Will the UK's low-carbon ripples spread?

- Published

- comments

The government has been dogged by criticism that it was losing its green credentials

For those of us brought up on a regimen of leaky windows, stalled trains and coal mining, the idea that the UK might be a global leader in the race to a clean, green low-carbon future is not an easy one to accept.

Is not our home insulation a paltry thing beside Sweden's? Are we not incapable of running a proper rail network like the Japanese? Does our ambition on nuclear electricity not pale beside that of France?

Whatever the reality of those stereotypes, the UK has now objectively forged ahead by becoming the first country to enshrine in statutory language a target for reducing greenhouse gas emissions that looks substantially further ahead than 2020.

Regular readers will know this blog majors on global issues rather than specifically UK ones - but if the UK is taking a global lead, it's clearly a matter of global interest, so here goes.

In case you're unclear about how this all works, a word of explanation.

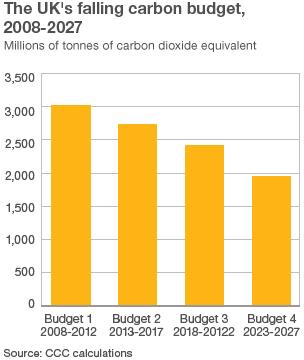

The Committee on Climate Change, external, the statutory advisers, recommend "carbon budgets", which set the total amount of greenhouse gases that the nation can release over a five-year period.

In each individual year it can release more or less than one-fifth of the total for the period; but by the end, the nation must be within budget.

A bit of wiggle room is afforded by carbon trading; but it's certainly a tighter process than financial budgeting, where deficits and debts can be rolled over and over until - like the US just now - a country ends up unimaginably in the red.

The carbon budget just approved - the fourth - covers the period 2023-7, which takes it beyond the targets set by the EU, for example.

A number of commentators (including your humble scribe) have in the past written somewhat sceptically about use of the term "legally binding", given that no-one gets sued or goes to prison if the targets are exceeded.

But I'm beginning to see how it works.

The Climate Change Act, external sets out rules by which the government must act - the principal one being that it must have very good reasons for diverging from the CCC's advice.

Green groups say that in this case, lobbying against the new carbon budget was poorly grounded in fact, with some business groups conflating the prospects for heavy industry with those for the UK economy as whole.

Greenpeace, external, I'm told, vowed to bring the government to judicial review if it acted on this "dodgy advice".

Here, then, are some of the legal teeth I'd been wondering about.

Many other countries maintain they too want to see their emissions coming down; so are any of them looking to adopt the UK model, in spite of its potential for locking governments in straitjackets?

Certainly, some are interested. Last December, Ireland published a draft climate change bill, external that bears many of the UK hallmarks; Hungary, Finland and Germany have also discussed, external establishing similar laws.

Beyond that, UK delegations have presented the idea to more than 20 countries spanning the developed world and the developing, on continents from North America to Asia.

It's a model that won't work everywhere; you'd suspect giving outsiders the power to hold governments to account wouldn't be seen as terribly appealing in some capitals.

That UK business considers it significant is beyond doubt - that's easily judged by the number of business organisations commenting on the budget's approval.

Some groups like it, external - others don't, external.

The ones that don't secured a clause guaranteeing a review in 2014, in principle allowing for targets to be weakened at that stage.

But green groups point out that under the law, any changes like that must be based on sound principles (preferably including amended advice from the CCC), otherwise they too will be subject to judicial review.

Other business organisations believe the UK will gain economically by establishing incentives for green industry.

"Companies looking to invest in the renewables supply chain will see this as a very positive signal - it makes the UK a more attractive venue for international investors," said financial consultants PricewaterhouseCoopers, external.

If these forecasts turn out to be correct, that may provide another incentive for countries to look at the UK and decide what they're seeing is good.