Inflation is like a box of chocolatespublished at 09:28 BST 18 June

Kevin Peachey

Kevin Peachey

Cost of living correspondent

As Forrest Gump almost said: "Inflation is like a box of chocolates".

For those unfamiliar with the 1990s blockbuster film, starring Tom Hanks, his character completes the line with: "You never know what you're gonna get."

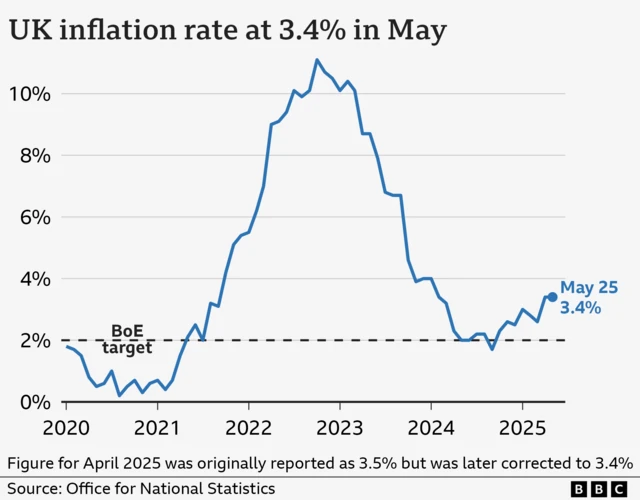

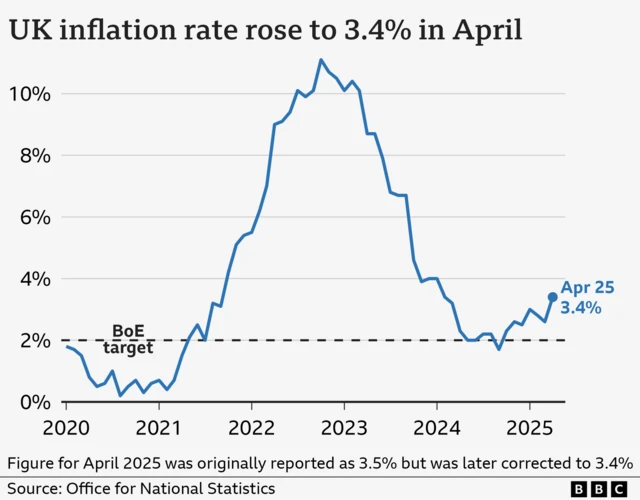

Today, we got an inflation figure for May that was unchanged on the previous month. But there is some interesting detail when you delve into the data.

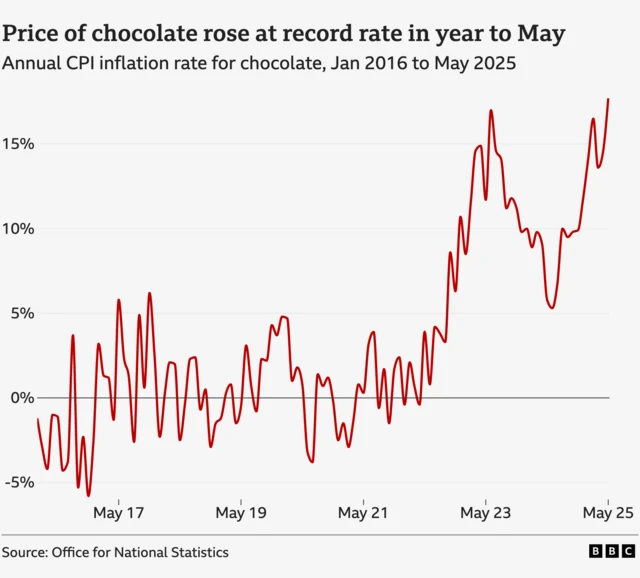

A jump in the rate of food price inflation - up from 3.4% in April to 4.4% in May - is the most striking. And, within that, chocolate prices rose at a record rate.

The rising cost of essentials like food puts the household budgets of those on lower incomes under particular pressure.

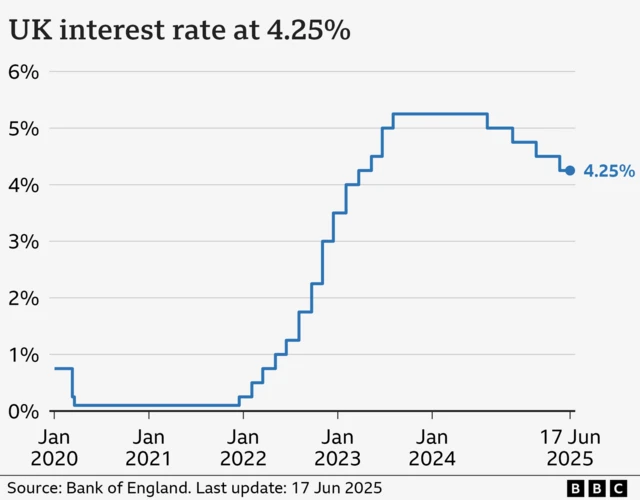

The outlook for prices and, in turn, interest rates, is complicated by international conflict and the impact on the price of oil.

So there's plenty for the Bank of England and the Treasury to chew over as we enter the summer.

We're closing our live coverage now, but you can read more in our news story here. We'll be back tomorrow to cover the latest interest rates decision, hope you can join us again.