Bitcoin 'will recover' from crash

- Published

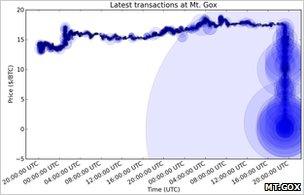

The value of Bitcoins fell from $17.50 to almost nothing in a matter of minutes

The virtual currency Bitcoin will "bounce back" after a hack attack caused its value to collapse, according to one of its senior developers.

Gavin Andresen said he hoped the crisis would lead to better security on sites where Bitcoins are bought and sold.

Prices on the main exchange, Mt.Gox, fell from $17.50 (£10.80) to almost zero when a large number of stolen Bitcoins were dumped on the market.

Trading was suspended and eventually rolled back to pre-crash rates.

Mt.Gox revealed details of the security breach on June 20 with an announcement on its website.

"It appears that someone who performs audits on our system and had read-only access to our database had their computer compromised. This allowed for someone to pull our database," the statement read.

Around the same time, an unidentified person accessed one of the compromised accounts and sold all of its Bitcoins.

They then attempted to buy the coins again and withdraw them in US dollars.

The fraudster was partially foiled when they hit Mt.Gox's $1000 daily limit.

The decision to reset the Bitcoin rate to a point just before the malicious trades were placed was criticised by some users who had taken the opportunity to buy low.

"Why should everyone who profited from the crash suffer your inability to secure the site?" wrote a user called Elments.

Questionable future

Although the problem was caused by security failings at Mt.Gox, it has raised wider questions about the viability of Bitcoin as a virtual currency.

"I am sceptical about its longer term prospects," said David Birch, director of Consult Hyperion, a consultancy specialising in electronic transactions.

"There were two things here - the specific bubble (caused by the dumping of stolen coins) and the exchange mechanism."

Bitcoin transactions are made by swapping anonymous, heavily encrypted codes which only a specific user can unlock.

Details of who owns each Bitcoin are distributed across a peer-to-peer network, with no central repository.

If an encrypted coin file is deleted, the money is lost.

Legal worries

The system has proved popular with online criminals, keen to keep their financial transactions secret, although it has a wider, legitimate, user base.

Mr Birch said the fact that so many Bitcoins were traded on a single exchange made it vulnerable to market shocks.

He also questioned the fundamental workings of the currency, saying that its emphasis on anonymity and decentralised nature meant there was little recourse for users when things go wrong.

The online freedom group, the Electronic Frontier Foundation (EFF) said it was dropping Bitcoin as a means of donating to its cause because of concerns about consumer protection, taxation and money laundering.

On the same day as the crash, the EFF's legal director Cindy Cohn wrote, external: "Since there is no caselaw on this topic, and the legal implications are still very unclear, we worry that our acceptance of Bitcoins may move us into the possible subject role."

Bitcoin developer Gavin Andresen conceded that current safeguards around the currency may be inadequate.

"I have been the person saying that Bitcoin is an experiment, so you can have confidence in it as much as you can have confidence in any start-up," he said.

"Like any start-up, it could change the world but it could also be risk."

- Published8 April 2011