Why is Tesco struggling in the US?

- Published

Fresh food with no additives is the selling point

Tesco might be one of the world's largest retailers, with profits in the billions, but it's not having everything its own way. The US stubbornly refuses to fall for its charms. Why?

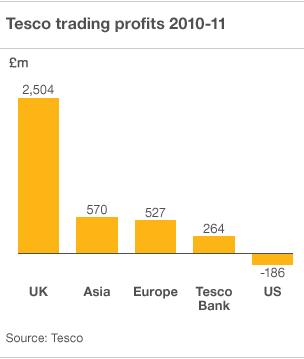

When Tesco recently announced its worldwide financial results, there was little surprise that its group profits were up 12%, to £3.8bn in the year ending in February.

But there was one region of the world that bucked the trend. The US was the only blot on its copybook, posting a loss of £186m.

Tesco's first US store opened in Los Angeles in 2007 and it has 175 now, all near the west coast, in California, Nevada and Arizona.

They go under the name Fresh & Easy, selling "wholesome food that doesn't cost your whole paycheck", according to the website.

The basic message is that it's fresh, healthy and inexpensive, which is underlined by the look of the stores.

In size, they are somewhere between a Tesco Metro and the big Tesco supermarkets, and the colour scheme is very green, from the leafy logo to the T-shirts worn by the staff, and is even the colour of choice for the world and inhabitants in its promotional video, external.

Allowing for the fact that economic conditions in the US since its launch have been very difficult, what else has gone wrong?

Tesco says the losses, up from £165m in the previous year, are down to two things - the cost of merging two suppliers and an unfavourable exchange rate.

"We expect losses to reduce sharply in the current year as strong growth in like-for-like sales continues and improved store operating ratios start to deliver individual shop-door profitability," says the Tesco financial report, external, which estimates the business will break even in 2013, when it hopes to have 300 stores.

But Tristan Rogers, CEO of Concrete, a UK-based firm which advises retailers on international expansion, questions whether Fresh & Easy provides Americans with anything they don't already have.

"Tesco isn't a brand. It's a recognised name but not a brand in the sense of being defined by its product - it's defined by price and convenience. And price and convenience is what the Yanks do better than anyone else.

"Why does Tesco think it can succeed there? Is there a gap in the market?"

Setting aside whatever one-off costs they may have incurred, the decision to go into the US and go under a different brand name offers great challenges for a retailer that's all about value, he says. The European brands that succeed in the US tend to be at the luxury end, like Jaguar and Ferrari.

"I've had too many conversations with business that have 'international' on the agenda and America comes up and the executives' eyes light up because they think 'big market, similar language, they've got money, we'll be rich'. But it's not that easy.

"Just because you want to go there doesn't mean they want you there or, more to the point, they need you there."

One of the reasons behind Tesco's success in the UK was its use of consumer data garnered from loyalty cards, he says, but applying the same logic to any market might not be enough.

Tesco, which says it has created 4,500 US jobs, isn't the first British retailer to find the American market a tough one to crack. Marks and Spencer has made two forays into the US, and had its fingers burnt.

It doesn't look like a Tesco on the outside

In 1988, it bought the 155 stores of fashion retailer Brooks Brothers, but sold them for a third of the price in 2001. It also sold its Kings supermarket chains, based in New Jersey, after losses.

But Tesco says it has learnt to adapt, and one change it has introduced that perhaps reflects the subtle difference in consumer habits in the US is to open an hour earlier so customers can pick up fresh coffee on their way to work.

Trevor Datson, Tesco's group media director, says Fresh & Easy is giving Americans something new.

"Fresh food at exceptional prices, and fresh meals from the Fresh & Easy kitchen, all of a quality which is unprecedented. The food is made on our own premises.

"The research proves that customers like it, but [chief executive Philip Clarke] Philip has been quite candid that there hasn't been enough of them yet."

Tesco spent 10 years preparing for its US launch and it has done its homework, says George Godber, a commentator on retail market trends.

"They've identified the west coast as that's more likely to go down the healthy eating route - a fresh fruit and veg model, which is much more what the UK supermarket experience is based on.

"So I think they applied the theory correctly but they failed to persuade people to come through the door.

"The brand awareness hasn't worked and if you don't get that right then you can't get money out of people's pockets."

They also might be losing some of the passing trade they enjoy in the UK, he says, because more Americans drive to supermarkets.