Does Bitcoin still matter?

- Published

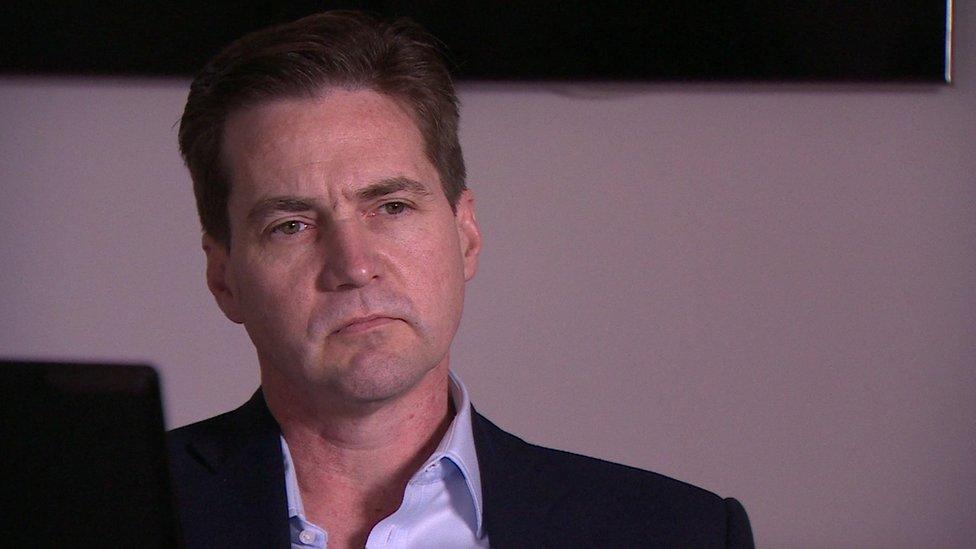

Craig Wright's assertion that he was the creator of Bitcoin this week occurred at the same time as thousands of members of a growing industry tied to the virtual currency attended the Consensus 2016, external conference in New York.

Attendees debated the truth of Wright's claims, but also grappled with the more poignant question of whether Bitcoin still matters?

Bitcoin has come a long way since its start. What was once marketed as a global currency - free from government restrictions - is now seen as a burgeoning technology that can help improve the world's financial system and change how information and assets are stored and shared.

Hundreds of new companies have started that focus on creating blockchains, the underlying ledger system on which Bitcoin is based.

Blockchain data is subject to 256-bit encryption

Bitcoin vs blockchain

The answer to Bitcoin's relevance depends on whether you are talking about the digital currency or the industry.

Because Bitcoin was the first digital currency, the sector as a whole is often referred to as the Bitcoin industry.

It now prefers to be called blockchain - after the technology which underpins Bitcoin.

The currency is struggling because of strains on its technology and persistent doubts about when and if it can become a mainstream form of money.

The blockchain industry however is thriving as new uses for the technology continue to be dreamed up and investors continue to fund them.

"Digital currency is now a misnomer for Bitcoin," says Erik Voorhees, chief executive officer for Shape Shift, a digital currency exchange. "It can be used as currency, but it can be used for many things."

Blockchain removes the middleman from transactions by recording each one to a 'block' in a chronological 'chain'

What is blockchain?

Blockchains rely on cryptography to allow a set of computers to make changes to a global record without needing a central actor.

Removing the middleman cuts costs in almost every sector.

The blockchain is a ledger that records everything that happens to a collection of data known as a "block" in a chronological order or "chain".

As a currency this is an important feature because it allows users to be sure their digital money is one of a kind, the same way each note in your wallet is unique.

"Blockchain tech will be the way we create assets because it allows you to transfer digital information without copying," says Adam Ludwin, chief executive of Chain.com, which builds blockchain networks.

Blockchain can be used to track the history of all sorts of information and maintain its value, so, for example, doctors could use it to update medical records.

Since each change to a blockchain is made simultaneously across the whole network, no information is lost and because changes cannot be undone the system maintains its transparency. A special key is needed to make changes to each block, so individuals can keep their records safe by protecting that key.

Craig Wright recently claimed to be the mysterious creator of Bitcoin

Bitcoin problems

The original code for Bitcoin was designed to produce a fixed amount. Its popularity has meant the digital currency is coming to its limit faster than many expected.

Among Bitcoin's core engineers there is a division about how to fix this problem.

One group advocates doubling the size of the "blocks" in Bitcoin, something that could help, but may be short-term. Another group advocates rewriting its underlying protocols to have far more blocks - a solution that would make old Bitcoins incompatible with the new ones.

For companies that are thinking of using blockchain tech or digital currency, this schism makes it hard to choose Bitcoin.

"This is sending signals that are making engineers worried," says Jeff Garzik, one of Bitcoin's core developers. "People are waiting to see what happens before launching."

Blockchain technology allows users to transfer or changes assets form any connected device

More blockchains

Almost since Bitcoin's creation there have been copycats. As more industries warmed to the idea of blockchain these imitators began to look less like virtual currencies and more like digital record keepers.

Some of these are public - allowing anyone to join and grow the chain - while others are private to ensure only trusted parties have access, an approach favoured by banks.

This explosions of new blockchains has created a need for inter-ledger operators. These companies allow people to exchange digital assets from one blockchain to another.

"Blockchain is another database and it's impractical to think of the world working on one database," says Chris Larsen, the chief executive of global financial settlement company Ripple.

Digital currencies could eliminate the need to exchange currencies

Could Bitcoin be a viable currency?

For believers in a government-free digital currency, Bitcoin is the still the biggest player.

Virtual currencies could still have a place in finance, particularly in countries with less stable governments and economies. Governments though have been looking for ways to add regulation, in an effort to prevent tax dodging, money laundering and other criminal activities that were associated with the early Bitcoin days.

Eventually blockchains could allow users to exchange the rights to all sorts of assets, like houses or stocks, update records and make payments without relying on a third party to verify the transaction.

But for this to become a reality more users will have to join blockchains.

- Published5 May 2016

- Published5 May 2016

- Published2 May 2016

- Published2 May 2016

- Published19 January 2016