Paradise Papers: Queen's private estate invested £10m in offshore funds

- Published

The Queen's private estate invested £10m in offshore funds

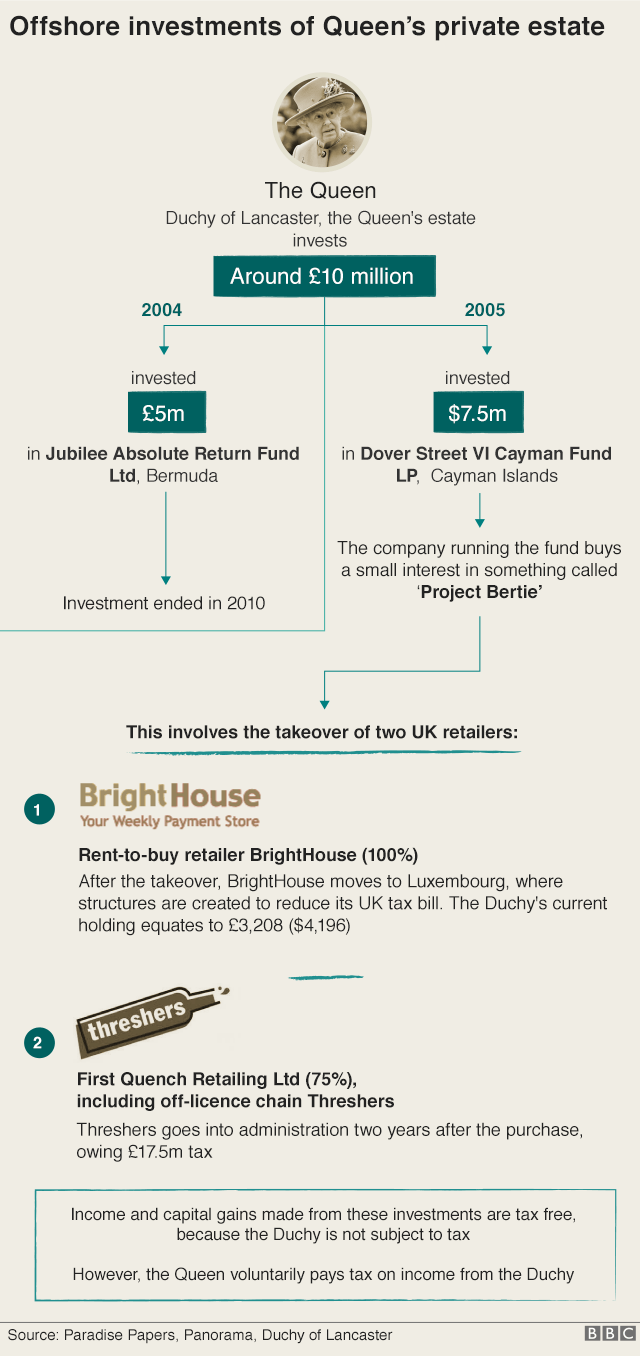

About £10m of the Queen's private money was invested offshore, leaked documents show.

The Duchy of Lancaster, which provides the Queen with an income, held funds in the Cayman Islands and Bermuda.

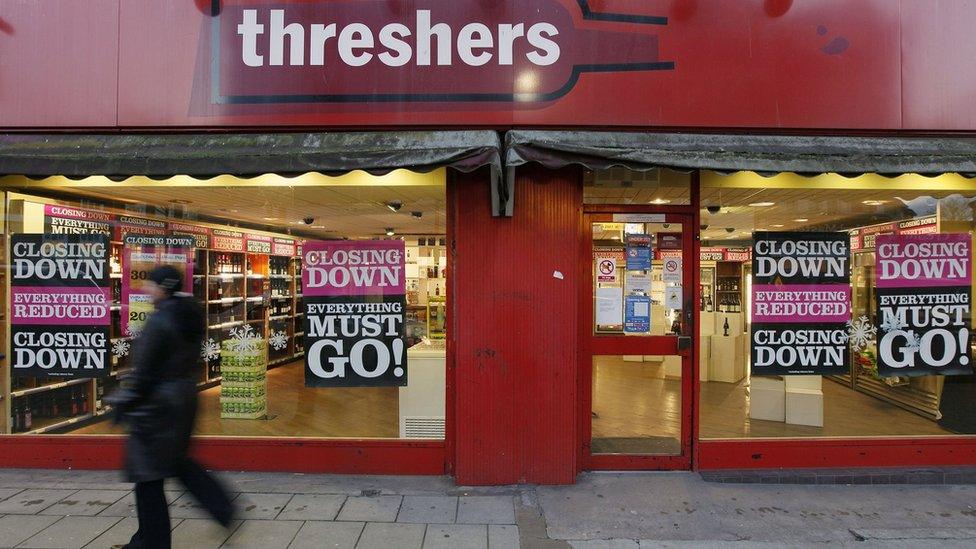

A small amount ended up in the company behind BrightHouse, a chain accused of irresponsible lending, and Threshers, which went bust owing £17.5m in UK tax.

The Duchy said the BrightHouse holding now equates to £3,208 and it was not involved in fund investment decisions.

It added it had been unaware the stores featured in the investments.

The chief finance officer of the £500m estate, Chris Adcock, told the BBC: "Our investment strategy is based on advice and recommendation from our investment consultants and appropriate asset allocation...

"The Duchy has only invested in highly regarded private equity funds following a strong recommendation from our investment consultants."

A spokesperson for the Duchy of Lancaster added: "We operate a number of investments and a few of these are with overseas funds. All of our investments are fully audited and legitimate.

"The Queen voluntarily pays tax on any income she receives from the Duchy."

Duchy's reputation

Details about the Duchy's investments came to light in the Paradise Papers - a leak of 13.4m documents from companies including Appleby, one of the world's leading offshore law firms.

The two funds were based in British overseas territories with no corporation tax and at the centre of the offshore financial industry.

But the Duchy said it was not aware there were tax advantages to it from investing in offshore funds, adding that tax strategy was not a part of the estate's investment policy.

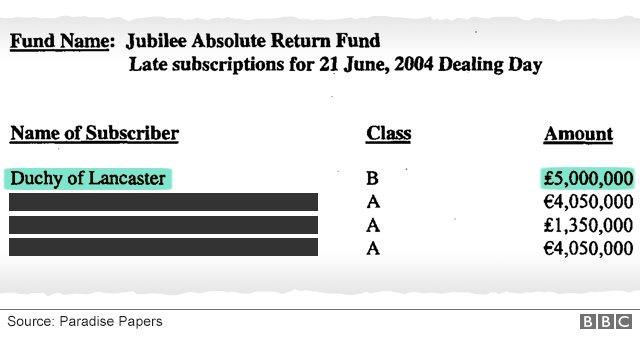

The documents show the Duchy of Lancaster put £5m in the Jubilee Absolute Return Fund Limited in Bermuda in 2004, with the investment coming to an end in 2010.

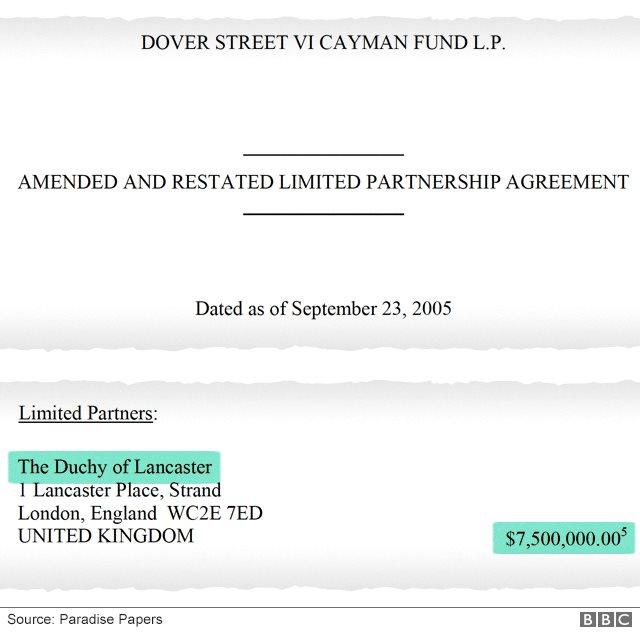

In 2005 the Duchy agreed to put $7.5m (£5.7m) in the Dover Street VI Cayman Fund LP.

Documents show the fund invested in medical and technology companies.

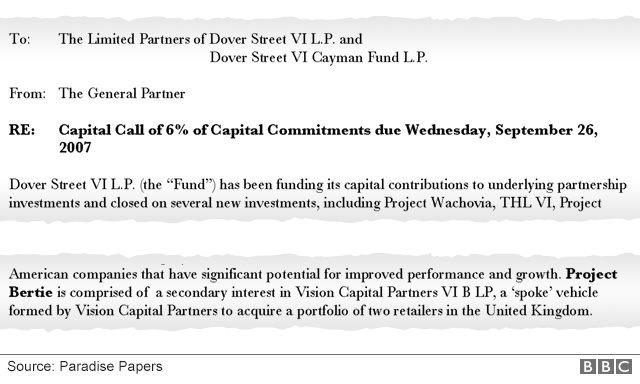

The connection to rent-to-buy firm BrightHouse began in 2007 when the US company running the fund asked the Duchy to contribute $450,000 to five projects, including the purchase of the two UK High Street retailers.

This included an interest in London-based private equity firm Vision Capital, the company which acquired 100% of BrightHouse and 75% of the owners of Threshers off licence chain.

Labour MP Dame Margaret Hodge says she is furious with those who advise the Queen

Under its new owners, Threshers' balance sheet was loaded with debt and it paid no corporation tax for two years. When the drinks retailer went bust in October 2009, external, almost 6,000 people lost their jobs.

The majority of Vision Capital's BrightHouse investment later ended up in a company based in Luxembourg and it began paying less corporation tax in the UK.

Last month, the UK's financial regulator, the Financial Conduct Authority, said BrightHouse, which sells electrical goods and furniture predominantly to people on lower incomes via weekly installments, had not acted as a "responsible lender" and ordered it to pay £14.8m compensation to 249,000 customers.

The Duchy said its investment in the Cayman Islands fund is due to continue until 2019 or 2020 and amounts to 0.3% of the total value of the estate, while its interest in BrightHouse now equates to just 0.0006% of its wealth. The Duchy did not provide a figure for its interest in Threshers.

Vision Capital said it "complies with all laws and regulations and pays its tax in full and on time. Any suggestion to the contrary is wrong".

Analysis: BBC royal correspondent Nicholas Witchell

The Paradise Papers' revelations over the Queen's finances are certainly embarrassing.

Many will also view the Duchy of Lancaster's offshore investments in BrightHouse and Threshers as dubious and inappropriate.

However, it is not a question of tax avoidance, but of judgement on behalf of her advisers.

The Queen is officially exempt from UK tax laws, but voluntarily pays her share of income tax on her £500m estate.

It is extraordinary and puzzling that her advisers could have felt that it was appropriate - for somebody whose reputation is based so much on setting a good example - to invest in these offshore funds.

There will be meetings and questions being asked within Buckingham Palace this morning as the monarchy finds its reputation tarnished by association.

The Duchy's 2017 annual report, external says it "gives ongoing consideration regarding any of its acts or omissions that could adversely impact the reputation of the Duchy or Her Majesty The Queen".

Labour MP Margaret Hodge, the former chair of the Commons Public Accounts Committee, said she was "pretty furious" with the Queen's investment advisers, saying they were bringing her reputation into disrepute.

"It is so obvious that if you're looking after the money of the monarchy, you've got to be actually cleaner than clean and you must never go near the dirty world of money laundering, tax avoidance, tax evasion or actually making money in dubious ways," she said.

'Preying on the vulnerable'

The business model of BrightHouse has long come under the spotlight.

A parliamentary report in 2015, external said the company was charging interest rates of up to 94%. One in five customers were in arrears and one in 10 purchases ended in repossession. In one case examined by MPs and Lords, a Samsung freezer cost £644 to buy in John Lewis but £1,716 under a five-year plan from the chain.

BrightHouse was attracting attention at the time of the Duchy's investment - with the Financial Times challenging its chief executive in November 2008 to respond to accusations, external that the chain was "preying on the vulnerable".

The company maintains it is a responsible lender and through its 300 stores provides a services to millions of Britons who are unable to access up traditional lines of credit.

BrightHouse told the Guardian newspaper it follows all relevant tax regulations and pays its tax in full and on time.

Vision Capital announced it was acquiring the stakes in BrightHouse and Threshers, external in June 2007.

Source documents

The offshore leaked documents show the Duchy of Lancaster was among 46 investors in the $312m Dover Street VI Cayman Fund LP.

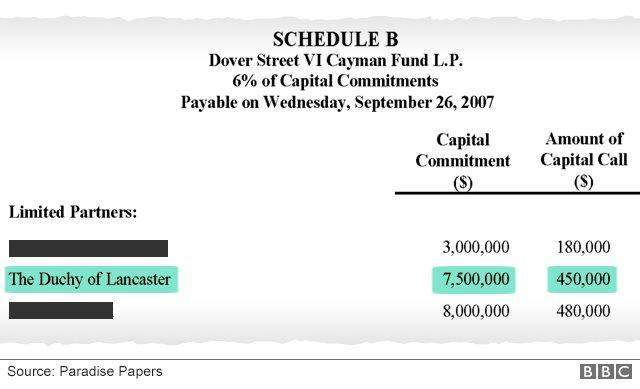

In September 2007, investors were asked to pay 6% of their financial commitment into five investments, including "Project Bertie".

The investors were told Project Bertie was formed to take an interest in a company set up by Vision Capital to "acquire a portfolio of two retailers in the United Kingdom".

The Duchy of Lancaster's $450,000 commitment to the "capital call" is listed in the documents.

Another document shows the investment in Jubilee Absolute Return Fund.

Full disclosure

Established more than 700 years ago, the Duchy of Lancaster has a commercial and residential property portfolio and financial investments.

Its main purpose is to provide income for the Queen, who is known as the "Duke of Lancaster".

Although the Duchy is not subject to tax, since 1993 the Queen has voluntarily paid tax on any income she receives.

The Duchy's annual report and accounts include a summary of its holdings and financial performance and are put before Parliament. The offshore investments were not referenced in the reports but there is no requirement for specific details of the Duchy's holdings to be disclosed.

Dave McClure, the author of a book about the wealth of the Royal Family, told the BBC "pressure will grow on the Duchy to open up to proper parliamentary scrutiny by the National Audit Office, which they've resisted for decades.

"The solution to the problem might be just full disclosure, so everyone knows what investments they're investing in."

The Duchy said the Queen "takes a keen interest in the Duchy's estates and tenants" but "appoints a chancellor and the Duchy Council to administer the affairs of Her Duchy. The chancellor delegates the oversight to the Duchy to the Council".

Investors in the Dover Street VI Cayman Fund LP made a commitment for a "given period" and are "not party to its ongoing investment decisions" or where money is "ultimately invested", it added.

Asked whether the Duchy had other investments in offshore funds, it said it "currently invests in a fund domiciled in Ireland".

The Chancellor of the Duchy of Lancaster is a government minister, external and sits in the cabinet, but plays a nominal role in running the estate. The current chancellor is Sir Patrick McLoughlin MP, the Chairman of the Conservative Party.

At the time the Duchy initially invested in the Dover Street VI Cayman Fund LP in September 2005, its chancellor was Labour MP John Hutton.

Ed Miliband was the chancellor of the Duchy at the time the call came to invest in the company taking over BrightHouse and Threshers. Coincidentally in 2016, the former Labour leader called for better regulation on buy-to-rent firms such as BrightHouse in a film for the BBC's Victoria Derbyshire programme.

The papers are a huge batch of leaked documents mostly from offshore law firm Appleby, along with corporate registries in 19 tax jurisdictions, which reveal the financial dealings of politicians, celebrities, corporate giants and business leaders.

The 13.4 million records were passed to German newspaper Süddeutsche Zeitung, external and then shared with the International Consortium of Investigative Journalists, external (ICIJ). Panorama has led research for the BBC as part of a global investigation involving nearly 100 other media organisations, including the Guardian, external, in 67 countries. The BBC does not know the identity of the source.

Paradise Papers: Full coverage, external; follow reaction on Twitter using #ParadisePapers; in the BBC News app, follow the tag "Paradise Papers"

Watch Panorama on the BBC iPlayer (UK viewers only)