Why is Samsung's Galaxy S9 flagship struggling?

- Published

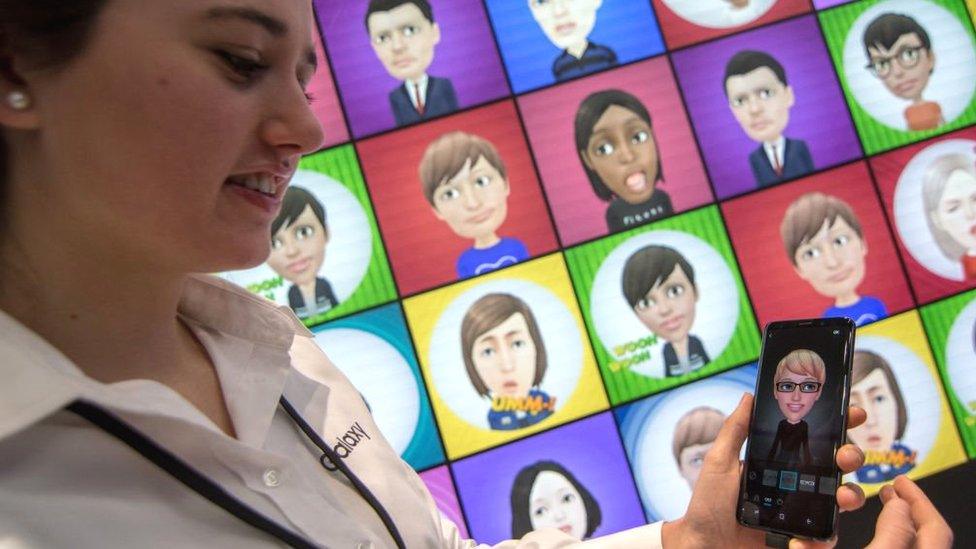

The Galaxy S9's introduction of AR Emojis that look like their owners has not made the phone a hit

It wasn't what Samsung or its investors were hoping for.

The company's electronics division has just posted a drop in its latest net profit - and it says "lower-than-expected sales" of its flagship Galaxy S9 smartphone were to blame, external.

The handset launched in February to a mixed reception.

Critics praised some of its new camera tricks, including the way it made it relatively easy to capture key moments in "super-slow-motion" video.

But they also cast doubt over whether the company had given consumers enough reasons to upgrade.

What is Samsung saying?

Despite speculation that the S9's sales, external have been the series's weakest since the S3, the company has not disclosed exact numbers.

The closest it came was to confirm the division responsible had suffered, external a 20% revenue drop.

But executives did tackle the matter head on during a conference call, external in which they referred to a "stagnant high-end market".

"As smartphones become more high-spec and product differentiation is becoming less clear, the global handset replacement cycles are getting longer," said one representative.

"Also, the higher price points of premium products appear to be driving market resistance."

In other words, Samsung believes the S9 failed to distinguish itself from other high-end handsets at the same time as being too expensive for many consumers' pockets.

Why has the S9 struggled to stand out?

With a few exceptions, most smartphones look pretty similar these days: a flat panel of glass fixed to a curved metal rear, with the bezels kept to a minimum.

Watch: Spencer Kelly gets hands on with the Galaxy S9

In particular, the physical differences between the S8 and S9's exteriors were pretty minor, with reviewers left to obsess over a slight shift in the position of the fingerprint sensor.

The other big hardware change was the S9's introduction of a dual aperture lens. But that may have proved a difficult sell to anyone beyond the photography geeks who probably already owned a dedicated camera.

"It's an exceptional phone but I don't think there was enough differentiation," said Roberta Cozza, from the tech consultancy Gartner.

"Differentiation today comes from creating compelling experiences and I don't think Samsung has done enough in that area yet.

"[Its artificial intelligence assistant] Bixby, for example, hasn't been the success it had been hoping for."

Samsung is far from the only handset-maker to have made its most radical changes on a two-year basis, with more limited tweaks to the in-between models.

But another expert suggested that this strategy had become problematic.

"What's changed in the last 18 months is that the rate of commoditisation has become much faster, in terms of the speed with which specifications and design characteristics can be copied from one brand to the next," said Ben Stanton, a tech analyst at Canalys.

"When the Galaxy S8 launched in 2017, it was a pioneering product and nothing looked like it.

The Galaxy S9 - shown on the right - strongly resembled the S8 - seen on the left

"But now there is a flood of devices that are very similar and sometimes better priced."

What threat do Chinese rivals pose?

China once presented Samsung with a huge opportunity. These days, it poses a threat.

The South Korean company used to be the bestselling smartphone brand in China's giant smartphone market.

Now, it has been relegated to the "others section" of market share charts, external and it is domestic companies that dominate.

Xiaomi recently floated its shares in Hong Kong

What's more, those same Chinese companies are making great strides abroad. Had it not been for the US's resistance to letting Chinese phones into its own market, the S9's sales could have been a lot worse.

"Xiaomi, in particular, is doing a very good job of bringing the specifications associated with premium phones like Samsung's down to much cheaper price points," said Mr Stanton.

"And it's doing that within about six to nine months of a brand new innovation coming to market.

"On the flipside, we're seeing Huawei going beyond the technologies that Samsung offers.

"It has AI embedded in its chipsets, triple cameras on the back of its P20 Pro - it's really raising the bar."

Watch: Huawei's P20 Pro has three rear cameras

Of course, it's not just the Chinese brands that are on the rise.

Google's Pixel phones - which offer unique features of their own - have also won plaudits.

Last year, the search giant took on 2,000 engineers from Taiwan's HTC. We should soon see the benefits of their efforts when the third-generation Pixel range launches.

Is Samsung too focused on Apple?

As innovative as its Android rivals are, Samsung has always been able to outspend them on marketing.

But some are questioning whether it is doing so wisely.

In particular, its recent efforts to throw shade at Apple in the US have drawn criticism.

It began in May by suggesting iPhone speeds lagged in comparison with its own phones, external.

Then more recently, it mocked the iPhone X's lack of a headphone socket, external and SD card slot, external, and made fun of its front-screen notch, external.

Samsung has mocked the design of the iPhone X's screen

"Such unprovoked aggressive behaviour is never typical of the winning side; it's most often exhibited by the losing team, which, realising that the final seconds of the match are ticking away, starts playing in a rough and desperate... way," said the news site Phone Arena in a recent editorial, external.

To be fair, Apple wasn't beyond making fun of the competition in its I'm-a-Mac/I'm-a-PC ads from yesteryear. But the difference was that it was the underdog at the time.

"Samsung should probably leave this strategy behind and focus more on the features that make its own products unique," said Ms Cozza.

What's Samsung doing to address the problem?

In the short-term, Samsung said it had brought forward, external the launch of its Galaxy Note 9, which will make its debut on 9 August in New York.

In addition, it said it intended to add new features to its lower-end handsets to increase their appeal.

Samsung showed off this concept image of a foldable phone in 2013

"We will also strengthen price competitiveness," added the chief of the company's mobile business, KyeongTae Lee - which sounds like a hint of lower prices.

Longer term, Samsung said the introduction of bendy smartphones should "bring new energy" to its line-up.

"We have been engaged in research and development of the foldable smartphones for several years," an unidentified executive revealed during its conference call.

"We're in the process of stabilising the performance as well as durability by working together with a parts company."

The comment backs up an earlier report by the Wall Street Journal, which said Samsung planned to release a phone in 2019 whose screen would fold like a wallet, external.

In the meantime, there's the launch of the S10 to come later this year, which may be the first to feature a new "unbreakable" screen announced by Samsung Display last week, external.

And it's worth remembering that whatever the S9's struggles, Samsung is thought to remain the world's bestselling phone-maker by a wide margin, external.

- Published1 August 2018

- Published24 February 2018

- Published25 February 2018