Face scanners added to chip-and-pin terminals

- Published

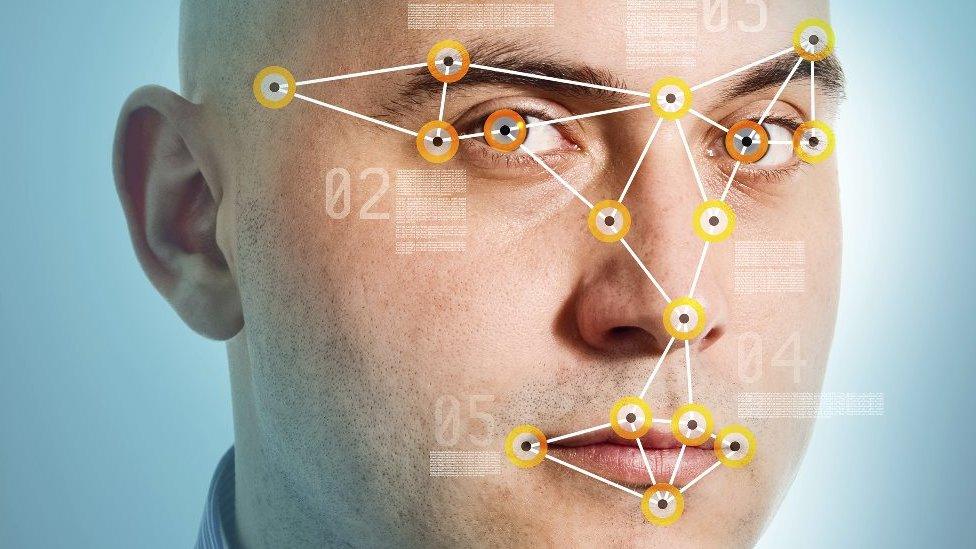

Customers might be asked to present an alternative ID if they fail the facial recognition scan

One of the biggest payments processing companies has revealed it is developing a chip-and-pin terminal that includes facial recognition technology.

Worldpay's prototype automatically takes a photo of a shop customer's face the first time they use it and then references the image to verify their identity on subsequent transactions.

The firm says the innovation could help reduce payment card fraud.

But one campaign group has raised privacy concerns.

At present, the test device is only being trialled internally at Worldpay. But a spokesman said that it could be deployed within five years if retailers showed interest.

The firm's existing machines are already used at about 400,000 stores across the world.

Worldpay says it accounts for 42% of the UK's market in chip-and-pin machines

'No-hassle solution'

The prototype - dubbed a Pin Entry Device Camera (PED cam) - features an upward-facing image sensor.

The firm says it would store the captured images in a "secure" central database.

"Biometrics has attracted a lot of attention," said Worldpay's director of technology innovation, Nick Telford-Reed.

"But people don't want the admin hassle of registering their details. With this prototype, we would remove that hassle.

"Card users could be automatically enrolled in the system when they use their card.

"The design also means retailers would not have to find space for another device on their already busy sales counters."

Because facial recognition tech is not foolproof, Worldpay is not suggesting that shoppers be blocked from making payments if its computer system failed to make a match.

Rather, it suggests that tills would display an "authorisation needed" alert, prompting shop staff to request an additional ID, such as a driving licence.

Customers might be asked to look into the payment terminals as they enter their code

Fraud losses

Although chip-and-pin technology has helped reduce card fraud in stores, it has not eliminated the problem.

In the UK, thieves can still make tap-and-go payments of up to £30 without entering a Pin, and criminals have been known to spy on victims entering their codes before stealing their cards.

According to the UK Cards Association, losses from fraudulent face-to-face card transactions in shops totalled £49.2m last year.

Worldpay is not the only financial company looking into the technology to tackle card fraud.

Mastercard is testing an app that requires shoppers to take a photo of themselves to verify online purchases

American Express has said it is also experimenting, external with the use of facial recognition in its labs

In the UK, PayPal carried out a limited trail in 2013 that allowed shoppers to make payments via facial scans that did away with the need to show cards altogether

BBC Business Correspondent Emma Simpson: "You can now use your phone and your face to pay instead of your wallet"

Privacy worries

Facial recognition's major advantage over fingerprints is that it is harder to use the information to fool people if hackers steal the biometric details.

The danger of this was highlighted by a US government breach in April that resulted in the loss of up to 5.6 million employees' prints.

Even so, privacy activists at Big Brother Watch have raised concerns.

"Whenever a company thinks of introducing such invasive technology, they must ensure the highest levels of protection are in place to safeguard people from misuse," said the organisation's research director, Daniel Nesbitt.

"It is important that a level-headed and wide-ranging debate takes place on whether facial recognition should become mainstream.

"Our privacy must not be forgotten in the rush to introduce new and potentially innovative ideas."

But Worldpay stressed that work on the project was still at an early stage of development.

"As part of the current trials our research team are gathering reactions to the prototype as well as investigating how the concept would work if people were wearing things like sunglasses or had grown beards to help evaluate its viability and develop the concept," said Mr Telford-Reed.

- Published30 July 2015

- Published3 July 2015

- Published22 January 2013