Big banks consider using Bitcoin blockchain technology

- Published

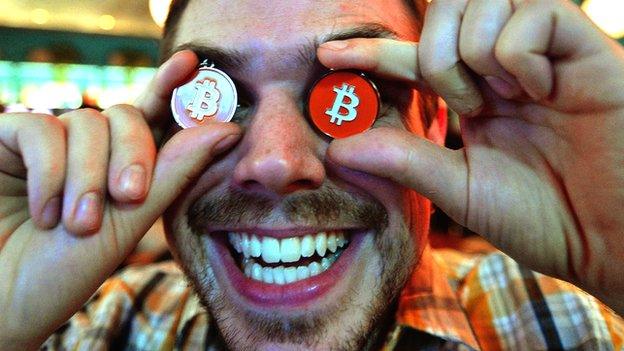

Does Blockchain technology work?

The basic technology underpinning the Bitcoin virtual currency could be used by some of the world's biggest banks.

Nine banks, including Barclays and Goldman Sachs, may adopt the blockchain system that logs who spends which virtual coins in an ever-expanding computer equivalent of a ledger.

The banks want to use the blockchain method because it is hard to fool - making fraud more difficult.

It could also speed up trading systems and make deals more transparent.

The project to test blockchain-like technology is being led by financial technology firm R3 which has signed nine banks up to the initiative.

The other seven are JP Morgan, State Street, UBS, Royal Bank of Scotland, Credit Suisse, BBVA and Commonwealth Bank of Australia.

Technical meetings with the banks had prompted discussion of how it could be used within banks' trading arms, said David Rutter, head of R3 in an interview with Reuters, external.

For Bitcoin, the blockchain acts as a globally-distributed ledger that logs transactions. Everyone involved with the virtual currency contributes to the way the blockchain verifies each deal. The sheer number of people involved makes it very hard for one bitcoin user to get fraudulent deals verified and approved.

Despite this, Bitcoin has been hit by a series of scandals and thefts although most of these came about because hackers exploited weaknesses on exchanges where coins are traded or in digital wallets where they are held.

Mr Rutter said the banks were most interested in the technical architecture underpinning the blockchain that could be adapted for their own ends. The first place the blockchain was likely to find a role was as a log of who bought which stocks or shares, he said.

By adopting the technology banks could cut the cost of reporting transactions and working out who bought what and when, he added.

No timetable has been given for when technical trials of the blockchain-like technology might begin.

- Published11 September 2015

- Published18 August 2015

- Published11 June 2015

- Published20 May 2015