UK to fight energy product ruling

- Published

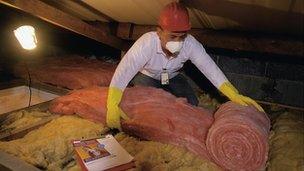

The reduction on energy efficiency products followed a campaign by green groups

The government is to fight an EU ruling that the UK must raise VAT on energy efficiency products from 5% to 20%.

VAT was reduced to 5% on energy efficiency products in the UK because government wants to tackle fuel poverty, reduce carbon emissions and create jobs.

The reduction followed a long fight by green groups.

They argued that it was nonsensical to tax energy saving more than energy use, which incurs tax of just 5%.

But the European Commission says the reduction on energy saving products breaches the VAT directive.

The directive allows for reduced VAT in several areas including water, food, audio books, restaurant service, gardening, nappies and energy itself - but not energy-saving products.

That is even though the commission's energy policy is to improve efficiency and cut carbon emissions.

The government says the VAT ruling is irrational and has confirmed that it will see the Commission in court, probably early next year.

The Climate Change Minister Greg Barker has started a Twitter campaign on the issue.

He told BBC News: "The Coalition's approach to energy efficiency is good for the environment and good for growth. Rather than obstruct us, Europe should follow our example!"

It's part of a long-running tussle over VAT and energy between the UK and the Commission. Gordon Brown personally intervened on the issue.

But green groups are suspicious that the government may be trying to pick a populist fight with Brussels.

Keith Allott from nature conservancy WWF told BBC News: "On this issue the government is clearly in the right. There are many barriers to energy efficiency so reducing the tax is a no-brainer.

"But it's ironic in the context that the UK government has been stone-walling on key provisions in the energy efficiency directive."

WWF accuse the government of failing to support EU mandatory targets for energy efficiency and of watering down targets for renovating public buildings. The government insists that it played a positive role in negotiations.

- Published16 May 2012

- Published30 May 2012

- Published22 May 2012