Diamonds: Natural and unnatural wonders

- Published

Diamonds - almost certainly genuine diamonds - on display at the Oscars

To a chemist, diamonds are a three-dimensional cubic lattice of carbon atoms. To most of us, they are the ultimate status symbol - but how long will they remain so, now that they can be mass-produced?

It was the US giant General Electric that first figured out how to bake a diamond back in the 1950s.

The High Pressure High Temperature (HPHT) technology they pioneered - which recreates the conditions under which natural diamonds form deep inside the earth - is still used today.

A giant steel vice crushes a canister of graphite the size of your fist with a force equivalent to the weight of an upturned Eiffel Tower.

At the same time, the canister is baked at up to 2,000C. That's enough to encourage the layered sheets of carbon atoms in graphite to re-jig themselves into a 3D diamond arrangement.

Diamonds are the hardest material in the world, and HPHT is still the best way of knocking out the millions of tiny stones - diamond "grit" costing a few dollars for a small pot - that are used as abrasives in everything from oil drill heads to stone grinders and cutters.

Back in the day, the world's biggest diamond company, South Africa's De Beers, was quick to see the threat - and opportunity - that this new technology posed, and rapidly moved into the sector itself.

Steven Coe, research head at De Beers' synthetic diamonds subsidiary Element 6 - named after carbon's place in the periodic table - says these super-compressed crystals still comprise 90% of everything they sell.

But the technology has one drawback. Trace amounts of nitrogen from the air infiltrate the diamonds, turning them an unattractive cloudy snot-green colour.

And that's where an exciting new way of making diamonds comes into play - "chemical vapour deposition".

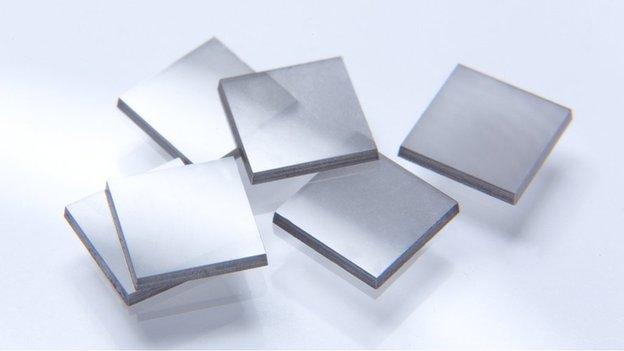

Instead of crushing graphite, this technique grows a diamond wafer, using a carbon-containing gas such as methane.

It is much slower - taking weeks instead of minutes - but the crystals are purer and clearer, and can be made to the size and dimensions needed.

This has opened up a whole new world of industrial applications, driving rapid growth in the industry.

At Element 6's enormous new research centre, just outside Oxford, Steven Coe opens up a briefcase to show off a surprising range of objects, many of which don't resemble diamonds at all.

First out of the case is something that looks and feels like a disc of perspex.

It is a circular window, 12cm in diameter, used in high-power lasers.

Diamond is almost completely transparent in the infra-red range, so the window does not distort the laser beam, Coe explains.

And because diamond is the best thermal conductor of any known solid at room temperature, the window does not overheat. But a single-crystal object this size will currently set you back $100,000.

That thermal property has also opened up another surprising application, in electronics.

As circuit-boards continue to shrink, they face a new problem - overheating. So Element 6 is doing a roaring trade selling diamond heat-sinks - the circuitry runs over a bit of diamond that sucks the heat out of it.

Coe shows one off, covered in that other coveted material - gold - which provides untarnishable electric contacts in many modern gadgets.

Another impressive single-crystal object is the blade of a scalpel, so sharp that Coe warns you will bleed before you even feel it touch your fingertip.

Next he produces a small, hollow, cupola-shaped object. "This is a diamond speaker dome," he says. "The tweeter in a loudspeaker system.

"Diamond is the stiffest material, so it provides the best possible high-frequency sound reproduction."

But there is one product that Element 6 absolutely does not do - gemstones.

Natural diamonds may be "rare natural wonders", but they also leave an ugly hole in the ground

A cynic might think this is because Element 6 is restricted from cannibalising the business of its parent, De Beers, whose mines still meet about a third of the world's demand for mined natural diamonds.

Indeed, according to diamonds consultant and journalist Chaim Even Zohar in Tel Aviv, one of the world's big diamond trading centres, Element 6 owns patents on technologies that might be used to produce coveted gemstones tinted attracted shades of blue and green - it just doesn't in practice produce any.

Chaim thinks that it is merely postponing the inevitable: "We are on the eve of what I call mass production capacity. And diamond mines are not forever."

Right now, he explains, diamond manufacturers can make far more money selling their wares as heat sinks and laser windows.

But as production capacity increases, and as the supply of mined diamonds continues to stagnate, he thinks it inevitable that synthetic diamonds will fill the growing gap in the gemstone market.

Man-made gemstones are already available, and Chaim sees them appealing to a younger generation of buyers influenced by the perception that mining harms the earth and fuels conflicts.

And they are now so similar to natural diamonds that millions of dollars' worth have been fraudulently passed off as the real thing - a scandal that Chaim first exposed in 2012, external.

The man-made stones even contained tiny flaws in the crystalline structure that mimicked those found in natural gems.

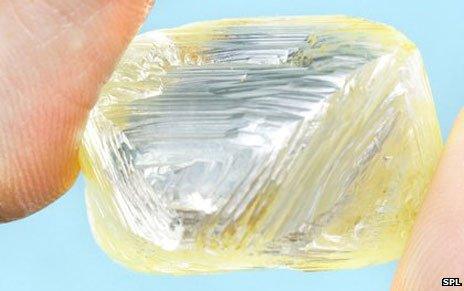

A genuine uncut diamond

It is still possible with sophisticated equipment to tell the difference, though - and De Beers has been rolling out such equipment precisely to eliminate the fraud risk.

But Chaim thinks synthetics could already be commonplace among the smallest stones in composite jewellery, where it is not worth the cost of checking.

Will customers actually care? De Beers certainly hopes so.

"I'm in the business of selling extraordinarily rare, very precious, very valuable natural wonders," says De Beers' marketing head, Stephen Lussier. "And that is what consumers buy."

His argument makes natural stones analogous to fine art - people are buying the exclusive back-story, not just the beautiful object.

But, as Chaim points out, chemically there is no difference between the two products. "Compare it to two lovely girls - one was born the natural way, one by artificial insemination - but they are equally lovely."

And while original works of art may be highly sought-after as status symbols, there is also a mass market for identical poster reprints.

So here's the real question: How much more do you think someone should pay to propose with a stone that's a billion years old, as opposed to one made last week in a factory?