Alligator Spread: When an investor will never be able to make a profit on the transactions they make. This is because the charges involved are higher than the profit made.

The spread refers to the difference between the highest and lowest assets. The spread "eats the investor", leading to the name Alligator Spread.

Bear Market: A bear market occurs when a stock market enters a long-term decline (so more than two months). If you have a fall of 20%, then you enter a bear market.

Bull Market: A bull market is the opposite - it's when the price of shares on the stock market is rising.

Bull or Bear? An easy way to remember the difference is to think of how the animals attack - a bull thrusts its horns upwards while a bear swats down with its big paws.

Cash Cow: An item that keeps providing a constant cash flow with very little maintenance. Once the initial capital outlay has been paid off, the cash cow generates funds which can be used elsewhere.

After all, a cow produces milk for many years - so the supply is often considered a guaranteed income. Examples include Cornflakes, Coca Cola and Ford Transit vans.

Dragon Bonds: These bonds, which are issued by Asian nations, are denominated in US dollars. They are used to attract foreign investment and are considered stable investments.

They were introduced by the Asian Development Bank in 1991 and are commonly used in China.

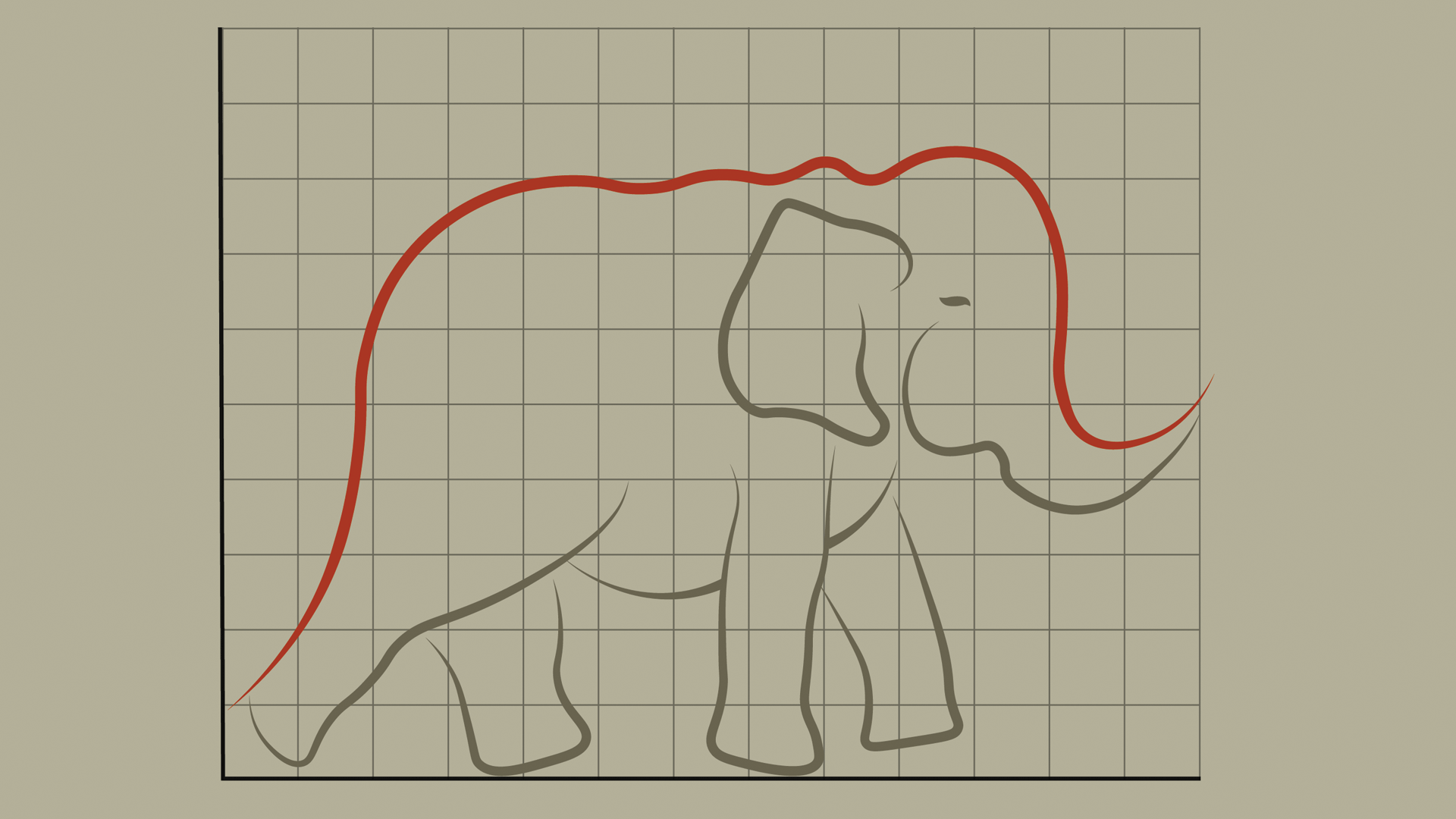

Elephant Curve: Created by former World Bank economist Branko Milanovic and his colleague Christoph Lakner. It is described as such because it looks like the body of an elephant.

The graph represents world income growth and pinpoints relative gain in household capita between 1988 and 2008. This was a period of "high globalisation".

Fat Cat: Calling someone a fat cat is often used to describe a rich and greedy person who owns lots of assets and uses the work of others to get even richer.

It also refers to executives whose pay is perceived by others to be excessive.

Gorilla: A company which has the biggest market share in the industry but doesn't have a monopoly. However, the size of its share means it is more able to take risks without fear it will lose a significant customer base. McDonalds could be considered an example of this.

Hawk: A hawk is a policymaker or adviser who tends to put a high priority on curbing inflation and is more willing than a dove to see higher interest rates to achieve that.

A Dove, on the other hand, is a policy maker or adviser who tends to be less willing than a hawk to see higher interest rates to curb inflation.

Iron Butterfly: An iron butterfly is a limited-risk, limited profit trading strategy. It involves the investor putting themselves in a protected situation whatever happens with the market.

Iron Condor: An Iron Condor is a limited risk trading strategy but with high odds. Its design is so there is a large probability of earning a small limited profit but only if the underlying security has low volatility.

Jungle: A jungle is a place where there is intense competition and where survival of the fittest rules. Ideal description for the business world.

Killer Bees: The killer bees help a company come up with defence strategies to stave off an attempted hostile takeover bid.

The individual or firm in question usually comes up with a plan to make the target look unappealing.

Lame Duck: Makes for easy prey. It refers to an individual or company that cannot keep up with the rest of the market.

The phrase was coined in the 18th century at the London Stock Exchange and referred to a stockbroker who defaulted on his debts.

Investors who continually make poor trades and lose out on profits are also described as lame ducks.

Meerkat Effect: Meerkats are active investors who keep checking their financial portfolios for signs of bad news. They are hyper-alert when it comes to sniffing out information especially when market conditions are changing.

Narwhal: A Canadian start-up that is valued at more than $1bn and was founded after 1999. Name created by Brent Holliday, CEO of Vancouver company Garibaldi Capital Advisors. The US equivalent is a unicorn (See U).

Ostrich Effect: Occurs when investors try to ignore negative financial information (although ostriches don't actually bury their heads in the sand).

Porcupine Provision: This is a clause in a corporation's charter or bylaws to prevent a hostile takeover bid.

Peacock Market: When markets are overvalued and the stock valuations are inflated by central bank policy. The phrase suggests a lot of puff and very little substance.

Queen Bee: A Queen Bee is a someone in a leadership role who does not encourage her subordinates' development, especially if they are women.

R is for Red Herring

Red Herring: A legal document filed by a company in connection to its initial public offering.

However, it doesn't include key details eg how many shares offered.

Sharks: The creatures feature quite heavily in financial lingo. A shark is a company that is trying to execute a hostile takeover. Sometimes the target company will need to deploy a "Shark Repellent" to try to stop the takeover from happening.

Tiger Economy: The economy of a country which is undergoing rapid economic growth and progression in its living standards.

The Asian Tigers include South Korea, Taiwan, Hong Kong and Singapore, while the Celtic Tiger refers to Ireland.

Unicorn: Used to describe start-ups that have grown from nothing to be worth at least $1bn.

Vulture Investor: Invests in distressed firms, assets or bonds in the hope that there will be a turnaround and the vulture can profit from this.

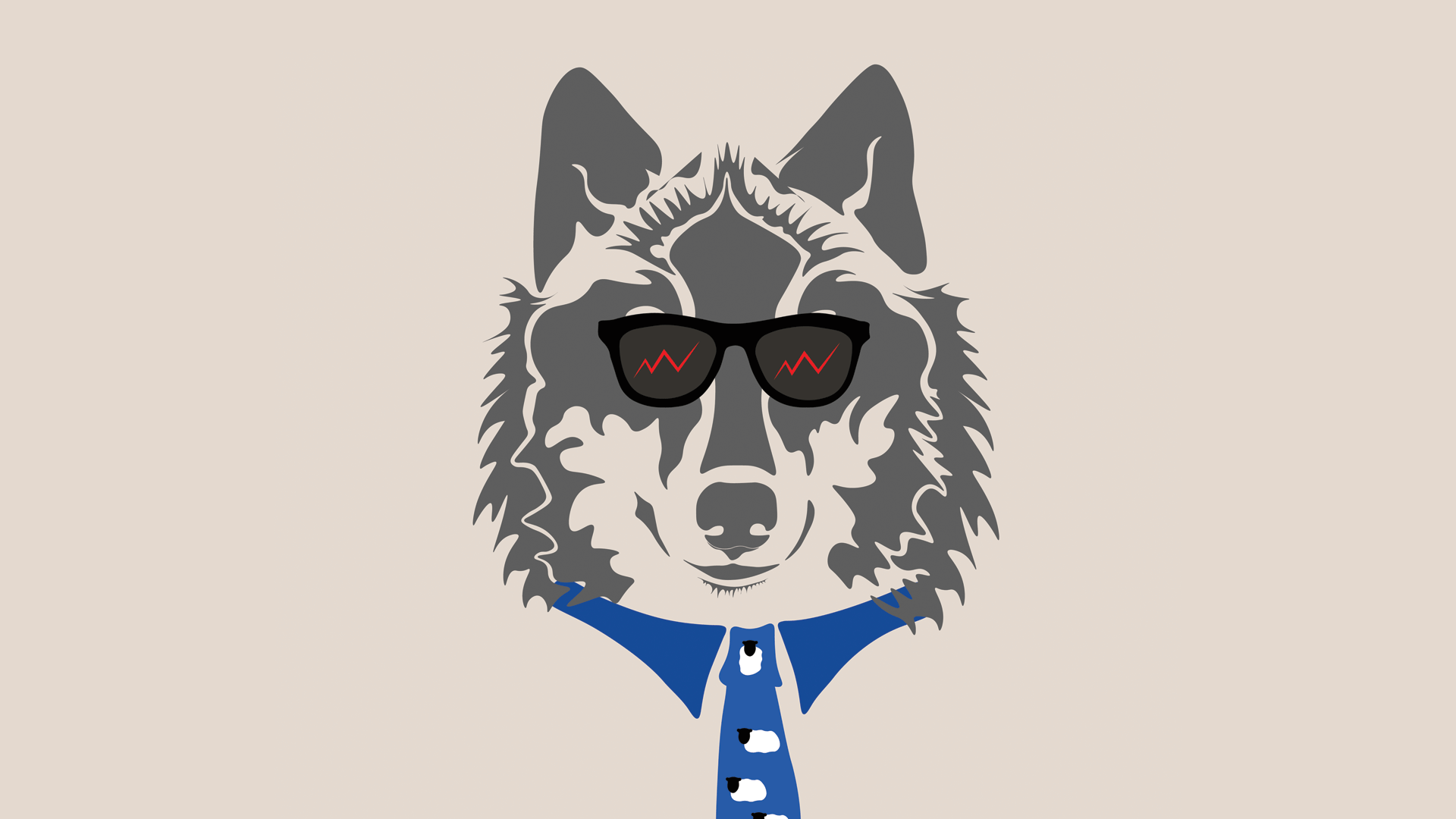

Wolf of Wall Street: A suave investor. One of the nicknames given to financial investor Jordan Belfort, who used it as the title for his memoirs.

X is for... really?

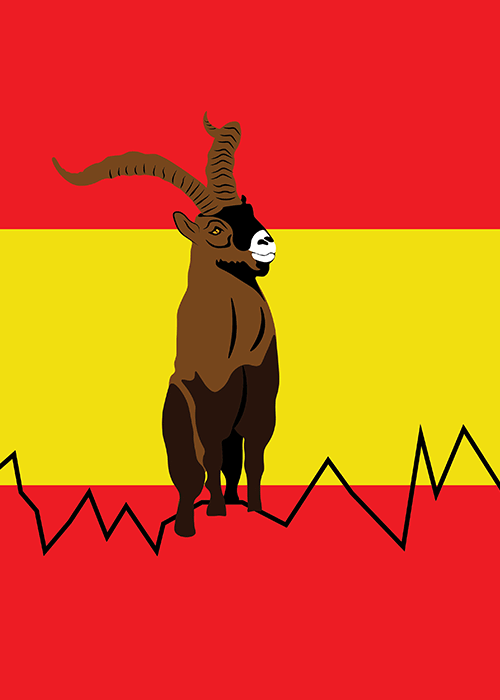

We tried. But there aren't that many animals beginning with X - let alone ones in the business lexicon. So we've gone with one ending in X and present Ibex 35 - the Spanish exchange index.

The Ibex 35 is made up of 35 top Spanish stocks in the Madrid Stock Exchange General Index and is reviewed twice a year.

Yak Shaving: A task that has to be performed otherwise a project becomes stagnant and you can't move on.

Zebra: Known as a "Zebra", a zero basis risk swap is a direct interest rate swap between a municipality (a fixed rate payer) and a financial institution (a floating rate payer).

Zebras also refer to an emerging movement looking to get more funding for starts up created by women and people from ethnic minorities. The founders of the movement say that unlike unicorns (see U), zebras are real.