The Liverpool app that sidesteps the banks

- Published

An Israeli company called Colu has launched a local digital currency in Liverpool, which aims to revitalise the local economy by cutting out the banks. Will it achieve more than paper local currencies have? To find out, Dougal Shaw followed the money trail.

Large chains like Starbucks, Costa or McDonald's, need not apply. This new digital currency, known both as Colu and Local Pound Liverpool, is only open to locally owned and run businesses. The idea is to encourage people to support the local economy.

Local currencies are common around the world - there are more than 10 in the UK. The idea behind them is that if you spend your money with a locally based company instead of a big chain, more of that money will continue to circulate locally. It won't be sucked out of your community into a company's foreign headquarters, or be paid out to shareholders.

But these currencies rarely attract enough users to have a real economic impact. Could Colu be different?

As well as being purely digital - running on a smartphone app - it is operated by a well-funded tech company that specialises in cryptocurrencies. In many other cases, local currencies are run by a small resource-starved team of enthusiasts and volunteers.

I went to see who is actually using this new currency, from a man buying his weekly sausages to the assistant mayor of Liverpool.

The customer

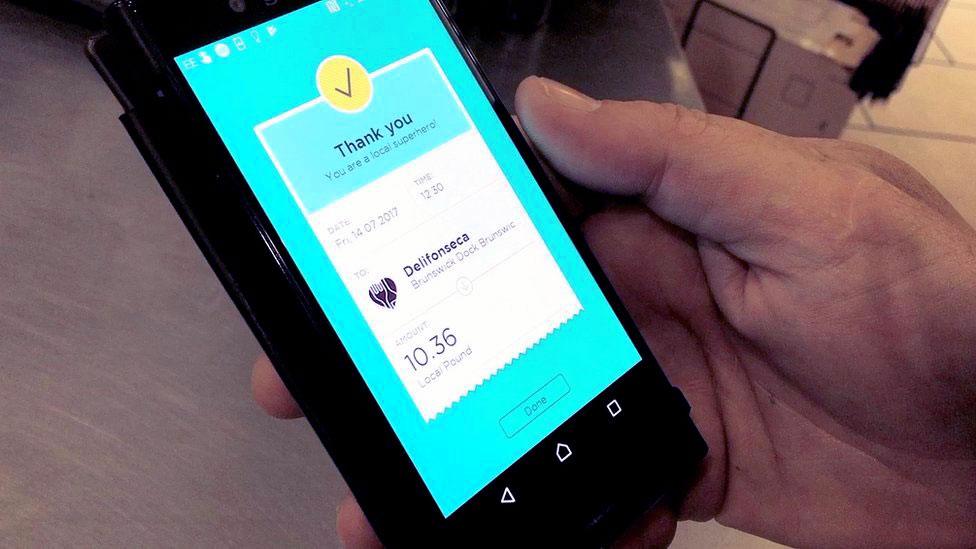

Foodie Ian Rasmussen is one of 17,000 Liverpudlians who have signed up to use Colu. I meet him at a deli called Delifonseca, where he is buying some sausages.

"I believe in local businesses, so I like to promote what they are doing through my consumption. One makes ethical decisions every day in the shops and I choose to buy locally because they tend to be more particular about where they get their food from. They tend to be better employers and re-invest in the community."

The app is easy to use, he says, which is one of the things that makes it appealing.

But local currencies appeal to Ian for another reason.

"Since the financial crash of 2008, businesses have completely fallen out of love with the banking system and realised how ruinous it can be. It's nice if local businesses can get round the inconvenience of banks that don't understand them."

When Ian pays for his sausages at the till, the transaction is made purely through the app, with no bank involved.

Ian has to buy his Colu pounds with normal UK pounds from his bank account. They are worth exactly the same.

At the moment, a complimentary £5 is offered to new joiners and 10% is added every time money is paid in. This is funded by Colu, in a bid to get more people like Ian to join.

Colu has a lot of venture capital behind it and investors are keen to see it grab market share, like Uber or Deliveroo.

The business owner

Candice Fonseca runs the deli where Ian purchased his sausages. It is one of more than 100 businesses accepting the local digital currency.

"Liverpool has a very strong sense of identity and in this globalised time people are more conscious of their localities," she says.

"We have customers who don't carry wallets, it's inevitable that currency will become phone-based.

"It's also cheaper for us. Customers can't really get their head around how much we pay for banking. Even to put cash into the bank as a business, we have to pay. The idea [with Colu] is to keep the money flowing locally. We'd like to give staff the option of taking Colu as part of their wages eventually."

Normally businesses pay a charge every time a customer uses a debit card (about 0.5-1%) or credit card (about 1-2%).

A transaction in Colu incurs zero charge for the business.

However, whenever anyone converts Colu back to normal UK pounds - cashing out, as it is known - they pay 1.5% commission. This is how Colu makes its money.

"If you pay another business [in Colu], then you don't pay anything, it's the cheapest way of taking money in that case. We're not cashing anything out. So we pay suppliers like Sugar & Lime, who we get our hire equipment from for outside catering, in Colu. We spend thousands with them."

The supplier

More than a quarter of a million local pounds have circulated so far in Liverpool. But somebody needs to cash out at some stage and take the hit of 1.5%.

One of them is Anthony O'Leary, who runs the catering equipment firm Sugar & Lime, which supplies Candice's deli.

His warehouse contains supplies from around the world, which can't be bought with local currency.

"We cash out our local currency because we're the end of the line. There's nobody for us to spend the local pound with at present.

"But there is scope for products that we buy to be manufactured more locally, in which case we could continue the chain," he says.

Although Anthony would prefer to be paid in cash, he says it's not a clear-cut decision.

"I've still got banking charges one way or another. Cash is expensive, credit card fees, it's all at a cost."

Colu also brings him new customers, he says, so in that sense it's a good investment.

Anthony can also see another way for him to pass on the Colu currency and avoid the 1.5% charge - he could pay business rates in the local currency. This is what happens in Brixton and Bristol.

But first the council has to agree to it.

The councillor

Gary Millar is assistant mayor of Liverpool and a technology enthusiast.

He is a user of the app and a fan of local digital currencies in general.

"A council like Liverpool could use this to ensure money stays local. We know when people spend money locally with an independent, 65p in the pound stays local. If they spend it with a big global organisation, it will be about 30p instead," he says.

"I think it's wonderful if a small business can pay its business rates using a digital currency - I'd love that to happen."

He says this would only be a logical extension of what is happening at the moment, and hints that discussions are taking place about the possibility of allowing business rates, planning fees and even parking fine to be paid in the new currency.

Millar says he could also imagine the council paying people with it, as long as this was done on an opt-in basis. The council pays some benefits on behalf of the government and of course it pays wages to its workforce - these could in theory be paid in Colu.

Millar is at pains to make clear that if such a payment system were adopted, Colu would have to take part in an open selection process.

The economist

Duncan McCann is an economist with New Economics Foundation who researches local digital currencies.

He thinks local digital currencies like Colu are a good idea, but he has some serious reservations.

"Local currencies seek to stop money escaping, the 'leaky bucket' argument we call it. They try to keep it circulating in your own community to do more good.

"Most local currency designs maximise the potential for the money to stick. There is some irony that this model that Colu is offering at its core extracts money to the mother company, which in this case is Colu [in Israel]."

Most other local currencies in the UK and Europe are run on a not-for-profit basis, he says.

The incentives Colu offers to new joiners can only last so long, he suggests.

"The big danger is that if no profit is being made, or worse they start making a loss, that they will just cancel the app and all the hard work is lost in an instant.

"Then it becomes very hard to start another local currency because there is so much bad feeling."

Transaction complete

Colu has been up and running in Liverpool since December. It also runs similar currencies in Tel Aviv and Haifa, both under two years old.

It is free of the financial overheads that come with a paper currency and its deep pockets allow it to provide incentives to users, at least for now, and to employ someone to recruit new businesses into the scheme.

Its backers think it can mount a challenge to global capitalism and multinational corporations.

Its fate depends on how many people vote with their digital wallets.

Watch the video, external and radio reports by Dougal Shaw, external on Liverpool's local digital currency for BBC World Hacks