Why isn't the government doing more to help heat homes?published at 14:23 BST 19 October 2022

Kevin Peachey

Kevin Peachey

Cost of living correspondent

Image source, Getty Images

Image source, Getty ImagesQuestion: John Roberts asks: "Millions of people rely on heating oil to heat their homes. Why isn't the government doing more to help them?"

Answer: The use of heating oil is widespread.

The cost is a particular issue in Northern Ireland where it is used by 68% of the population, mostly in rural areas.

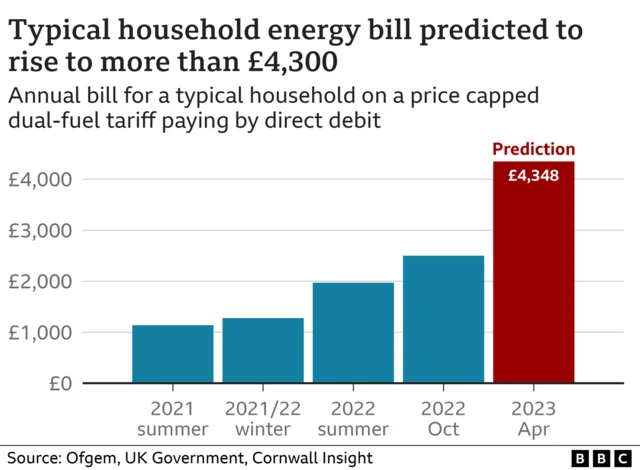

The government has promised a £100 payment to people who use heating oil to help with their bills.

A review by the Treasury into what happens next with support for energy bills will clearly have to take this issue into consideration too.