Panama papers Q&A: British overseas territories and Crown dependencies

- Published

Labour leader Jeremy Corbyn has said the government should consider imposing "direct rule" on the 14 British overseas territories and three Crown dependencies if they do not comply with UK tax law. It follows a leak of documents from Panama-based Mossack Fonseca that showed the law firm registered more than 100,000 secret companies to the British Virgin Islands, one of the overseas territories.

What are Crown dependencies?

Crown dependencies are not part of the UK or the European Union but self-governing dependencies of the crown.

They have their own directly elected legislative assemblies, administrative, fiscal and legal systems and their own courts of law. Its citizens are issued with British passports.

The three Crown dependencies are the Bailiwick of Jersey, the Bailiwick of Guernsey and the Isle of Man. Within the Bailiwick of Guernsey there are three separate jurisdictions: Guernsey, which includes the islands of Herm and Jethou; Alderney; and Sark, which includes the island of Brecqhou.

The Queen is their head of state and the islands' lieutenant-governor is Her Majesty's personal representative.

Their constitutional relationship with the UK is through the crown and is not enshrined in a formal constitutional document. They are not represented in UK Parliament.

Guernsey and Jersey were part of the Duchy of Normandy when Duke William became King William I of England following his conquest of England in 1066. They later became subject to the English Crown. The Isle of Man came under the English Crown in the 14th Century following periods under the Kings of Norway and Scotland.

What are British overseas territories?

There are 14 British overseas territories, and many were former colonies. They are under the sovereignty of the UK but do not form part of the UK itself.

Most are largely self-governing, each with its own constitution and its own government, which enacts local laws.

The total population of the territories is about 250,000.

Citizens of the overseas territories are issued with a British passport and get consular assistance and protection from UK diplomatic posts.

Where are they?

Overseas territories:

1. Bermuda

2. Cayman Islands

3. Turks and Caicos Islands

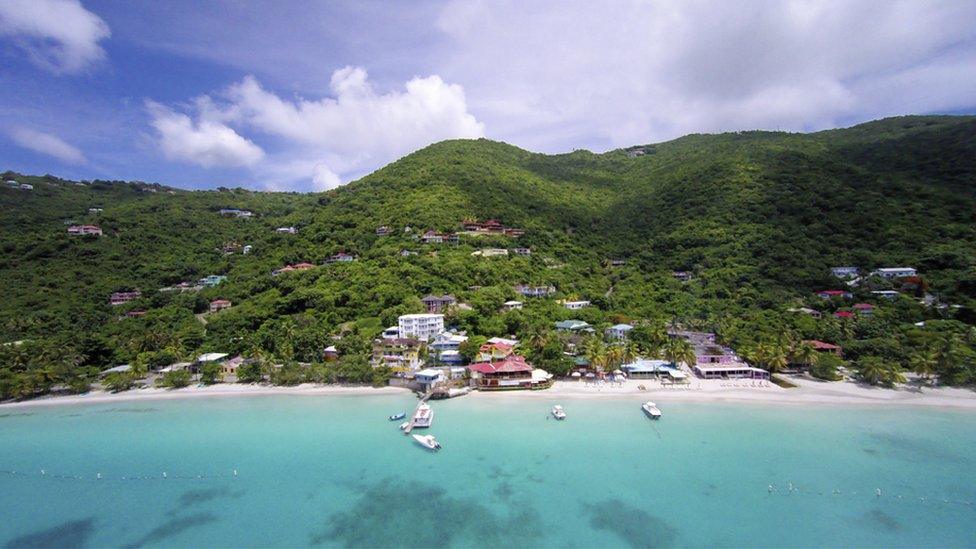

4. British Virgin Islands

5. Anguilla

6. Montserrat

7. Pitcairn, Henderson, Ducie and Oeno Islands

8. Falkland Islands

9. British Antarctic Territory

10. South Georgia and the South Sandwich Islands

11. St Helena, Ascension and Tristan da Cunha (including Gough Island Dependency)

12. British Indian Ocean Territory

13. Gibraltar

14. Sovereign Base Areas, Akrotiri and Dhekelia (on Cyprus)

Crown dependencies:

15. Isle of Man

16. Bailiwick of Guernsey

17. Bailiwick of Jersey

What is their connection to the Panama Papers?

British Virgin Islands is named more than 113,000 times in the leaked documents from Mossack Fonseca, the Bahamas more than 15,000 times and Aguilla more than 3,000.

Jersey had 39 mentions and the Isle of Man eight. Guernsey is not listed in the top 21 names of jurisdictions cited, while the UK is named 148 times in the leak.

The Crown dependencies and the overseas territories have tax regimes designed to be internationally competitive.

Many regard the islands and outposts as tax havens, although that is a label they strongly dispute.

The British Virgin Islands is home to 452,000 international businesses, the second largest home to international businesses behind Hong Kong.

There is no income tax, no capital gains tax and no inheritance tax. There is also no public record of any owners of a business and no accounts are published, ensuring secrecy for those operating there.

The British Virgin Islands said it has robust controls and was strengthening them.

The International Consortium of Investigative Journalists (ICIJ), which published the investigation, showed that 500 banks, their subsidiaries and branches had registered 15,600 shell companies with the law firm. Three of the biggest banks involved are based in the Channel Islands.

Authorities in Jersey, Guernsey and the Isle of Man have defended their reputation following the leak.

The Isle of Man government said it had put "robust defences" in place against corruption, tax evasion and money laundering and the island "was not a place where criminals could find a welcome".

Guernsey Finance and Jersey Finance, which promote their island's financial industries, said the jurisdictions complied with international finance regulations.

What control does the UK government have over them?

The Isle of Man is a Crown dependency

They are self-governing territories which rely on the UK for international relations and defence, but their autonomy can be removed.

UK legislation does not normally extend to the Crown dependencies and their legislatures make their own domestic legislation.

Primary legislation requires royal assent. In the Isle of Man the lieutenant-governor has delegated responsibility to grant royal assent to any non-reserved legislation relating to domestic matters.

The crown dependencies raise their own public revenue and do not receive subsidies from or pay contributions to the UK. However, they make annual voluntary contributions towards the costs of their defence and international representation by the UK.

The Falkland Islands is a British overseas territory

Each overseas territory has its own constitution and its own government and has its own local laws. They are responsible for their own tax rates.

As a matter of constitutional law the UK Parliament has unlimited power to legislate for the territories.

What is "direct rule" and has it been used before?

Direct rule is defined by the Oxford English Dictionary as a system of government in which power and administration are exercised by central government, rather than one in which there is any measure of devolution.

The UK government imposed direct rule on the Turks and Caicos Islands, external in the Caribbean in 2009 for three years after evidence was found of widespread corruption among the ruling elite.

This meant power was transferred to a UK-appointed governor.

It was only after the Turks and Caicos government implemented rules around sharing tax information that home rule was restored in 2012.

But Anthony Travers, the chairman of the Cayman Islands Stock Exchange, told BBC 5 live Drive Mr Corbyn's call to impose direct rule in crown territories was "hopelessly misinformed".

He said legislation that had been passed in the Cayman Islands in the last 15 years "provides for complete tax transparency for HMRC and the IRS and for other EU tax authorities and indeed for law enforcement".

"So there is no secrecy with regard to transactions in the Cayman Islands whatsoever," he said.

"The suggestion that there is any sort of covert or non-disclosed activity in the Cayman Islands is redundant. Tax haven is a redundant expression when it comes to the Cayman Islands."

Anthony Travers, Cayman Islands Stock Exchange chairman, said legislation passed in the last 15 years "provides for complete tax transparency"

Mr Travers said the Cayman Islands and the other overseas territories "display the highest standards of transparency".

He added the government "can not go around imposing colonial rule without substantial justification for doing so".

Is direct rule possible?

Graham Aaronson QC, a tax barrister who led a tax study for the government in 2011, believes Mr Corbyn's suggestion throws up more questions than answers.

"That's a constitutional law issue, whether it's possible, anything is possible if they are British dependencies," he told BBC Radio 4.

"Is it a sensible suggestion or is it just a reaction, a very understandable reaction of anger?

"What are you going to do, impose tax rule if, is it a threat, are you actually going to do it? If it's direct rule, then what are you going to do? Are you going to introduce new tax laws within those jurisdictions? This is all going to take years and years and years and years."

What is the government doing to tackle tax evasion and avoidance?

In 2013, the prime minister wrote to the overseas territories urging them to "get their house in order" and sign up to international treaties on tax.

The 10 territories that received his letter were Bermuda, the British Virgin Islands, the Cayman Islands, Gibraltar, Anguilla, Montserrat, the Turks and Caicos Islands, Jersey, Guernsey and the Isle of Man.

They agreed to sign up to the Multilateral Convention on Mutual Assistance in Tax Matters - an initiative led by the Organisation for Economic Cooperation and Development (OECD).

They also agreed to publish national action plans on beneficial ownership, detailing the true owners of so-called "shell" companies.

Downing Street says it has asked three things of the overseas territories and Crown dependencies: the automatic exchange of tax information; a common reporting standard for multinational companies; and central registries so people know who owns companies.

It says they have all delivered on the first two, so now they must deliver on central registries. Gibraltar, Bermuda and Jersey have already done so.

A spokesman said the government is close to agreement with Guernsey and Isle of Man.

- Published5 April 2016

- Published6 April 2016

- Published3 April 2016