US-EU trade deal: Six reasons to care

- Published

Talks to thrash out the largest free trade agreement in history have been officially launched at the G8 meeting in Northern Ireland. So what might a US-European Union deal achieve?

About £100bn ($157bn) to the EU, £80bn to the US, and £85bn to the rest of the world.

As UK Prime Minister David Cameron officially launched the trade talks, rattling through the potential gains, it was easy to forget how much work lies ahead.

Tearing down trade barriers between the world's two largest economies will not happen overnight, and nothing will be signed on a deal before the end of 2014.

There are two key elements - the reduction of tariffs and the harmonising of regulations.

So, unpicking the jargon and distilling the generalities, what might it really mean?

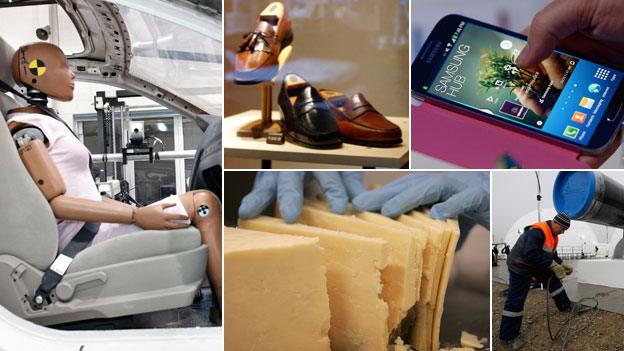

1. Cheaper shoes for Americans

Only 1% of shoes sold in the US are made on American soil, but that influx of foreign-made shoes comes at a price - tariffs are as high as 66%, giving the US Treasury a handy $2.4bn (£1.5bn) a year.

"From the importer to the distributor to the retailer, that price is marked up to create profit margins," says Matt Priest, president of the Footwear Distributors and Retailers of America (FDRA).

"So looking at a children's shoe at $9.99, $3-4 of that could be attributed to the tariff paid at the border."

By eliminating that barrier, put in place by the Tariff Act of 1930, prices will fall in the mass market, he says.

"If Walmart was to pass on that saving to consumers, the competitors will follow. If you're a single mum with three kids and you have to buy them shoes once a quarter you're talking about a decent saving just by eliminating this tax."

2. Europe less reliant on Russian gas

Under the Natural Gas Act of 1938, US natural gas exports are regulated and must be authorised by the Department of Energy, which considers whether exporting is "consistent with the public interest".

However, exports to free-trade-agreement (FTA) partner countries are fast-tracked, so cheap American shale gas would be available to all member countries of the EU, says Bruce Stokes, a non-resident fellow at the German Marshall Fund of the United States.

"That would be in American self-interest and help our trade imbalance but there are US industries who benefit from cheap energy and who probably are not keen to see European competitors benefit from it also.

"It would also help the European economy and go some way to weaning it off Russian gas. So there are huge geo-strategic reasons for the US to tie its allies to itself through energy exports.

"Whether you would be able to export enough gas to wean Europe off Russia entirely, it depends, but symbolically it would be very important."

3. Good news for European car firms...

"The US has a growing appetite for economical European cars like Golfs and the Focus," says British motoring expert Quentin Willson.

"This will help European manufacturers like Peugeot and Citroen enormously who are struggling globally.

"The import cost for Mercedes and BMW will fall as well, as quotas increase. For the European car industry this would be a huge benefit.

"The big obstacle to all this will be the very militant US auto trade unions who won't like it all."

...and Japanese ones

If car safety standards are harmonised then it will lead to potential gains for car manufacturers in the US, the EU and beyond, says Davide Tentori, researcher in international economics at Chatham House.

Airbag standards and crash tests are conducted in two different ways, so making a single test would reduce costs in both regions and for third-party manufacturers.

"For example, if a Japanese manufacturer wants to enter the market this will help because they will only face one standard."

4. Chinese standards edged out

It will be tricky for the two regions to agree on exactly the same regulations, but the hope is they will harmonise enough to bring huge savings to manufacturers.

Companies tend to build things that are easier to sell in the biggest market, says Stokes, so a huge market with common technical standards will be a huge draw for global investment.

"You would be creating a market with no tariff barriers and diminished regulatory barriers, worth about $30tn (£19tn), which would basically set the technical standards for the immediate future.

"Samsung has made it clear, for example, that its next generation of mobile phones will be built to either a European-American standard, or a Chinese one. And that if Brussels and Washington fail to come up with common specifications, it will be Beijing's standards that Samsung adopts.

"And perhaps more importantly, these regulations would be openly arrived at, transparent and accountable, unlike those developed by the Chinese government."

Car manufacturers in the US and EU have already agreed common standards in things that the average consumer never sees, says Stokes, like the way batteries in electric cars are tested and operate.

To avoid car companies having to come up with separate electrical vehicles for each market, he says, they want to build cars in Europe they can sell in the US and vice-versa.

5. More good cheese

Dairy products sold between Europe and the US pay tariffs, particularly high entering the US, so both sides in negotiations will be looking at how they can reduce or eliminate them.

But there is little concern about European cheeses flooding the American market, says John Umhoefer, executive director of the Wisconsin Cheese Makers Association, who sees benefits on both sides of the Atlantic.

He doesn't envisage the EU targeting the US to export cheaper cheeses because it wouldn't represent good value, but hopes that more "higher end" cheese will go in both directions.

"The US cheese industry has benefited from Americans coming to understand fine cheeses that have originated in Europe over 1,000 years.

"And as we have become a more sophisticated market, the American cheese industry has made cheeses that are as good or better.

"If barriers were removed, we have more chance to sell more cheeses in Europe, which is great."

6. Cheaper drugs

At the moment, when pharmaceutical companies in the US put a new product on the market, it needs authorisation for sale in Europe, says Jan Techau of think-tank Carnegie Europe.

And the same goes for European products that enter the American market.

"It takes forever and it's very expensive. Without this, we would have a wider array of choices on the market, so doctors could prescribe different things.

"It would increase competition which always means that prices fall so customers benefit. So everyone would be affected in a positive way."