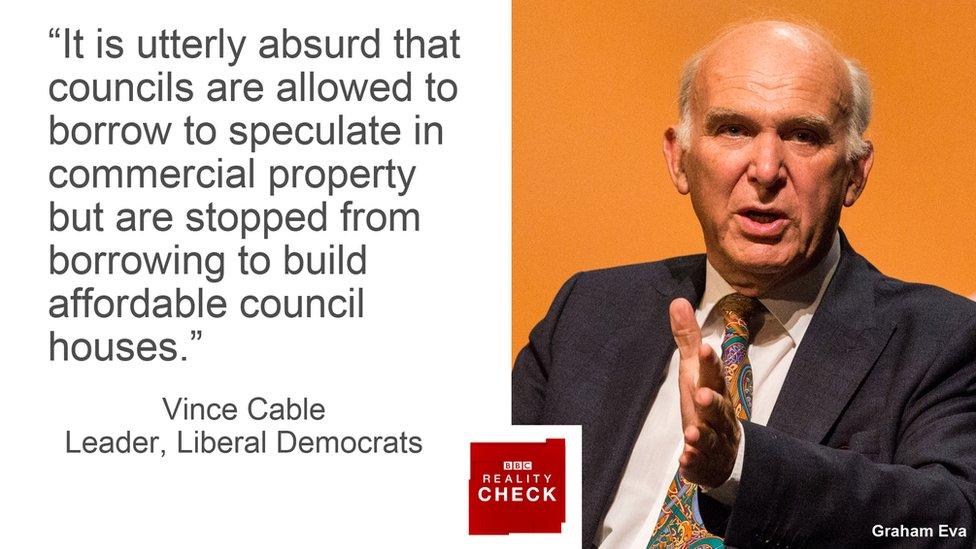

Lib Dems: Is it right that councils are barred from borrowing to build houses?

- Published

The claim: Vince Cable says councils are stopped from borrowing money to build council houses, but are free to "speculate" in commercial property.

Reality Check verdict: He is right. Caps are placed on local authorities, limiting their ability to borrow money to build council houses.

There is nothing to stop councils borrowing money to invest in commercial property (non-residential buildings). But there are restrictions when it comes to borrowing to build housing.

Councils can access low-interest loans through a government body, the Public Works Loan Board, external (PWLB).

Local authorities may use that money to invest in commercial property in the hope of a bigger return compared with the interest on their loans.

The PWLB does not need to know the reason a local authority needs a loan, provided it can afford the borrowing costs.

The responsibility for local spending and borrowing decisions lies with locally elected council members, according to the government, external.

Tony Travers, professor of local government at the London School of Economics, said investing in commercial property had proved an attractive option for cash-strapped local authorities.

"This is an attempt by councils to generate a longer term surplus and use that cash on their day-to-day services," he said.

"A council could - for example - invest in a bank and use its profits to pay for other things."

The danger of course is the value of investments can go down as well as up, so councils could be left in debt.

Loans for council house building are much more complex

Social housing

Are local authorities equally unrestricted when it comes to building houses?

When it comes to England, the answer is no. They are subject to tight limits.

This is because council budgets are split into different pots, which are very difficult to move around.

When a council wants to build new homes or temporary accommodation, the transactions come out of a pot known as a housing revenue account (HRA).

And since 2012 rules governing HRAs have restricted the amount councils can borrow to fund house-building.

The cap varies from council to council, depending on how much housing debt they already have.

According to Prof Travers, the cap was brought in to prevent it being too easy for councils to build social housing, which would have added to government debt.

But the rules do create an odd inconsistency: councils are free to borrow to invest in the private commercial property sector but are restricted when it comes to building council housing.

- Published19 September 2017

- Published19 September 2017