RBS squeezed struggling businesses to boost profits, leak reveals

- Published

RBS's chief conduct and regulatory affairs officer, Jon Pain, speaks to Andy Verity about the leaks

Royal Bank of Scotland secretly tried to profit from struggling businesses, leaked documents show.

The bank bought up assets cheaply from failing businesses it claimed to be helping, the confidential files reveal.

Staff could boost their bonuses by finding firms which could be squeezed in what it called a "dash for cash".

RBS said it had let some small business customers down in the past but denied it deliberately caused them to fail.

The cache of documents, passed by a whistleblower to BuzzFeed News and BBC Newsnight, support controversial allegations in a report three years ago by the government's then entrepreneur in residence Lawrence Tomlinson.

He accused the taxpayer-owned bank of deliberately putting viable businesses on a path to destruction while aiming to pick up their assets on the cheap.

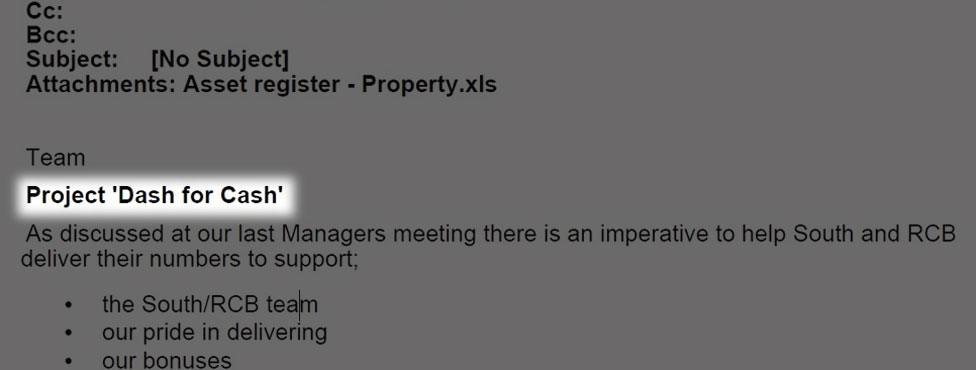

An email from 2008 urged staff to mount a "dash for cash" from the bank's business customers

The documents show the bank's efforts to make money out of struggling businesses were ramped up after the 2008 financial crisis.

More than 12,000 companies were pushed into the bank's controversial "turnaround" division - the so-called Global Restructuring Group (GRG) - in the wake of the crash.

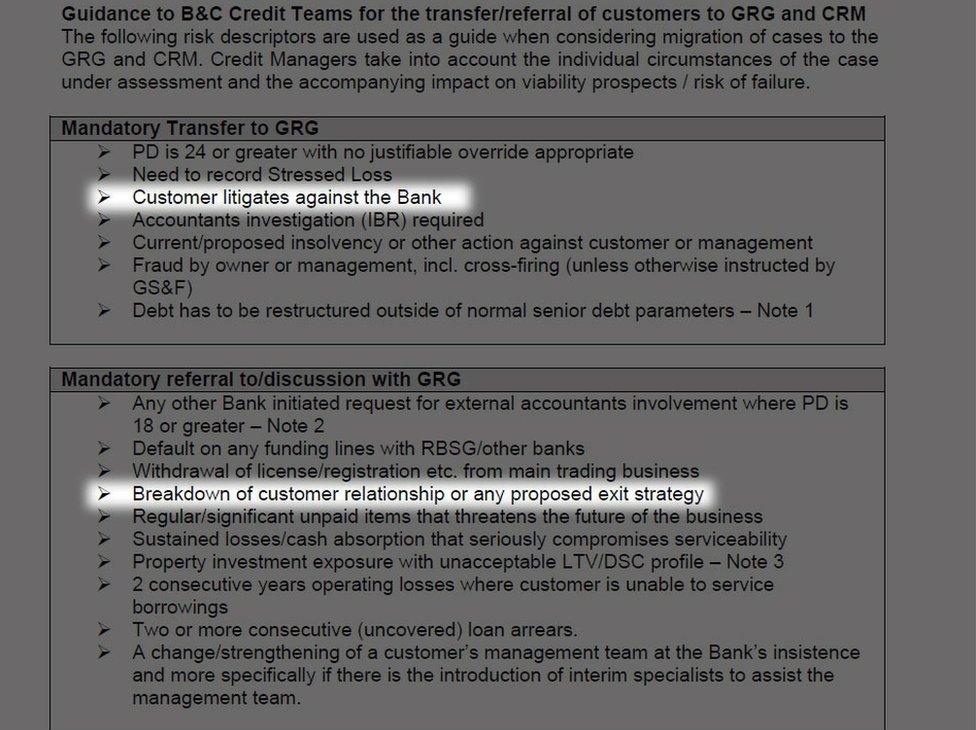

Customers could be put into the division simply for falling out with the bank.

Between 2007 and 2012, the value of loans to customers in the GRG increased five-fold to more than £65bn.

Many of the small business owners affected say they have not only lost their businesses but also experienced family break-ups and deteriorating physical and mental health due to the stress of their treatment at the hands of the bank. Others have been made homeless or bankrupted.

'This was 35 years of my life'

Architect Andi Gibbs blames RBS for the failure of his business

Architect Andi Gibbs borrowed £1.3m from RBS in 2008 for a property development aimed at regenerating a drug-ridden red light district of Norwich.

As a condition of his loan the bank insisted he purchase a financial product supposed to protect against rising interest rates.

It was mis-sold and when rates fell, it started draining cash from his business. A year later RBS told him it had done a new valuation of his property - it was now worth too little compared to his loan.

His firm would have to go to what it said was a "turnaround" division - the Global Restructuring Group.

In the GRG Andi faced higher interest fees and threats to pull the plug. He ended up losing his business and says the bank cost him his health, his home and his marriage.

"What they have said reads like they now realize they have destroyed legitimate businesses. I don't believe they had any interest in understanding the businesses and I think they are kind of admitting to that," he said. "Banks are there to help, not to destroy."

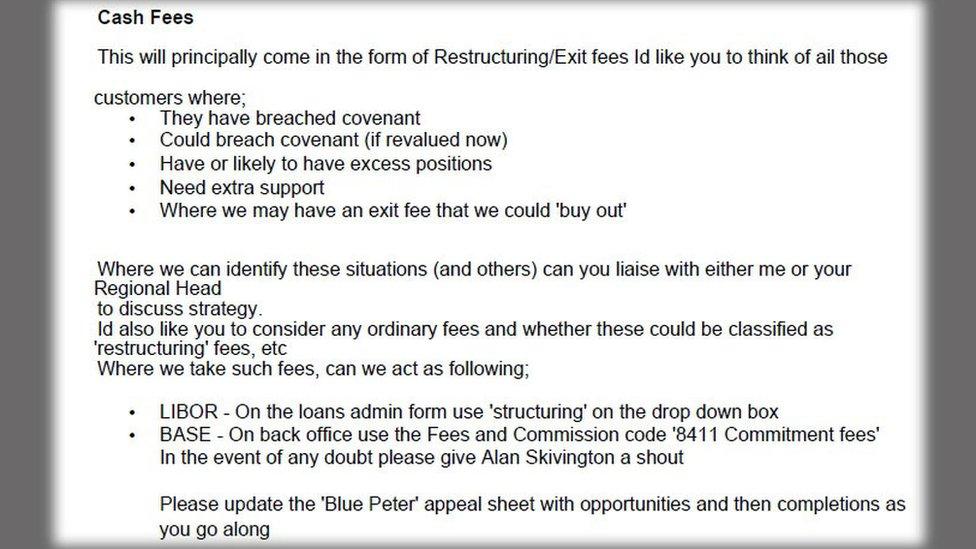

The documents confirm that bank staff were rewarded with higher bonuses based on fees collected for "restructuring" business customers' debts - cutting the size of their loans and getting cash or other assets from the customer.

In what was described by an RBS executive as "Project Dash for Cash", staff were asked to search for companies that could be restructured, or have their interest rates bumped up.

The documents also show that where business customers had not defaulted on their loans, bank staff could find a way to "provoke a default".

The "dash for cash" document showed how staff were urged to find reasons to justify moving businesses to the restructuring division

Many business owners complained that unrealistically low valuations were used to claim they had breached their borrowing limits and force them into the GRG.

From there the bank sought to squeeze cash from the businesses through higher interest and fees, pressuring customers to sell assets to pay down loans, taking an equity stake in their businesses, or by pushing the business into administration.

The bank told Newsnight: "RBS has been very clear that GRG's role was to protect the bank's position... In the aftermath of the financial crisis we did not always meet our own high standards and we let some of our SME customers down.

"Since that time, RBS has become a different bank and significant structural and cultural changes have been put in place, including how we deal with customers in financial distress."

But the bank insisted that a detailed review of millions of pages of documents had found no evidence that "the bank artificially distressed otherwise viable SME businesses or deliberately caused them to fail."

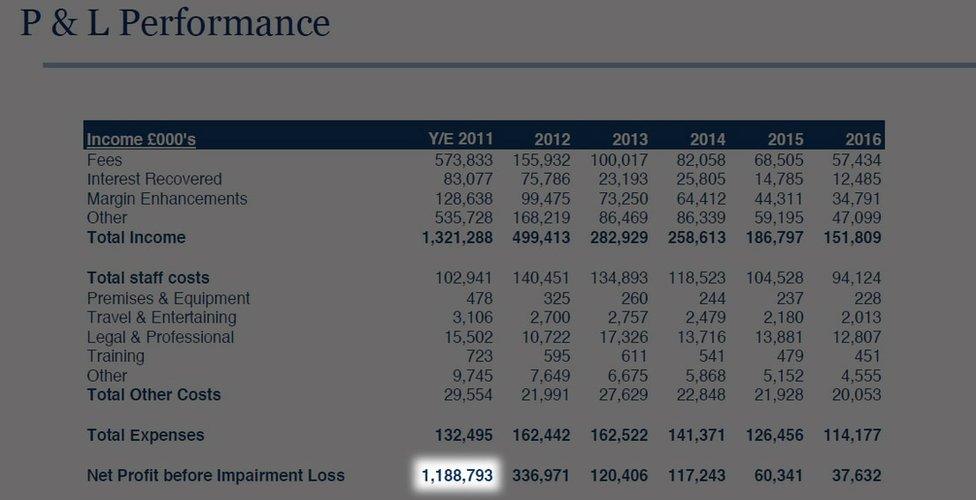

The senior RBS executives in charge of GRG, Derek Sach and Chris Sullivan, repeatedly claimed before MPs in 2014, in response to Mr Tomlinson's allegations, that GRG was "not a profit centre".

That denial was repeated before MPs 27 times, with executives claiming it was "totally inappropriate" to call it a profit centre.

Weeks later, then RBS chairman Sir Philip Hampton accepted it was a profit centre, saying there had been a "lack of clarity" but said it was "an honest mistake".

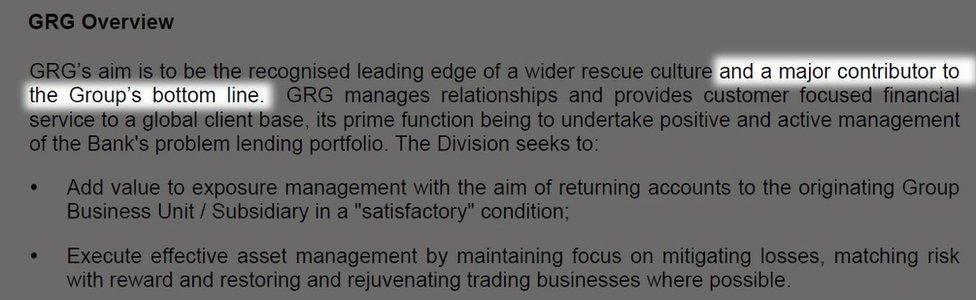

However in a confidential internal document approved two years before that appearance by Mr Sach, GRG was said to be "a major contributor to the bank's bottom line".

Customers could be moved into the GRG division simply for falling out with the bank

The documents show GRG's income from fees exceeded its expenses by a wide margin, returning a profit of £1.2bn in just one year, 2011.

They also show RBS's own auditor, Deloitte, was concerned there was a "reputational risk" of "perceived conflicts of interest".

Derek Sach, the global head of GRG, was on the one hand running a division that purported to help business customers turn themselves around. On the other, he sat on a committee at West Register, the property arm of RBS, that decided what customer assets to buy for the bank.

RBS commissioned the law firm, Clifford Chance, to report on Mr Tomlinson's allegations in what it billed as an independent report.

The 2014 report said it had found no evidence to support most of his accusations - for example, that West Register was deliberately targeting client's assets.

However, the documents show West Register was being passed information about properties held by customers transferred to GRG even before the companies had agreed to sell them, apparently undermining that conclusion.

They also contradict claims by RBS that most of the customers returned to normal banking after a spell in its turnaround division.

In 2012 the bank had transferred 1,483 business customers to GRG. Only 452 cases were returned to normal banking.

The GRG group made nearly £1.2 billon for RBS in 2011. Executives told Parliament in 2014 it was not a profit centre

An internal company document confirms GRG's aim was to be a major contributor to the bank's "bottom line"

The Financial Conduct Authority was ordered in 2013 by then Business Secretary Vince Cable to conduct a so-called "skilled persons report" into Mr Tomlinson's allegations.

The report, carried out by two firms of consultants, Mazar's and Promontory, has been completed and passed to the Financial Conduct Authority, but FCA chief executive Andrew Bailey has refused to name a date of publication.

Mr Tomlinson, who published the 2013 report on RBS's treatment of small businesses, said: "These documents are massively significant in that they finally, for me, prove what was in my report.

"I think RBS should just come clean and say yes, GRG was a profit centre and it did act against the best interest of the UK as a whole."

Watch Andy Verity's full report for BBC Newsnight at 22:30 on Monday on BBC Two - or catch up afterwards on iPlayer