Barclays bank joins Apple Pay in UK

- Published

Barclays is the last of the big UK banks to join Apple Pay

UK-based Barclays customers can now use Apple Pay, nine months after the digital wallet service was first launched in the country.

Barclays had been the biggest UK lender not to support the facility.

The bank offers rival facilities of its own - including bPay and Pingit - but had faced pressure from some customers, external to support Apple's effort.

However, Barclays said it had no plans to join Android Pay or Samsung Pay when they come to the UK later this year.

"We are passionate about helping customers access services and carry out their day-to-day transactions in the way that suits them," said Barclays UK's chief executive Ashok Vaswani.

"Adding to the existing choice, from today both Barclays debit and Barclaycard credit card customers can use Apple Pay to make payments with their Apple device across the UK."

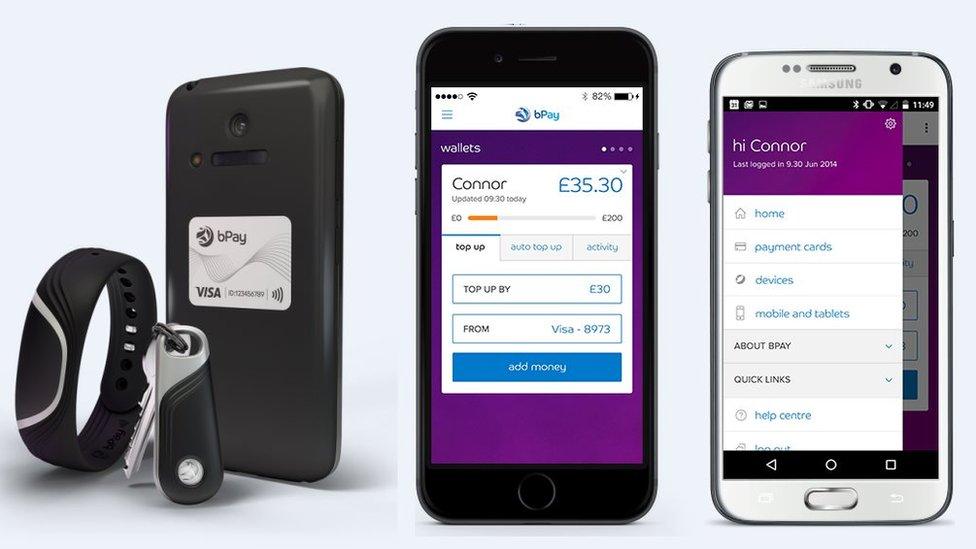

Barclays' bPay allows its customers to use a wristband, key fob or sticker to trigger contactless payments

When questioned about its lack of commitment to similar services for Android-based handsets and tablets, a spokeswoman noted the bank already provided a way to take advantage of the devices' NFC (near field communication) chips.

"In January this year, we introduced a contactless mobile payment feature to the Barclaycard Android app that allows customers with an Android phone to make contactless payments for £30 and under, and at some retailers for up to £100, using their mobile device," she explained.

"Alongside this they can manage their account on the go and have lost, stolen and damaged cards instantly replaced on to their phone."

At present, Apple does not allow third-party apps to make use of the NFC chips in its devices.

Slow start?

Apple Pay allows debit and credit card details to be added to an iPhone, iPad and/or Apple Watch. The devices can subsequently stand in for the physical cards at contactless payment terminals.

In addition, it can be used as a way to pay for goods within compatible apps without a user having to type in the linked card's three or four-digit security code.

Apple has yet to disclose any data about how widely the service has been used since it was launched in the UK in July 2015.

Apple Pay can be used to pay for tickets on London's public transport system

However, the Memo news site recently reported that , external that just 0.4% of Transport for London's daily pay-as-you-go journeys had used the service over the last six months of 2015 despite support for Apple Pay being publicised at Tube stations.

Even so, one expert said it would be wrong to suggest it had flopped.

"The adoption of device-based payments will be more of a marathon than a sprint," said Ben Wood from the CCS Insight tech consultancy.

"The tech firms have to get consumers to engage in a behavioural change away from using their cards and cash.

"But Apple Pay - and Android Pay , external- are already in a strong position given the amount of support they are getting."

Apple's recent introduction of the iPhone SE could also help.

It is the US firm's first entry-level handset to feature a fingerprint sensor, allowing the smartphone to support Apple Pay.

Several of the smaller UK lenders that do not yet support the service have also indicated their desire to join.

Barclays said it had no plans at present to join Google's Android Pay service

Metro Bank told the BBC it intended to join Apple Pay within a few months, while Virgin Money said it was looking into adopting it later.

"The banks have felt they had to support Apple Pay and similar services for use at stores' contactless card terminals," commented Dave Birch, a payments specialist at Consult Hyperion.

"But I personally think all of these payment mechanisms will eventually be subsumed into applications.

"In the future, when you go to Tesco's - for example - you will pay via a Tesco app, and it will use Barclays bPay, Apple Pay, PayPal or whatever."

- Published23 March 2016

- Published14 July 2015

- Published14 July 2015