China's Xiaomi unveils two thinner, lighter phablets

- Published

The BBC's Celia Hatton attends the launch of Xiaomi's latest device - and finds more than one similarity to a certain US tech giant.

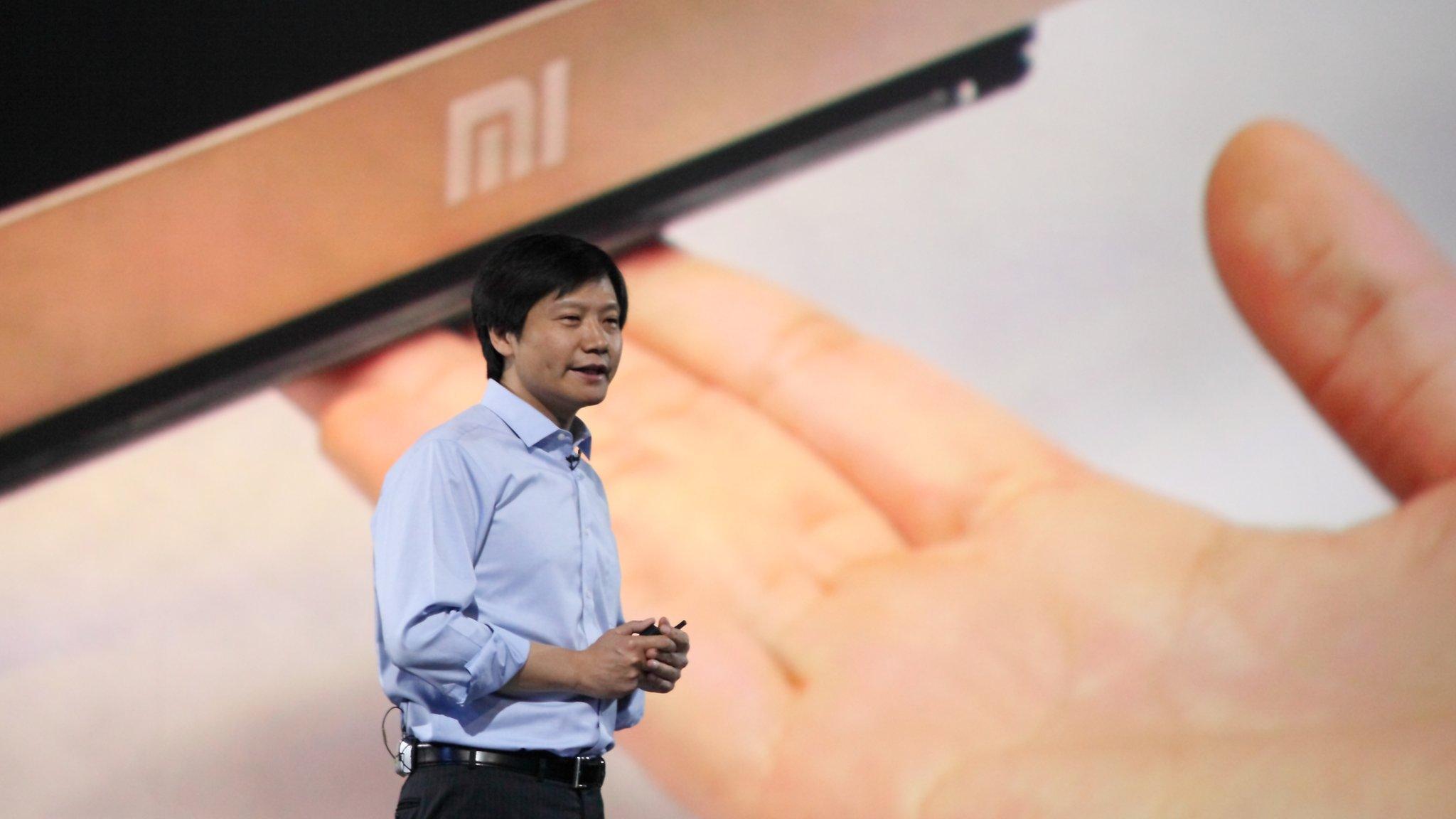

Chinese smartphone maker Xiaomi has unveiled two flagship phablets in Beijing on Thursday, comparing them directly with Apple's largest iPhones.

Chief executive Lei Jun introduced the Mi Note, saying it was shorter, thinner and lighter than the iPhone 6 Plus.

Priced at 2,299 yuan ($371; £244), the 16 gigabyte model is less than half the price of Apple's handset and Samsung's phablet, the Galaxy Note 4.

Analysts say Xiaomi became the world's third bestselling phone firm in 2014.

Phablets are generally mobile devices that have features of both a smartphone and a tablet, but are too big or small in size to be classified as either one.

Xiaomi - which was only founded in 2010 - announced that the Mi Note was 6.95mm (0.27in) thick and weighed 161g (5.7oz).

That makes it 1.05mm thinner than the iPhone 6 Plus and 11g lighter.

The flagship Mi Note Pro has a higher resolution display and a faster processor than the basic model

It also features a 13 megapixel (MP) rear camera, made by Sony, and a 4MP front one.

In addition, Xiaomi announced the higher-end Mi Note Pro, which will be released at a later date. This model has:

a higher resolution 2K display (515 pixels per inch)

a faster 64 bit Snapdragon processor and 4G chip, which is capable of 450 megabits per second (Mbps) downloads

more RAM memory (4GB)

64GB of built-in storage

It will sell for 3,299 yuan ($532; £350).

The company has been accused of copying iPhones in the past and Wee Teck Loo, head of consumer electronics research at market research firm Euromonitor, said a lot of emphasis was put on a side-by-side comparison with the iPhone 6 Plus at the start of the launch.

"Xiaomi appears like a teenager who wants to act like an adult and yet, clings on to his blanket for comfort - Apple bashing," he said.

Kiranjeet Kaur, senior market analyst at IDC Asia Pacific, said Xioami's comparisons to the iPhone implies the firm believes it is a product they look up to.

"They are trying to position against Apple or are trying to appeal to the Chinese consumer who still aspire to iPhones," she said.

Price war

In terms of features, analysts said that the specifications of Xioami's new devices did not show a "breakthrough in innovation" and its low prices were still the biggest attraction.

"Xiaomi changed the game in a way. Instead of keeping everyone's focus on ground-breaking innovative features coming on flagship phones, it has switched attention to packing great specs at modest price points," Ms Kaur said. "The key would be if they surpass the competition and its earlier models at those price-points."

The flagship devices basically extended what Xiaomi was good at - models that were targeted at Apple and Samsung, the only firms that still outsell it, Mr Loo added.

"The new models are definitely an upgrade compared to their predecessors - Xiaomi desperately needed to refresh its line-up to keep up with its competitors," he said.

Analysis: Celia Hatton, BBC News, Beijing

Xiaomi unveiled a variety of shiny new products at its latest launch: two smartphones, headphones, even a powerful air purifier.

However, the company's chief executive also used this event to improve his company's image.

Lei Jun has said in the past that he doesn't want his company to be known as a cheap Chinese company selling cheap phones. He's well aware that critics believe Xiaomi is rising on the back of Apple's product innovations.

Instead, Mr Lei spent much of his presentation detailing the time and effort Xiaomi's designers pour into their work.

He told the audience that Xiaomi filed for 2,318 patents last year, including 1,380 in China and 665 international patents. In 10 years, Mr Lei promised, his company will be filing for tens of thousands of patents a year.

Xiaomi is a "world leading innovator", Lei Jun says. However, until his phones and tablets begin to look significantly different than the ones that Apple is selling, questions will remain regarding Xiaomi's ability to function as a leader, not a follower.

Xiaomi's rise

The Beijing-based firm overtook global market leader Samsung last year to become the top-selling handset brand in the world's largest smartphone market, China.

Just last month, Xiaomi was also dubbed the world's most valuable "technology start-up" after it raised $1.1bn (£708m) in a funding round, giving it a valuation of $45bn. That surpassed the $40bn value of taxi booking app Uber.

Unlike some rivals, Xiaomi makes a virtue of the fact that other firms make the components it uses, including a camera by Sony and a screen by Sharp

The Chinese company reported that its revenue in 2014 more than doubled to 74.3bn yuan (£7.8bn; $11.97bn) in pre-tax sales last year, up 135% from 2013.

It sold more than 61 million phones in 2014, a rise of 227% from a year earlier.

Its soaring sales come despite an intellectual property challenge faced in India last year, where sales were temporarily halted after Swedish firm Ericsson filed a patent complaint.

The firm has set a target of selling 100 million phones in 2015, but Mr Loo of Euromonitor said the goal was a little "stretched" and its success depended on overseas expansion, which has not been as successful as it had hoped for.

"Xiaomi is not well-known beyond China and only tech-savvy consumers in other markets have heard of the company, unlike Lenovo which is a household name internationally," he said.

Despite its strong numbers, Xiaomi's phones are only available in select Asian countries outside mainland China, including Taiwan, Hong Kong, Singapore, Malaysia, the Philippines, India and Indonesia.

There had been speculation, external that it might soon announce a move into the US, but there was no mention of this at the latest launch.

Andrew Milroy, senior vice president for telecoms at Frost & Sullivan Asia Pacific, said the firm would face challenges when it entered developed markets such as the US and UK, because most consumers there get smartphones on subsidised contract plans from service providers instead of buying the phones upfront.

"The actual price of a handset doesn't matter as much to you if you live in developed markets and that helps the likes of Apple and Samsung," he said. "It would be hard to find people in Western countries who'd be willing to trade their high spec Sony, Samsung or Apple phone for a Xiaomi."

- Published15 January 2015

- Published14 January 2015

- Published5 January 2015

- Published30 December 2014