Tesco effect: How big firms quietly own little brands

- Published

- comments

There's been negative coverage over a new "family" coffee chain that is actually backed by Tesco. Why do people become vexed?

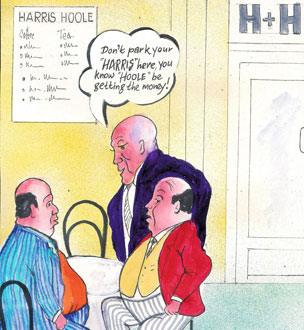

With its exposed brickwork, muted lighting and expensive decor, Harris and Hoole is the epitome of a modern, upmarket coffee shop of the kind that has colonised the UK's High Streets in recent years.

The one sound you won't hear amid the tinkle of ceramic cups and relaxed chat, is a tannoy announcement saying "clean-up in aisle seven".

Yet Harris and Hoole would not be expanding quite as rapidly as it is without the financial backing of supermarket giant Tesco.

Tesco's stake has been reported at 49%, but the coffee chain will only say it is "up to 49%". Not that you would know this from a visit to one of its 10 outlets or the company's website, where Tesco barely merits a mention.

The Guardian reported on the supermarket's stake last year and this week Mail Online featured it prominently, although many readers left comments in support of Tesco and the chain.

Harris and Hoole in Uxbridge

There's been some ill feeling on social media. One alienated customer tweeted, external: "Appalled to discover seemingly independent #Harris+Hoole coffee shop @N8CrouchEnd 49% owned by #Tesco. Never go again". Another questioned Tesco's record on paying tax and tweeted, external: "#Harris + Hoole will be added to my boycott list."

It is not hard to see why Tesco would want to get into coffee shops - they are among the few growth areas in a bleak retail landscape.

And Tesco is not the first multinational to buy into a self-consciously cool, quirky and independent-sounding brand.

"Large global brands realise there is a generic dislike of super brands, so they often like to appear smaller than they are to avoid negative publicity," says Stuart Roper, a corporate reputation expert at Manchester Business School.

Ben and Jerry's ice cream (Unilever), Innocent Smoothies (Coca Cola), Green and Black's chocolate (Cadbury/Kraft) and Copella apple juice (Tropicana/Pepsi) are among the many formerly independent brands now owned by large corporations.

But what seems to have irked anti-corporate coffee lovers about Harris and Hoole is that Tesco has not bought into an existing brand, but is instead attempting to build one from scratch.

"Our main objection is that they are masquerading as a little, independent shop. They are a wolf in sheep's clothing," says Brian Hitcham, of Save Whitstable Shops. Hitcham has campaigned to stop a Harris and Hoole opening in his town.

Hitcham, an antiquarian bookseller, fears the arrival of Harris and Hoole and other chains will damage the character of the Kent seaside town and force genuine independents out of business by driving up rents.

The new coffee chain is treading carefully.

Its Australian founder, Nick Tolley, met Hitcham and other campaigners in December in an attempt to convince them he is not out to destroy their town.

"Our priority is to get the Whitstable shop right and the process may take time but we'll keep the local community informed as the project continues," he says.

Poster from Save Whitstable Shops campaign

Tesco, for its part, says it has never hidden its involvement with Harris and Hoole. It has taken a non-controlling stake in a string of businesses in recent years, from a garden centre to an online streaming service.

"Tesco invests to help build brands where we believe we can add value," says a spokesman.

This, argue entrepreneurs, is the crucial point that anti-corporate campaigners always overlook.

Banks are reluctant to lend money to start-ups unless they are already making a profit, so if you want to expand your business, getting into bed with a multinational is often the only game in town.

Teapigs, a high-end tea manufacturer, is another company that has come under fire for allegedly hiding its corporate roots.

Its website, with pictures of the office dog Harvey and tales of founders Nick and Louise's passion for "real tea", ticks all the cute and quirky boxes.

It's not easy to spot any mention of Teapigs being a subsidiary of Tetley which in turn is owned by giant Indian industrial conglomerate Tata.

There has been a predictable backlash from bloggers.

The Foodie Gift Hunter says she felt "miffed" and "duped" by Teapigs, external.

"To me, you can set a business up any way you like. You can be owned by who you like. Just don't expect us not to be disappointed when you turn out to be something different to how you portray yourselves," she wrote, adding that she would no longer be purchasing their teabags.

Digital consultant Alex Balfour says his wife was similarly disappointed.

"Upset wife by telling her Teapigs is effectively Tetley spin off - ex-tetley execs, 100% owned by Tata which owns Tetley. That's marketing," he tweeted, external.

But self-styled "tea evangelist" Nick Kilby, who started Teapigs in 2006, thinks the criticism is unfair.

"If people were in our shoes they would probably have done the same thing. If they had actually been through what we went through they wouldn't be making these sort of comments. They are very ill-advised."

If the company had received financial backing from a bank, then it would not have come under pressure to reveal the name of the financial institution on its website, he argues.

The firm operates as a separate business, with no interference from Tetley, he says.

"That sort of criticism is never going to go away. Some people are always going to think 'big is evil' and yes it is in some cases but in many other cases it isn't. We all rely on big companies and big institutions."

Ben and Jerry started in a Vermont garage, and sold to Unilever in 2000

Brian Millar, director of strategy at branding agency Sense Worldwide, says corporations have had a crash course in how not to trample over the family firms they buy into.

"Multinationals are getting smarter at working with these small brands without ruining their authenticity.

"The key is often to keep the founder in the business and not have them waltz off to the beach, while the brand they have lavished so much care on becomes just another name in a big house of brands."

Entrepreneur Harry Cragoe, who invented PJ's smoothies in 1994, knows all about this.

He sold out to Pepsico in 2005 and watched with mounting horror as the product to which he had dedicated his life was rebranded, repriced and, within 18 months, ditched altogether.

"It was mortifying," he recalls.

It had always been his intention to sell the firm - that is often the only way an entrepreneur can reap the financial rewards of their years of effort.

But if a key part of your business strategy is being "open, honest and transparent" or "ethical" then it puts you in a difficult position, he says.

He decided to walk away from the business after the Pepsico deal ("I have got nothing against multinationals. It is just wasn't something I wanted to be involved in") heading for the beaches, not of the Caribbean, but Camber Sands, where he has set-up a luxury hotel.

His main competitor, Innocent, sold a 58% stake to Coca-Cola, but the firm's founders retained day-to-day control of the business, building it into Europe's leading smoothie brand.

Consumer surveys suggest people think less of a brand when they discover it is owned by a multinational - but that does not mean they stop buying it.

People love products that look and feel authentic.

Only a small percentage will take the trouble to find out whether they really are - and an even smaller number will be so outraged by what they find that they will boycott it.

"It's hard to tell how long the reputational damage lasts," says Stuart Roper.

It's very much a minority of customers that inconvenience themselves to change brands. Significantly less than 10%."

Additional reporting by Megan Lane

You can follow the Magazine on Twitter, external and on Facebook, external