After the FTX chaos, is crypto down and out after a torrid 2022?

- Published

If Bitcoin was a boxer it would be a scrappy brawler that refuses to give up.

But the last few weeks it has taken a pummelling, with the collapse of industry giant FTX and the arrest of its founder Sam Bankman-Fried in the Caribbean.

Bitcoin is used to taking knocks, but this anti-establishment fighter was already on the ropes after its most bruising year yet.

If Bitcoin was a boxer it would be lying on its back on the canvas seeing stars.

It is down, but is it out?

Bitcoin's rags-to-riches rise

Bitcoin has a cracking underdog story that befits a Rocky-style boxing tale.

Starting on the mean lawless streets of internet forums in 2009 it was just a featherweight prospect.

Yes there was a spark of promise but only a noisy niche of fans were true believers and it was worth next to nothing - a few pennies at first.

Over the years its band of promoters swelled though, helping develop Bitcoin and fight against the establishment.

Bitcoin's value rose to thousands of dollars and it started being recognised and welcomed in certain places. It started to be accepted on specialist websites or in trendy cafes.

Slowly, against all the odds, Bitcoin became sought after - like a prize fighter.

Thousands of imitators like Ethereum, Dogecoin and Litecoin emerged too, before in 2021 Bitcoin hit the big time, achieving extraordinary fame and fortune.

People were throwing money at it and all other cryptocurrencies and one coin cost nearly $70,000 (£57,200).

The establishment too was falling over itself to invest in Bitcoin and crypto projects.

'Watershed moment'

But then, in November that year, Bitcoin started taking losses and it has kept on getting worse, with continuing knocks and scandals leaving it at its lowest point for years in value, trust and excitement.

"This is a terrible time for the crypto space and we may see even worse days to come after the recent FTX scandal. It is a watershed moment for crypto," says Stefen Deleveaux, president of the Caribbean Blockchain Alliance.

FTX's collapse last month has been the biggest shock to crypto in years. It was the world's second largest exchange - the entry point for millions of people to get into crypto.

It was seen as one of the most trusted platforms, but collapsed into bankruptcy in days after its finances were revealed to be unstable.

FTX's founder Sam Bankman-Fried is now in custody, accused by the US of building "a house of cards on a foundation of deception, while telling investors that it was one of the safest buildings in crypto".

Mr Bankman-Fried told the BBC he hoped he had not killed crypto.

FTX founder Sam Bankman-Fried's downfall has rocked the crypto world

FTX has undoubtedly dealt a knockdown blow. But 2022 has repeatedly pummelled crypto.

"We've never seen anything like this before in cryptocurrencies," says Prof Carol Alexander, from the University of Sussex Business School. She predicted last year that crypto would crash in 2022, but admits she has been surprised by the frequency of events.

Blow after blow

The first major blow came in May with the sudden collapse of two popular digital coins that caused $400bn to be wiped from the value of Bitcoin and the crypto ecosystem.

Do Kwon, the founder of the two Terra coins, is now wanted by South Korean authorities, which accuse him of hiding in Serbia.

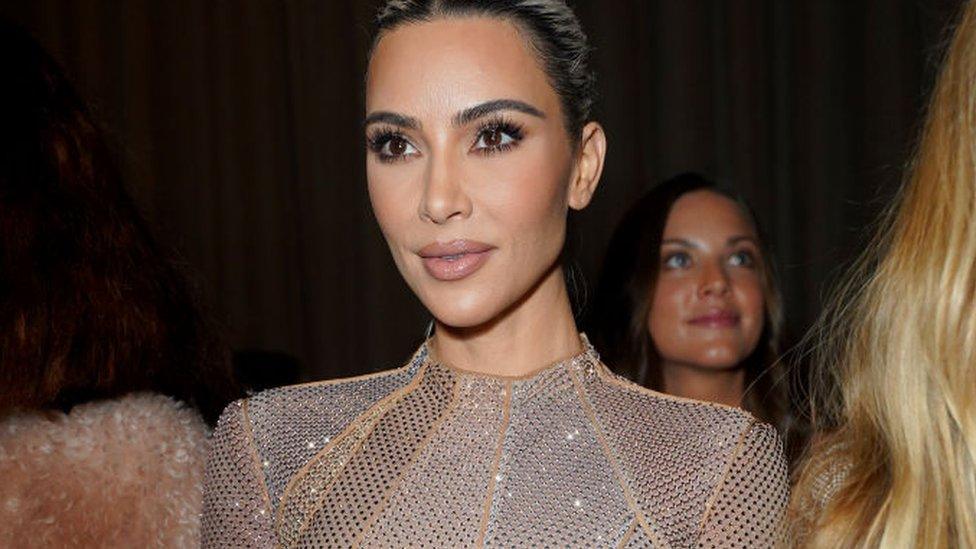

Numerous other smaller scandals have rocked trust in the cryptocurrency ecosystem, like Kim Kardashian being fined $1.26m for promoting an ill-fated crypto coin.

Terra founder Do Kwon is wanted by police

There has also been the collapse of the previously booming Non Fungible Token market with NFTs that formerly fetched millions now struggling to sell.

Massive hacks on crypto companies have also knocked confidence, with the largest seeing hackers steal $600m from the Ronin Network.

With the value of Bitcoin and all other currencies sinking, large crypto companies like Celsius, Three Arrows Capital and BlockFi have gone bankrupt, leaving investors large and small out of pocket and police investigating what happened.

The price of one Bitcoin, often seen as a barometer for how the whole ecosystem is doing, is now hovering at less than $18,000 - a 70% fall from its November 2021 peak.

US authorities said Kim Kardashian had received $250,000 for advertising a controversial crypto coin without disclosing she had been paid

Crypto the comeback kid?

The fall of the FTX exchange and others leaves a huge hole in the industry and there are jitters about others.

On Tuesday, more than $1.4bn was withdrawn from Binance, seemingly as a result of negative crypto headlines. The company's chief executive Changpeng "CZ" Zhao urged calm on Twitter saying it was "business as usual".

But Andy Renshaw, senior vice-president of product management at Feedzai, said crypto relies on having a strong and diverse pool of exchanges in order to survive this ongoing fight.

"Without a credible and trusted place to exchange safely, crypto is unlikely to return to title-fight status, never mind belt holder - at a minimum the fundamentals need to be fixed in training camp."

Digital coins are of course only one part of the crypto ecosystem, but most estimates are downbeat on their value rising any time soon.

Prof Omid Malekan, of Columbia Business School, says things are looking bleak for crypto as a speculative asset. "Prices are down and many of the biggest investment-related service providers have blown up."

But he says, crypto remains first and foremost a technology, and in that regard he says, "It is doing just fine, in some ways better than ever."

Prof Malekan says the the adoption of both Bitcoin, and so-called stablecoins, in developing countries with no reliable financial infrastructure shows the technology is improving lives.

Mr Deleveaux also argues that the violent booms and busts in crypto belies its overall progress. He points to how crypto is being used by charities to get funds to places where normal money cannot reach because of conflict or repression.

He also argues that the latest scandals are "a chance to purge the scammers and grifters" out of crypto.

"Crypto is just basically a very short word for the future of the digital global economy," says Prof Alexander, citing the use of crypto technology in the building of metaverse environments which some think will be the future of work and life.

Related topics

- Published10 December 2022