Could blacklisting China's AI champions backfire?

- Published

Some analysts believe the US and China may be about to engage in an AI arms race

Just over two years ago, China announced an audacious plan to overtake the US and lead the, external "world in AI [artificial intelligence] technology and applications by 2030".

It is already widely regarded to have overtaken the EU, external in many aspects.

But now its plans may be knocked off course by the US restricting certain Chinese companies from buying technologies, external developed or manufactured in the States.

Washington's justification is that the organisations involved have made products used to commit human rights abuses against China's Muslim ethnic minorities.

But it is notable that those on its blacklist include many of China's official "national AI champions", among them:

Megvii - an image recognition software developer sometimes referred to as being the world's most valuable AI start-up

iFlytek - a voice recognition specialist

Hikvision - one of the world's biggest CCTV systems manufacturers

SenseTime - a start-up that makes AI services for use in smart city, transport and education applications

Yitu - a developer of machine vision and voice recognition tools

Like the telecoms firm Huawei before them, they now face major disruption as a consequence of the Trump administration's intervention.

That is, in part, because they are reliant on US-based know-how.

SenseTime, for example, formed an alliance with the Massachusetts Institute of Technology, external (MIT) last year to jointly fund research projects. And Yitu recently worked with researchers at the University of California San Diego, external to develop algorithms to diagnose illnesses in children.

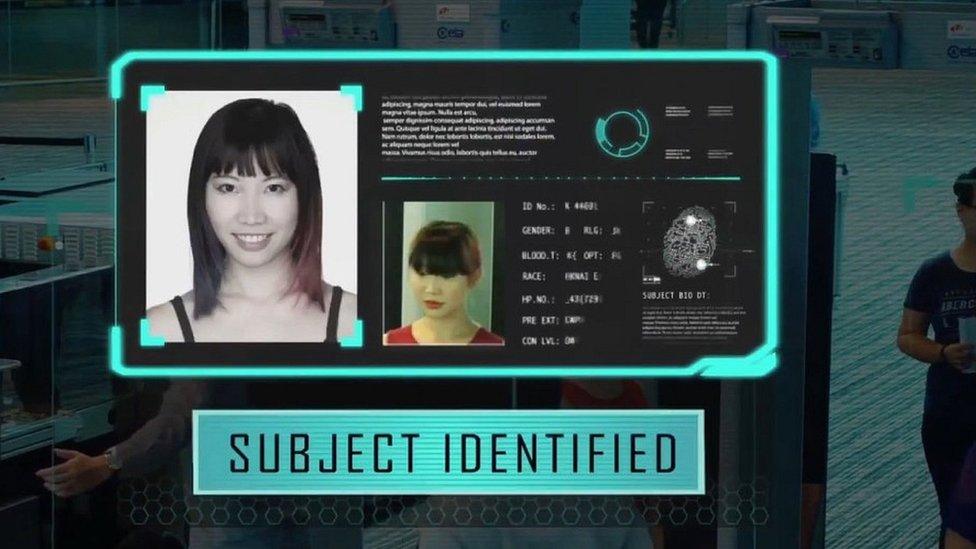

Hikvision is one of the world's biggest sellers of surveillance camera equipment

The move also threatens to jeopardise the companies' ability to attract foreign investment. The Bloomberg news agency has already suggested that a planned $1bn flotation by Megvii could be derailed as a consequence, external.

But perhaps most crucially, the blacklisting threatens to cut off the supply of computer chips and other components that Hikvision requires to build its surveillance cameras, and the others need to train their algorithms.

Chinese chips

The US is the undisputed leader in semiconductors.

Whether its CPUs (central processing unit) and GPUs (graphics processing units) from tech giants including Intel and Nvdia, or chips that specialise in AI-related tasks from lesser-known firms such as Ambarella and ON Semiconductor - American firms provide the tech that underpins the Chinese tech firms' progress.

This dependence has not gone unnoticed.

At present only 16% of the semiconductors used within China are made in the country, and only half of those by local companies - according to a report by the Center for Strategic and International Studies, external.

Megvii's Face++ technology is used to verify people's ID for mobile payments and other services

But the study notes that Beijing aims to boost that figure to 40% by the end of next year, and raise it to 70% by 2025.

"For decades, building indigenous Chinese chips has been an aspiration of the government," Matt Sheehan, author of The Transpacific Experiment - a book about China and the US's tech ties - told the BBC.

"Moves like the entity lists have turned that aspiration into an imperative for the government, but also potentially a matter of life or death for private Chinese companies.

"That doesn't mean they'll succeed at it any time soon. This is one of the most complex engineering tasks out there, one that often requires decades of accumulated in-house knowledge and experience.

"But it does seem that China's own AI chip start-ups will not be short of cash or new orders any time soon."

Over recent weeks, first Huawei, external and then Alibaba, external have unveiled computer server chips specially designed to carry out machine learning tasks at high speed.

Xiaomi has also said it is working on a similar product.

Meanwhile, smaller start-ups have secured hundreds of millions of dollars worth of funds for other types of AI processors, such as chips for self-driving cars, external or processors for "intelligent robots", external.

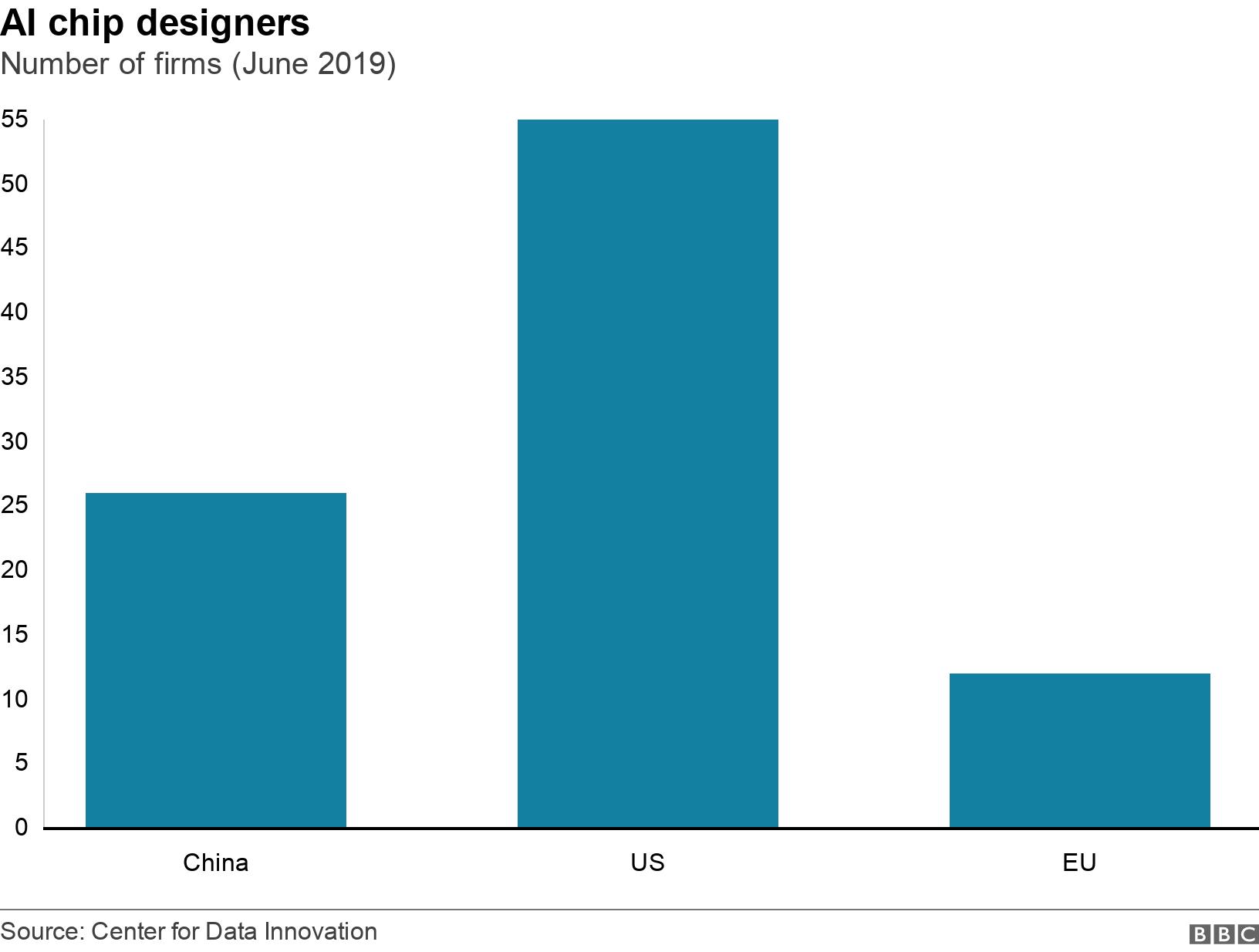

American firms are not standing still, but one Washington-based think tank warns the US should not consider its lead to be unassailable.

"US firms are also developing specialised AI chips," the Center for Data Innovation said in a report, external.

"Nonetheless, China's development of well-funded AI chip start-ups and advancements in chip design indicate it may be able to close at least some of the gap."

Huawei claims its new AI chip offers "more computing power" for machine learning tasks than its rivals

It added that the EU was a "laggard" in this field by comparison.

National security

All this matters because AI-driven technologies have the potential to make companies more productive, citizens better-educated and healthier - and also armies better equipped to wage wars.

"China's success in commercial AI and semiconductor markets has direct relevance to China's geopolitical power," noted Gregory Allen for the Center for a New American Security, external.

"It reduces the ability of the United States government to put diplomatic and economic pressure on China and... it increases the technological capabilities available to China's military and intelligence community.

"Regarding the latter, essentially all major technology firms in China co-operate extensively with China's military and state security services and are legally required to do so."

Putting the brakes on China's AI champions may serve the US's own national security and foreign policy interest in the short term.

But ultimately, it could spur on the Chinese Communist Party's determination to make its tech industry less dependent on foreign partners, with all the financial and geopolitical consequences that entails.