Bank shows appetite to ease interest rates eventuallypublished at 13:13 BST 18 September

Faisal Islam

Faisal Islam

Economics editor

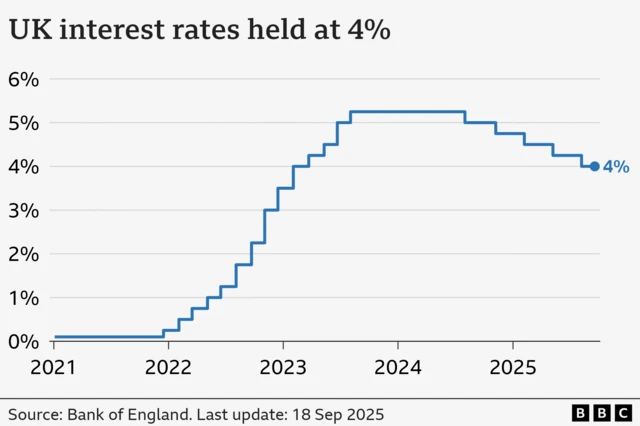

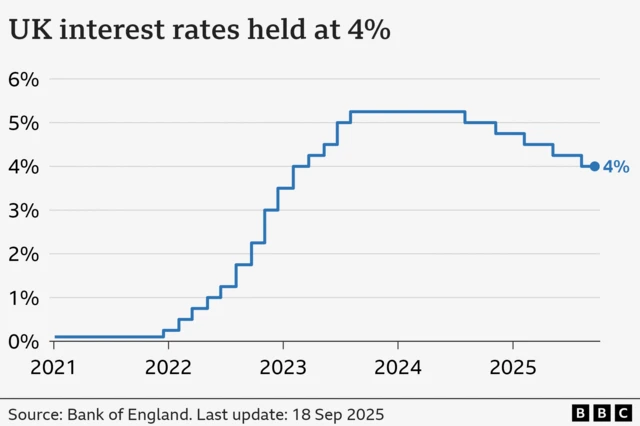

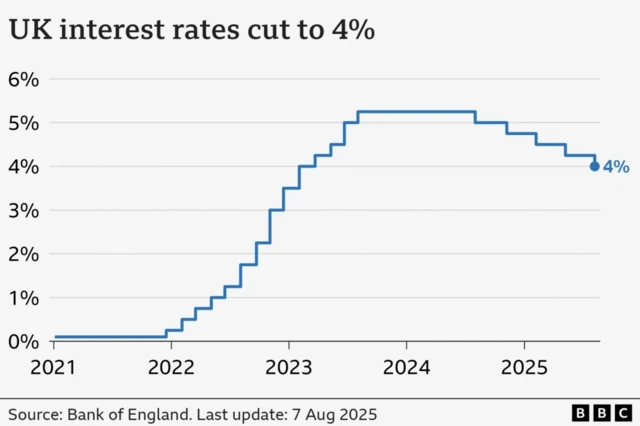

As expected the main interest rate was kept on hold at 4%

But in an indication of an appetite to still to cut at some point, two of the nine-member Monetary Policy Committee voted to bring the rate down to 3.75%.

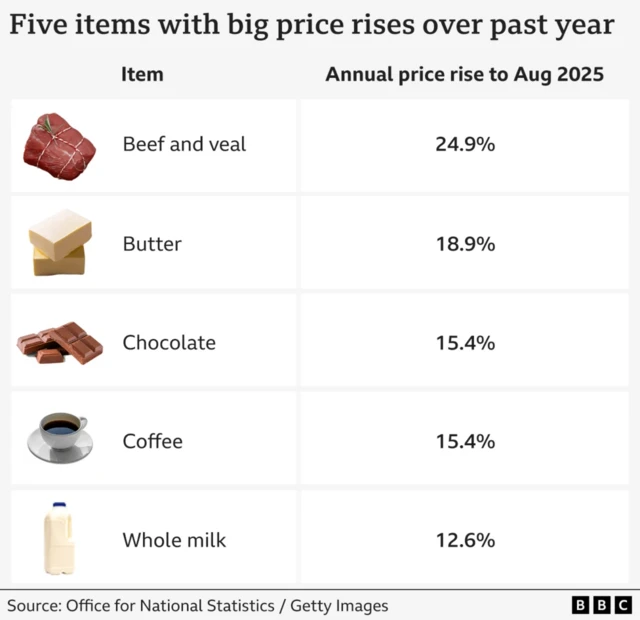

Governor Andrew Bailey said “we are not out of the woods yet” on inflation, so “any future cuts will need to be made gradually and carefully”.

The bigger decision made today was to slow the rate at which the Bank of England sells its stock of UK bonds, amassed during the financial crisis and pandemic.

This reversal of quantitative easing - known as quantitative tightening - had been running at the rate of £100bn a year.

This is being slowed to £70bn a year over the coming period, and in particular will result in fewer auctions of long term government debt.

The governor said this was to help wind down its crisis interventions “while minimising the impact on gilt markets”.

There has been a marked increase in the effective interest rate charged for very long term government debt.

The Bank said this was a global phenomenon but there have also been changes to the market for long term debts in the UK, with less buying from traditional buyers such as defined benefit pension funds.

- We're ending our live coverage now. Read more on today's decision in our main news story