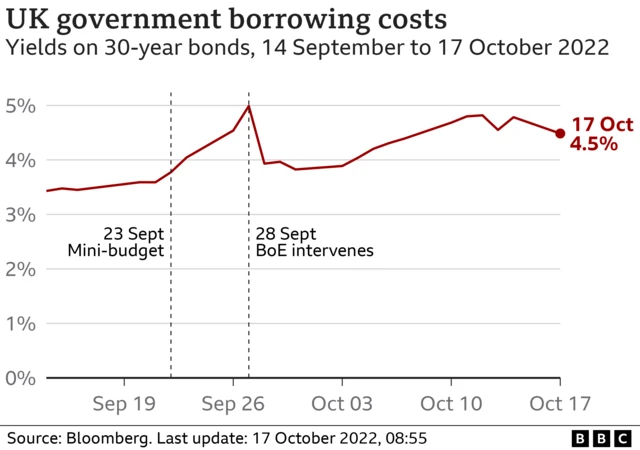

Hunt hopes to deliver confidence and stabilitypublished at 11:15 BST 17 October 2022

Chancellor Jeremy Hunt said no government could control the markets but they could give certainty about public finances.

He said the plans he was announcing would avoid uncertainty ahead of the full fiscal plan announcement at the end of the month.

It will deliver confidence and stability, he added.

Quote MessageAs I promised at the weekend, our priority in making the difficult decisions that lie ahead will always be the most vulnerable and I remain extremely confident about the UK's long-term economic prospects as we deliver our mission to go for growth."