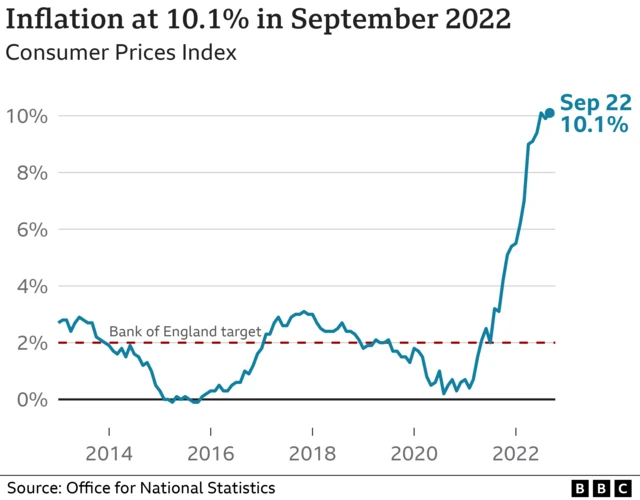

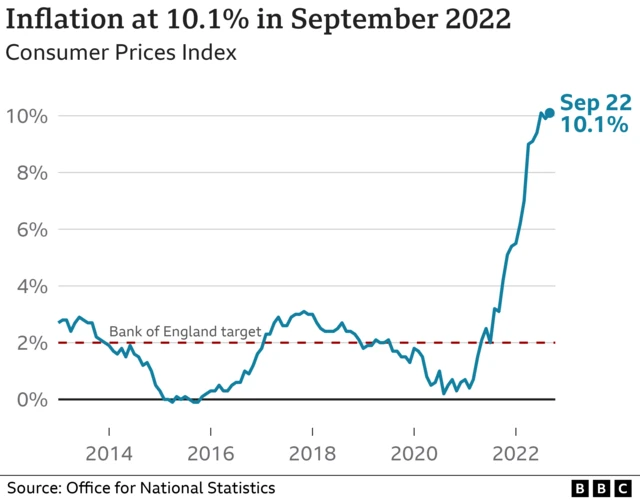

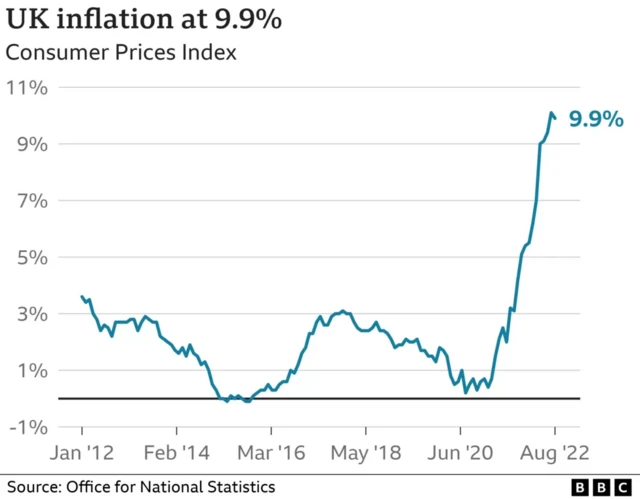

How does current inflation compare with previous years?published at 07:55 British Summer Time 19 October 2022

As we've been reporting, inflation has risen to 10.1%. We're all experiencing this already - in the higher prices we're paying for basic goods, from buying loaves of bread to boiling the kettle.

Inflation is also looked at when employers consider pay rises, and when the government considers increasing state pensions and benefits.

Here's a look at how that figure compares with previous years.