds that they cannot pay, and due to the fact that many homes share adjoining roofs with properties owned by a housing association, they also have no choice about what type of remedial works are carried out".

The first minister says "I know that the Trivallis housing association are working closely with Rhondda Cynon Taf council, and they’re assisting, where possible, the private property owners affected by RAAC at that estate. Now, a remediation plan for social housing has been developed by the housing association, and I understand that private residents have been offered the opportunity of participating in that process should they wish."

Last year five schools in Wales - Ysgol David Hughes and Ysgol Uwchradd Caergybi on Ynys Môn, Ysgol Maes Owen in Conwy, Ysgol Trefnant in Denbighshire and Eveswell Primary in Newport - were identified as being affected by RAAC, compared to more than 230 in England and 39 in Scotland.

What is RAAC?

Reinforced autoclaved aerated concrete is a lightweight material that was used mostly in flat roofing, but also in floors and walls, between the 1950s and 1990s.

It is a cheaper alternative to standard concrete, is quicker to produce and easier to install.

It is aerated, or "bubbly", like an Aero chocolate bar.

But it is less durable and has a lifespan of around 30 years.

Hello and welcome to our live coverage of Eluned Morgan’s seventh session of First Minister's Questions.

The meeting is held in a hybrid format, with some members in the Siambr (Senedd chamber) and others joining by video-conference.

You can click on the play button above to watch the proceedings from 1.30pm.