A Point of View: Why every household should have its own currency

- Published

As micro-currencies try to usurp traditional government-issued money, Adam Gopnik wonders whether families could benefit from minting their own coins.

Money is pieces of paper with pictures of people on them, a wise child once said, and she was right. Whose face should be on our money, far from being a secondary, cosmetic question, turns out to be a big one. I knew, for instance, that the Euro was in crisis the first time I ever saw a euro. It was the only insipid currency ever printed. There was nothing on each denomination except a bridge or arch, no pictures of people at all - and then not even an actual European celebrity bridge, the Rialto in Venice or the Pont Neuf in Paris, but a limp generic representation of a limp generic bridge. No one - not billy goats or trolls or any of the other denizens of the actual European imagination - could live under such bridges.

The continent that gave the world the inquisition and the telescope and the sonnets of Petrarch was reduced to the symbol of a melancholy arch presiding over a melancholy land that lay nowhere and had no folk. Not Goethe or Leonardo or Johan Cruyff - not even such consensus Europeans as Tintin and the Captain were allowed to show their faces on the euro (although I suppose Herge's questionable politics made even that impossible). The absence of common heroes showed, more eloquently than any number of charts or graphs, that the eurozone had been linked together by fiat more than common feeling. I was also pretty sure that the euro would survive anyway, since if there is one thing you learn about French high functionaries it's that what they insist on having happen, happens, and reality be damned.

And so the imagery, the iconography, of money is more than just decor. It displays the true convictions of the commonwealth that intends to support its value. We put presidents on our money here in the US because, despite their obvious deficiencies, we make a papacy of the presidency, and treat it as a semi-divine state. You over there, I know, have been debating who to put next on your money, on the flip side to the Queen. I liked seeing Charles Darwin on the £10 note, and although I certainly approve of the final choice of Jane Austen, I still think that you will discover dangers to having an ironist on your money (I grew up in Canada, where we keep the Queen's picture on our money too - and there is, I will say, something odd about a genial lady ageing on the currency, with lines and liver spots).

The governor of the Bank of England unveils the new Jane Austen £10 note

It's natural that money comes to represent our common life. In so many ways, it is our common life. In the best sense, it's a confidence game. The idea of money began, after all, when some early man or woman first realised that instead of lugging around the portable property that had value - seashells or gold nuggets or the like - you could simply carry tokens that stood for that property. Then the other early men and women had to learn to trust that the portable property was really back there, in the cave. It was left to modern man and woman to see that you could have the tokens without even having the portable property they once stood for. Now the tokens are so many removes from the property that what money stands for is really the full faith and confidence of the people that print it - essentially, pounds and dollars and euros are IOUs from the army and navy, promising that our accumulated common goods won't be looted by Vikings or Vandals.

Vikings: Keep them away from your currency

Now, for the first time, we have a sudden boom in micro-currencies, issued by notional nations or even neighbourhoods, and we also have for the first time what are sometimes called crypto-currencies, Bitcoin being the most famous - and so the government-money nexus seems in serious doubt. As I grasp the concept of these micro-currencies and crypto-currencies, it is essentially that the value of money need no longer be guaranteed by the nation state. A roving network of internet users can rely instead entirely on each other to ensure the value of the tokens. This idea doesn't fill me with confidence, but then, I'm the man who doesn't even tweet. In the new virtual world, you can use an agreed crypto-currency to buy and sell while avoiding the government altogether - a particularly good idea if you happen yourself to be, so to speak, a Vandal or a Viking.

The future of micro-currencies seems to me more or less unlimited, since the central economic insight I've gained over the years is not that governments are more or less like households, but that households are all more or less like small states - which, like actual governments, tend to pitch two essentially irrational economic theories against one other.

I live in a household, for instance, that has its own economic policy - or rather two of them. One was invented by my wife, Martha, and the other is my own. Marthanomics, as they're known, are strictly speaking a subdivision of the underlying field of Marthamatics, the theory by which two and two might make four but might as well make six, since how much bigger is six than four really? In this way, if something costs half as much again as you thought it would, it costs the same as you thought it would.

Marthanomics extends this principle. The writer Calvin Trillin used to say of his late wife, the wonderful Alice, that she believed that any extravagant purchase considered even for a moment should be considered money saved for spending later. Marthanomics simplifies this principle with the efficiency of genius - all money spent is money saved. Either the thing you are spending on will be so much more expensive tomorrow that it would be criminal not to buy it today - or else the thing you are buying will be worth so much more tomorrow that it would be a sin against thrift not to buy it now. "I saw our vase at Bloomingdale's," she will say of some extravagant thing that we could not afford when we got it, "and you know what? The price has doubled. It's good we bought it when we did. We saved so much." The act of spending and the act of making are seen, in Marthanomics, as essentially the same act seen at two different moments in time.

This logic is irrefutable. And our home is filled with beautiful things. In fact, I wonder if that isn't what Keynes really had in mind with his famous economic crack about our all being dead in the long run anyway - that although we should consult futurity and the welfare of our children, we should not consult them too much, since if we continue to defer good things indefinitely no one will ever have them at all.

Martha points out (she is pointing it out now, reading over my shoulder and holding my hands away from the keyboard as she does) that Marthanomics has grown up strictly in opposition to what she calls the Adam Avoidance approach to the domestic budget. The first principle there is that any bill left in its envelope long enough should be considered as already paid. This is matched by the insight that invoicing employers for work done is a bit vulgar, not to mention insulting, and should also be avoided if at all possible. Indeed, the over-riding principle of my system is that all economic issues should be avoided if at all possible. If I were chancellor of the exchequer, I would simply leave all the documents locked up in my red box for months, and, when budget day comes, I would get up in Parliament and try and change the subject.

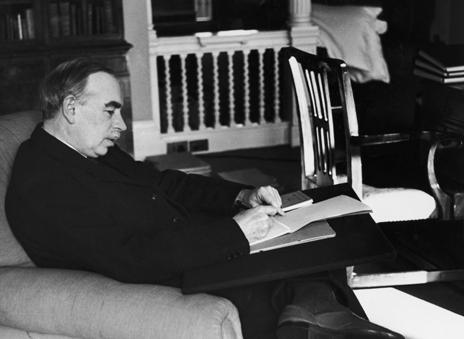

The economist John Maynard Keynes: "In the long run we are all dead"

I'm sure that your household has economic theories as odd and original, and that they too, ought to be commemorated by their own coin. I predict that in the future every household will have its own micro-currency. The people down the street who buy only in quantity (thousands of rolls of toilet paper at a time) will have giant bills, while the ones who defer their taxes for too long can have a picture of Oscar Wilde on theirs, in memory of his great forgotten remark, when confronted by the taxman demanding that he pay tax on the house where after all, he slept: "Ah! But I sleep so poorly." My family's micro-currency will have pictures of the Beatles and the Kinks, at their full glory, and vaguely psychedelic spirals and whorls all over it. And so it will go, house by house and family by family, making our micro-currencies like morning poems. For what is money, after all, but a game we have decided to play, a study in mutual confidence, a medium of exchange?

A Point of View: Money Matters is broadcast on Friday 14 February on Radio 4 at 20:50 GMT and repeated on Sunday 16 February at 08:50 GMT. Or catch up on BBC iPlayer

Follow @BBCNewsMagazine, external on Twitter and on Facebook, external