Disney bets the House of Mouse on streaming

- Published

- comments

The Mandalorian will be a Star Wars series exclusive to Disney+

There’s no question Disney produces incredible entertainment. The firm has had us laughing, crying and falling in love with its characters for almost 100 years.

But the launch of its eagerly-anticipated streaming service Disney+ - which goes live in the US, Canada and the Netherlands on Tuesday - will mean the legendary House of Mouse will need to be able to compete not just on programming, but technology too.

"We're making a huge statement about the future of media and entertainment and our continued ability to thrive in this new era,” chief executive Bob Iger said on a call with his shareholders last week.

They’d just been informed of a 66% drop in profits, and a 50% rise in costs, mostly attributed to the move to streaming. Creating the Disney+ platform has been, and will continue to be, a hugely costly exercise - with no guarantee the rewards will ever materialise.

On the tech side, in 2017 the firm spent $1.58bn (£1.22bn) - in addition to $1bn it had already invested - to gain control of BamTech, a Manhattan-based streaming media specialist that previously helped US broadcaster HBO set up its streaming services.

To make sure it has a strong enough library, Disney has been on an unprecedented acquisition spree that has made it into the world’s largest media company.

It included a $71.3bn deal to snap up 21st Century Fox, which included the 20th Century Fox studio, National Geographic, a large stake in pre-existing streaming service Hulu, and TV channel FX - giving Disney exclusive rights to stream The Simpsons, among other things.

And perhaps the biggest draw on launch day will be The Mandalorian, a live-action Star Wars series exclusive to Disney+, reportedly created at a cost of more than $100m.

‘Kingdom-wide’ advertising

Having exclusive streaming rights to Star Wars, Marvel and The Simpsons - not to mention complete control of its own lucrative creations, like Frozen - will make Disney+ a major competitor to Netflix, Amazon and others overnight.

But that alone won’t be enough to recoup the tens of billions of dollars in investment.

Disney has estimated that before the effort can break even, it needs in the region of 60 to 90 million monthly subscribers. Netflix - which has had a 12-year headstart - currently has 61 million paying customers globally.

The Simpsons will be a Disney+ exclusive thanks to the firm's acquisition of 21st Century Fox

Media industry analysts MoffettNathanson predict Disney+ will attract some 8 million paid subscribers by the end of this calendar year, thanks to aggressive marketing and a deal with Verizon that will see some of its customers given free access to Disney+.

The Verizon arrangement is a direct attempt to fight Apple’s decision to give away a free year of its service, Apple TV+, when a person buys a new Apple device.

And, if anyone knows how to market itself, it’s Disney.

The New York Times has referred to efforts to promote Disney+, external as a “kingdom-wide” onslaught: Anchors on local TV stations owned by Disney will reference the launch; staff in Disney’s retail stores will wear t-shirts; buses at theme parks will promote the exclusive shows.

During a time-out in Monday’s Seattle v San Francisco American Football game, commentators on ESPN - owned by Disney - mused how The Mandalorian would be “huge” for their families. An exclusive clip from the series was shown during the half-time show.

In October, in an effort to promote pre-orders, Disney’s social media team posted a thread of “basically everything”, external that will be available on the service on launch day (around 500 films and 7,000 TV episodes). Independent estimates have suggested that there may have been as many as 2 million sign-ups before launch.

The global launch of Disney+ will be fragmented, however, with much of the world having to wait to get the service due to legacy deals that are still in place.

The UK, for example, will get Disney+ in March, although it's still not clear exactly how full its library will be as Sky is believed to have ongoing deals to stream some of Disney's content up until 2021.

Disney has said it will have clawed back all of its content rights globally by the end of the same year.

Self-disrupt

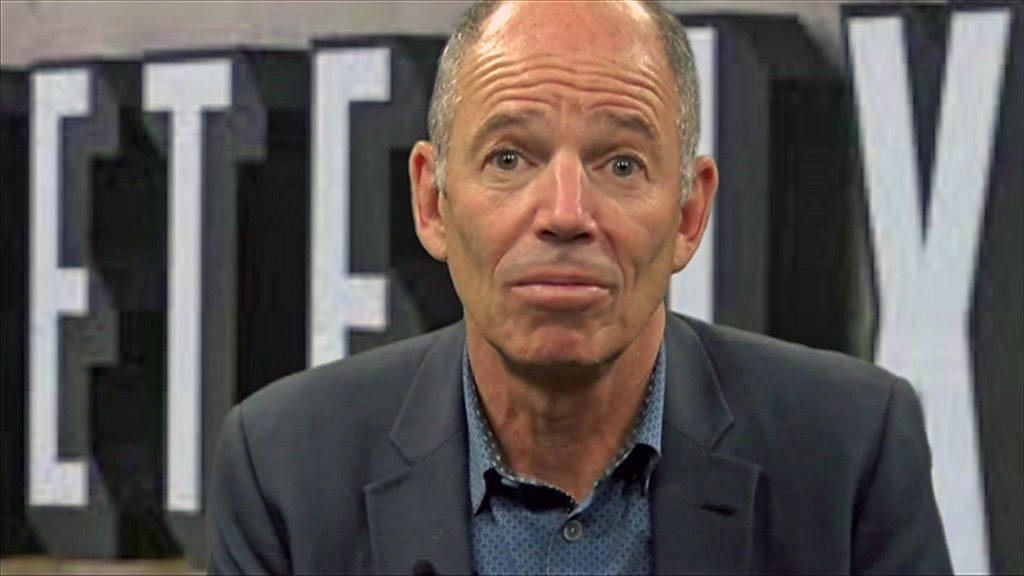

Disney’s move to streaming, and having direct access to its audience, will be the legacy of Mr Iger, who took over as chief executive in 2005. He announced in April that he would be stepping down at the end of his contract in 2021.

Disney boss Bob Iger said the shift to streaming makes a "huge statement about the future of media"

Having the ability to sell its product directly via Disney+, rather than through cable companies or cinemas, brings vast new opportunities - not least because the firm will have access to data on its customer’s habits, data it can use to market merchandise and make decisions about future programming.

But to realise that long-term ambition, Disney will be upended.

Investors are excited about that future. Despite the sharp drop in profits, Disney has in fact exceeded Wall Street expectations: The firm’s share price is up by around 17% compared to this time last year. It’s up 29% since June 2017, when Mr Iger is said to have committed to the decision to go all-in on streaming.

“Rarely has a company willingly created this much financial disruption in strategically pivoting to a new business model,” said MoffettNathanson.

That’s not to say it’s a difficult choice for Mr Iger to make, though.

In March, the Motion Picture Association of America released a startling statistic. For the first time, there were a greater number of Americans subscribing to a streaming service than to traditional cable.

The inevitability of that shift didn't make it any less seismic: Television had entered a new era, and film will follow. These changes may be expensive, but Disney certainly can’t afford to waste any time.

_____

Follow Dave Lee on Twitter @DaveLeeBBC, external

Do you have more information about this or any other technology story? You can reach Dave directly and securely through encrypted messaging app Signal on: +1 (628) 400-7370

- Published8 November 2019

- Published31 October 2019

- Published30 October 2019