Dark web hackers boast of Tesco Bank thefts

- Published

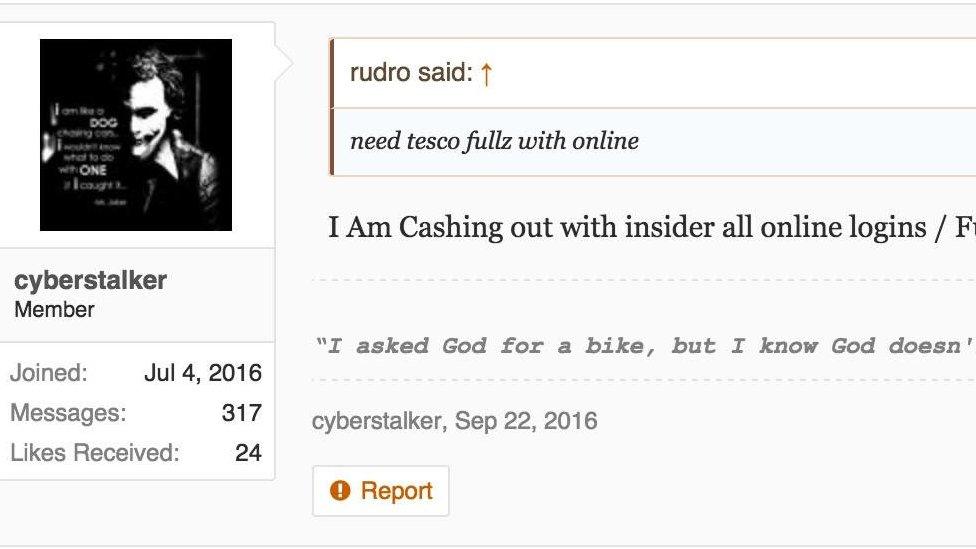

Cyberint said it had found messages about Tesco Bank on several dark web forums

Hackers boasted of thefts from Tesco Bank months before the company reported losing £2.5m in an attack.

Cybersecurity company Cyberint said it had discovered posts on a variety of dark web forums whose members had described the lender as being a "cash milking cow" and "easy to cash out".

It is not clear, however, whether there is any link between these claims and the money stolen just over a week ago.

The bank has repeatedly declined to give details of the crime.

It says it is unable to do so while a criminal investigation is being carried out.

Elsewhere, the Sunday Times suggested, external that the raid had involved the use of contactless payments triggered by smartphones.

And a second cybersecurity company said it had warned Tesco of problems with several of its mobile apps four months ago, but had been ignored.

Tesco Bank initially said 20,000 accounts had lost money but later reduced that to 9,000

The Financial Times was first, external to report that Cyberint had carried out its own probe of hidden web pages following the thefts over the weekend of 5-6 November.

The Israeli company said it had found discussions about a tool that "brute forced" access to Tesco's accounts by testing thousands of login and password combinations until one was found to work.

It said the bank had repeatedly taken steps to prevent such attacks, but the hackers had apparently bypassed the measures.

"It was a cat and mouse game, but we saw indicators starting from September - so two months before the actual attack - of quite a few threat actors saying, 'We've been successfully getting into accounts and cashing out through various means.'" Elad Ben-Meir, Cyberint's vice-president of marketing, told the BBC.

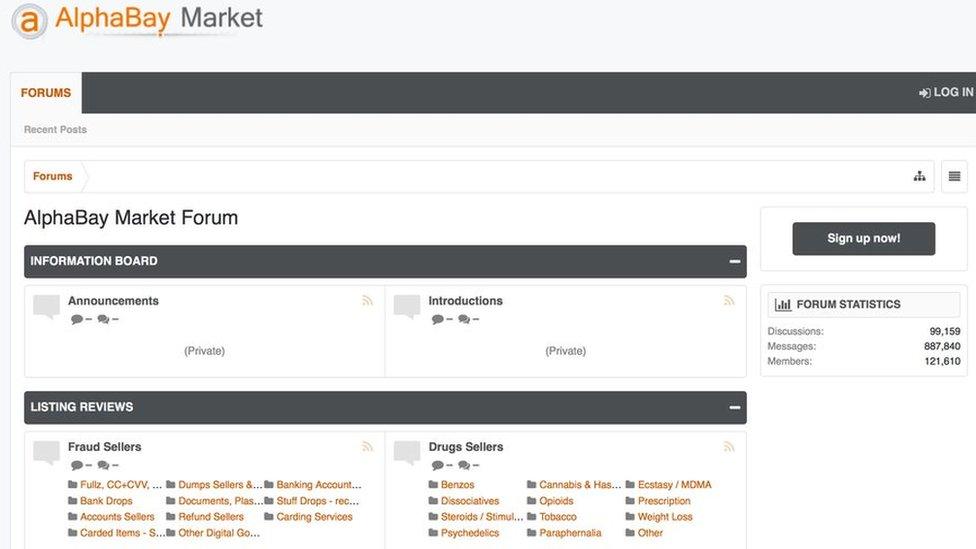

"This was on the AlphaBay forum, Hacking Forum and some lesser known places - and there was plenty of proof.

"One of the guys said, 'I used to cash out £1,000 every week without anyone ever noticing.'"

Mr Ben-Meir said his company had attempted to pitch for business with Tesco Bank earlier in the year, but the talks "didn't proceed anywhere".

The dark website AlphaBay has risen in prominence after Silk Road - another illegal trade site - was shut down

Mobile app specialist Codified Security said it had not received any response when it had contacted the supermarket Tesco and its subsidiary Tesco Bank four months ago by email.

"We were doing research into mobile apps across the UK market and found some problems with various apps that they have and reached out to try and warn them," the London-based company's chief executive, Martin Alderson, told the BBC.

Mr Alderson is not making public what the flaws involved, but said Tesco Bank was not the only lender his company had contacted.

"The top tier banks are really good with their mobile security - so, NatWest, Barclays et cetera are fantastic," he said.

"But the second-tier banks and some of the financial tech companies can struggle with this.

"They are pressured to bring out a coherent mobile strategy because their customers are demanding it.

Technology explained: What is the dark web?

"But often I'm not sure they have the understanding of all the technical aspects to make them secure."

Mr Alderson said roughly half of the companies Codified Security wrote to never responded, so Tesco's handling of the matter was not unusual.

The bank has not officially commented on this, but a source at the company told the BBC: "Tesco Bank regularly receives promotional information from consultancies, but in all areas we have first-class colleagues working hard to serve our customers."

The Sunday Times reports that some of the stolen funds were spent in Best Buy stores

The Sunday Times says the attack was carried out by thieves using mobile phones that used stolen Tesco Bank data to set up contactless payment accounts.

It says fraudulent purchases of thousands of low-priced goods were made at Best Buy electronics stores in the US as well as other American and Brazilian retailers.

The paper does not credit a source for this information.

However, it might tie in to an alert from Europol two months ago that criminals had begun using Android phones to trigger fraudulent tap-and-go payments.

"The possibility of compromising NFC [near field communication] transactions was explored by academia years ago, and it appears that fraudsters have finally made progress in the area," the organisation's Internet Organised Crime Threat Assessment said.

"Several vendors in the dark net offer software that uploads compromised card data on to Android phones in order to make payments at any stores accepting NFC payments."

A spokesman for Tesco Bank said that "none of our systems were breached" and no personal data had been lost, but would not comment further.

- Published8 November 2016

- Published7 November 2016

- Published7 November 2016