The lengths people go to avoid paying tax

- Published

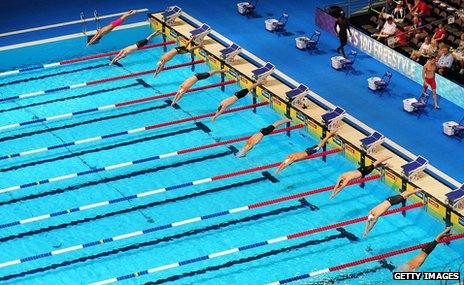

Can you imagine it filled with $1 bills?

It's been a taxing few days. Advisers who promote "aggressive tax avoidance" have been berated by the British government. Meanwhile a new report claims there could be $21tn (£13.5tn) stored away worldwide in offshore accounts.

The mind can't comprehend the amount. If it was denominated in $1 bills, it would fill nearly 10,000 Olympic-sized swimming pools. Provided the pools were empty and that it was possible to provide enough security personnel to guard all of the pools. (It would probably be better to use the Army and police rather than a private security firm.)

Put another way, 21 trillion seconds ago, the world was 600,000 years younger and experiencing the Lower Palaeolithic period. This was the time of <italic>Homo heidelbergensis</italic>, one of mankind's early ancestors.

Archaeologists say <italic>heidelbergensis</italic> was in some ways quite advanced, with rudimentary language and, maybe, a habit of burying the dead.

But they were also extremely primitive. There is a lot of evidence to suggest he had not yet discovered the ability to measure large quantities of anything in terms of how many Olympic-sized swimming pools would be filled - a skill we would regard as essential now.

Overwrought quantification metaphors aside, $21tn is a lot of money to stash.

How would you even go about hiding it? With the entire output of the world's economy only being about $60tn (£39tn) or so, surely like an elephant hiding behind a curtain, you would notice the bulge somewhere?

Except now the elephant isn't even in the room, or in a room on an island somewhere. <link> <caption>According to the Tax Justice Network report</caption> <url href="http://www.taxjustice.net/cms/upload/pdf/The_Price_of_Offshore_Revisited_Presser_120722.pdf" platform="highweb"/> </link> - offshore "refers not so much to the actual physical location of private assets or liabilities, but to nominal, hyper-portable, multi-jurisdictional often quite temporary locations of networks of legal and quasi‐legal entities and arrangements".

So it sounds like some tax advisers have found the entrance to The Matrix.

Wherever it is, it's not in the real world experiencing real things, like tax. The report estimates that if tax was paid on the investment returns, it would yield more than the twice the amount OECD countries are spending at the moment on overseas development aid.

That's probably not how the money would have been spent in the first place. According to the report, a wide range of people might be availing themselves of these schemes: 30-year-old Chinese real-estate speculators, Silicon Valley software tycoons, Dubai oil sheiks, Russian presidents, mineral‐rich African dictators and Mexican druglords.

It conjures up the image of a group of baddies gathered in uneasy truce around a table in a secret location with only one item the agenda: How Do We Stop Superman? Just as they are about to agree a strategy, Superman himself appears and causes chaos for the participants with a selection of his superpowers.

Superman can use lasery eyes to melt all the guns he wants, but he can do nothing about a basic human urge best encapsulated by "plebianbob" one of the commenters on the £21tn story when it was first published earlier this week: "If you were very rich would you willingly pay tax?"

The very rich don't want to pay tax for three reasons:

First, money is lovely and having lots of it is better than not having lots of it.

Second, some very wealthy people collect money and giving it away ruins the aesthetic of the pile they have. It's an inclination common to all collectors.

For example, over time I have accumulated a few hundred books. Although they are of varying quality and there are many I will never read again (or read at all), the prospect of giving any of them away makes me very protective. There'll be a hole in the shelf where it was. I would miss any of them - even the Twilight series.

I need all these books, OK?

It's unlikely the Mexican druglords, Chinese property developers and mineral-rich African dictators sit in a library of money, rearranging the bills by alphabetical order and genre, but the impulse to hoard is the same.

Finally, it's about trust. Wealth gives people confidence. Confidence makes them sure of their opinions, and one of their opinions is that they are much better at spending their money than the government is. Allied to this is the fact that for many wealthy people, the tax is not deducted at source. They have to volunteer it.

When your tax is deducted from your wage bill, while you are aware the money was taken and would love to have it back, it was never in your hot little hand. The best you can do is to imagine the good work that money will do to support essential public services - to buy medicine in a hospital or pay the wages of a librarian who suggests a wonderful book to a child who goes on to become a Nobel Laureate poet.

When you're self-employed, it's a different story. You don't have to file until the end of the year, during which time you've become very attached to your money and you would like to see it well-treated.

This attachment convinces you that if you give it to the government, it's going to meet a sticky end. You picture your poor forlorn little notes being grasped in the meaty hand of a politician as they spend it on new curtains for the ministerial office.

By the time it comes to filing day, you are in a spitting rage. Which leads to aggressive tax avoidance.

You can hear <link> <caption>Colm O'Regan</caption> <url href="http://www.colmoregan.com/" platform="highweb"/> </link> every Saturday on In The Balance, on the BBC World Service, at 11:00 GMT