'I bought Bitcoins in 2011 - now they're worth £19,000'

- Published

Drew Llewellyn bought his first Bitcoin in 2011.

Over the years, he has paid up to £899 ($1,100) and as little as £14.70 ($18) for one Bitcoin, as the value of the digital currency has dramatically risen and crashed.

But now, for the first time, one Bitcoin has topped the value of an ounce of gold.

And Drew, who owns 18, is pretty happy about it.

On Thursday night, the value of a Bitcoin closed at £1,036 ($1,268) while an ounce of gold stood at $1,233.

"For years critics have said Bitcoin will never last - that its value will drop, that it will never be adopted, and even that it's some kind of ponzi scheme, external," he told Newsbeat.

"Today's all time high is another example of how, year on year, Bitcoin is becoming more prevalent, reliable and valuable."

What can you buy with Bitcoin?

Drew, who works in IT in North Lincolnshire, has used his Bitcoin to buy everything from a steam link (to play video games), to Amazon vouchers, to computer parts.

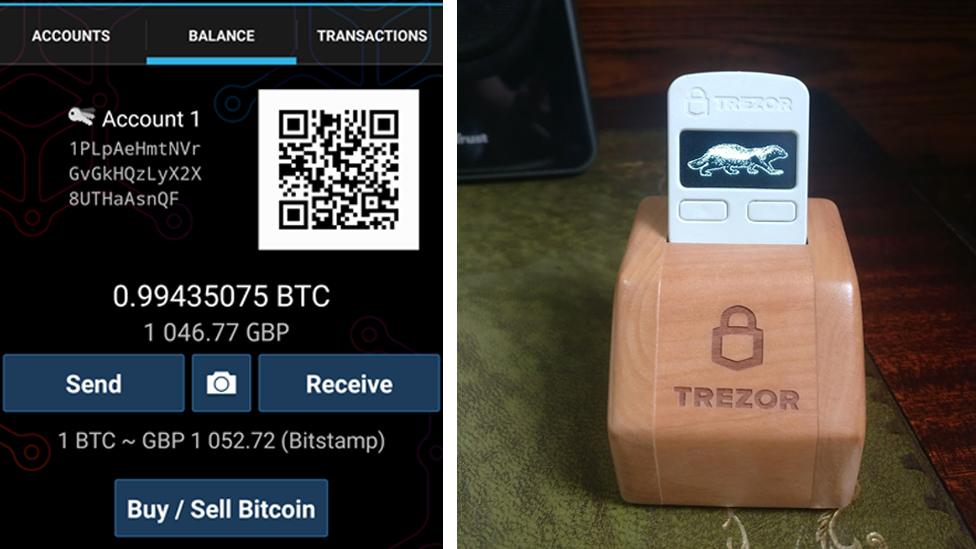

He has an app called a Mycelium Wallet on his phone to buy things with Bitcoin, and a secure Trezor Bitcoin Wallet which stores most of his Bitcoin on a separate device (see photo below).

But Drew mainly sees his stash as a savings pot and tries not to spend too much.

So he's hoping this latest rise in the value is just the start of a bigger trend.

He lost money in 2013, when the price crashed. But overall, says that he's made around £6,500.

Drew's virtual wallet for paying with Bitcoin on his phone, and a Trezor Bitcoin Wallet (R)

How does Bitcoin work?

Bitcoin is a type of digital currency that operates completely online - the coins you see are just a novelty.

Each Bitcoin is basically a computer file which is then stored in a 'digital wallet' app on a smartphone or computer.

People can send a Bitcoin (or part of one) to a digital wallet, and to other people, and each transaction is recorded in a public list called a blockchain.

Why do people want to use it?

Like Drew, many people like the fact there's no central bank and that you own your money: "Any Bitcoin I own is entirely mine, it can never disappear."

He points to people who lost huge amounts of money in Venezuela and even in Britain, during the financial crisis.

But he acknowledges that there are risks. He tells Newsbeat:

"It's a trade of freedom to have your own money, as opposed to taking your money and putting it in a bank that might crash."

Find us on Instagram at BBCNewsbeat, external and follow us on Snapchat, search for bbc_newsbeat, external