Mourinho faces tax probe call over Sunday Times claims

- Published

Jose Mourinho has been accused of using off-shore accounts to avoid paying tax

The tax affairs of football manager Jose Mourinho should be investigated by British officials following allegations he used off-shore companies to reduce his tax bill, a UK MP has said.

Mourinho is accused of moving millions of pounds of earnings to the British Virgin Islands to avoid paying tax.

The Manchester United manager's agent said the allegations were "unfounded".

Public accounts committee chairwoman Meg Hillier told the Sunday Times, external the claims required "close examination".

HM Revenue and Customs said it would not comment on named individuals, but took "all allegations of tax evasion extremely seriously" and "always investigates allegations of fraud together with any intelligence provided".

'Complex web'

Further claims about the tax affairs of Mourinho - as well as other top international football stars - have been made in the Sunday Times and other European newspapers.

The publications acquired leaked documents from the website Football Leaks, following a cyber attack on football agents earlier this year.

Mourinho has been accused of using "a complex web of off-shore companies" to avoid paying tax in the UK and Spain.

The allegations surround his time as manager of UK side Chelsea, between 2004 and 2007, and Spanish club Real Madrid, between 2010 and 2013.

According to the reports, Portuguese-born Mourinho, 53, placed £10m (€12m) into a Swiss account owned by a British Virgin Islands (BVI) firm.

The newspaper claims Mourinho and his advisers deducted substantial costs for a BVI company - which it suggests has no employees.

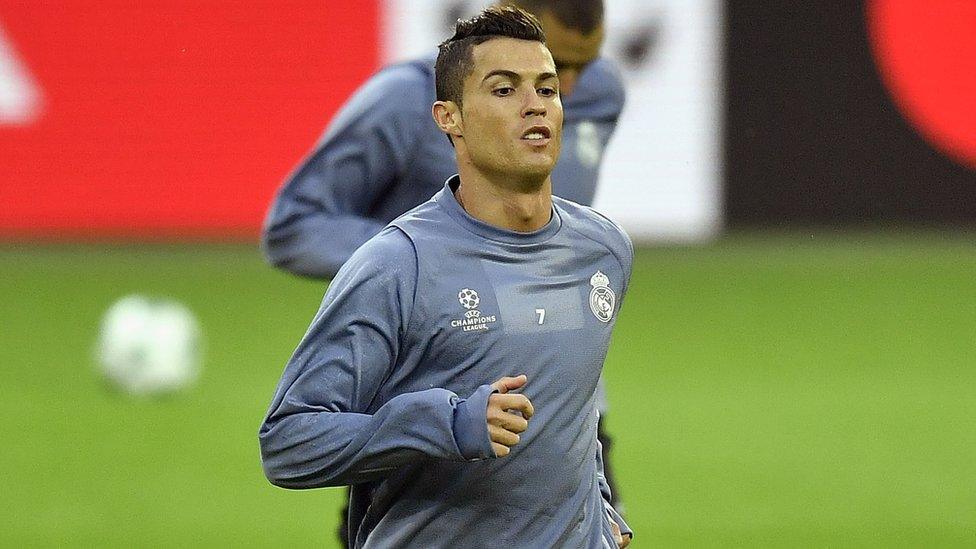

The Sunday Times says Mourinho - as well as Real Madrid star Cristiano Ronaldo - also used bank accounts and companies in Ireland, Switzerland and New Zealand to process substantial earnings for their image rights.

However, Jorge Mendes - the agent for both Mourinho and ex-Manchester United player Ronaldo - denies the claim.

He says both men were fully compliant with UK and Spanish tax rules.

The statement added that the allegations stemmed from a cyber attack earlier this year on some sports agents, details of which were prohibited by a Spanish court from being published.

Leaked documents have also resulted in allegations about Cristiano Ronaldo

The head of HMRC will appear before Ms Hillier's committee - which is responsible for overseeing government expenditure - this week.

The Labour MP told the BBC: "I think it is really important that the tax authorities take a really close look at what's gone on and we will be raising this with them on Wednesday."

She said the allegations would be "galling" for football fans who buy season tickets and spend a lot of their disposable income on watching games.

"On Wednesday, we are already examining HMRC on how they deal with high net-worth individuals and it is clear that there are issues there about the resource they have got and how they go about dealing with people with very large amounts of wealth," she said.

A spokesman for the tax authority said last year it had received an additional £800m "to help tackle the cheats" by increasing the number of people prosecuted.

He added: "HMRC carefully scrutinises the arrangements between football clubs and their employees in respect of any image right payments to make sure the right tax is paid - in recent years we have identified more than £80m in additional tax payable from clubs, players and agents.

"We take seriously allegations that customers or their agents may have acted dishonestly in the course of an enquiry, and can reopen closed cases if we suspect this has happened. "

International consortium

The allegations surrounding Mourinho and Ronaldo are based on two terabytes of leaked information which allegedly includes original contracts.

The claims were published by an international consortium of journalists - including German newspaper Der Spiegel, Spain's El Mundo and the UK's Sunday Times - which obtained a trove of about 18m documents.

Other top players were also named in the documents.

The consortium says it intends to publish a series of articles under the banner "Football Leaks" over the next few weeks.

It comes eight months after the so-called Panama Papers lifted the lid on how the world's rich and powerful use tax havens to hide their wealth.

Jose Mourinho and Cristiano Ronaldo during their time together at Real Madrid

Real Madrid, Ronaldo's current employer, did not respond to requests from news agencies for comment.

Manchester United said the allegations related to events before Mourinho's arrival at the club and so it would not comment.

One of the papers in the consortium, the Dutch NRC, alleges that Ronaldo moved €63.5m (£53.1m, $67.7m) to the British Virgin Islands at the end of 2014.

The paper says the striker received sponsorship fees which were moved via two Irish companies to the tax haven, 11 days before Spain changed an advantageous tax law.

According to the reports, Friday's first batch of leaks centred on "a system" put in place by Mr Mendes, whose company has denied any wrongdoing.

His company, Gestifute, said in a statement that neither Ronaldo nor Mourinho "have been implicated in legal proceedings of the tax evasion commission in Spain".

The company accused the media consortium of operating in an "insidious" way concerning the stars' tax obligations.