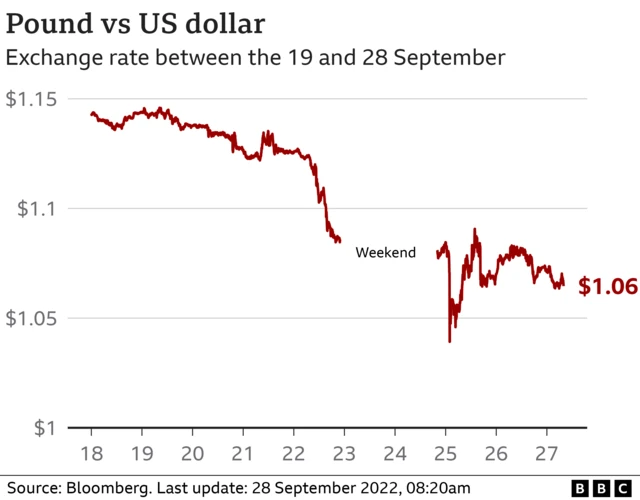

Labour calls for chancellor to make a statementpublished at 13:23 BST 28 September 2022

We've got more reaction to today's financial storm from Labour, which is calling for an urgent statement from the Chancellor Kwasi Kwarteng on how he is going to stabilise the economy.

Shadow chancellor Rachel Reeves made the call following the Bank of England’s announcement that it will buy up government debt.

She says people will be "deeply worried" about the cost of their mortgage, about their pensions, and the cost of living.

She says the financial upheaval is a "direct result of the Conservative government's reckless actions, which include tax cuts for the richest 1%".

“Their decisions will cause higher inflation and higher interest rates - and are not a credible plan for growth," she says. “The Chancellor must make an urgent statement on how he is going to fix the crisis that he has made.”