Paradise Papers: PGL holiday firm cut tax bill after rule change

- Published

The UK company which owns the PGL children's holidays brand exploited an anti-tax avoidance law to actually save itself tax, the Paradise Papers show.

An amendment to rules introduced by the government in 2013 allowed Holidaybreak to legally avoid corporation tax by artificially shifting German profits to the Isle of Man.

Holidaybreak says it follows all tax rules and disclosure requirements.

The UK Treasury denies its regulations can help multinationals avoid tax.

But the EU last month announced it is investigating, external whether the amendment to the Controlled Foreign Companies (CFC) rules amount to illegal state aid.

'Open to exploitation'

David Cameron's coalition government had pledged to work with the Organisation for Economic Cooperation and Development (OECD) and update tax rules to ensure "these do not allow or encourage multinational enterprises to cut their tax bills by artificially shifting profits to low-tax jurisdictions".

The CFC rules, external, first introduced in 1984, enabled HMRC to impose full corporation tax on foreign subsidiaries of UK companies if they considered them to be shifting profits into tax havens.

But the rules were reformed in 2013 and an "exception" was added to allow offshore subsidiaries of UK firms financing other group companies abroad to pay a quarter of the full rate.

Campaigners including Action Aid have warned it would be open to exploitation and undermine the government's claims to support international efforts against tax avoidance.

The Paradise Papers documents held by offshore law firm Appleby and seen by BBC Panorama show how a finance company set up by Holidaybreak could use the CFC change to pay corporation tax in the UK at 5.25% in 2015. Company profits in Germany are taxed at around 30%.

By paying the reduced UK rate, Holidaybreak would be able to cut the amount of tax it paid on its German business by more than 1m euros (£900,000) a year, calculations suggest.

Interest payments

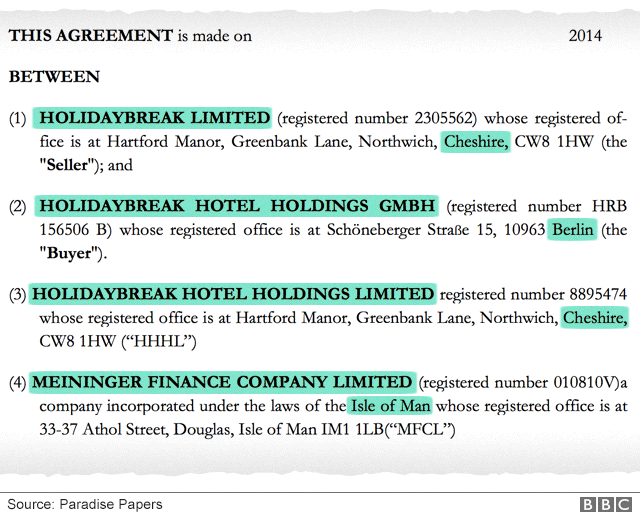

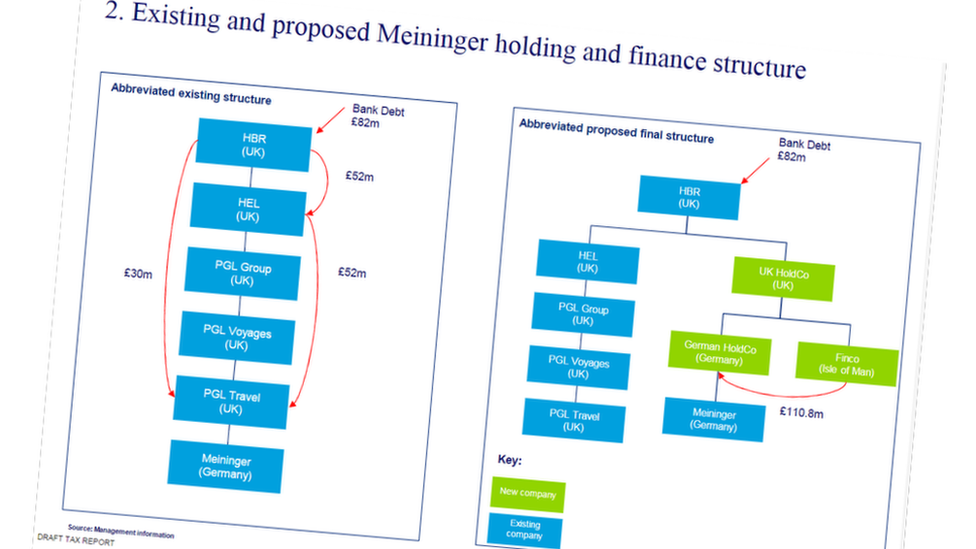

The documents show the tax structure put in place after Cheshire-based Holidaybreak acquired the German budget hotel group Meininger in 2013.

Appleby set up Meininger Finance Company Limited in the Isle of Man and it loaned 134.6m euros (£110.8m) to the German hotel group.

Source document

The German company had to pay interest on the loan, which reduced both its profits and the amount of tax it had to pay in Germany.

The interest payments went to the Isle of Man. Under the old rules they would have been taxed by the UK government at the full rate of corporation tax, but under the new rules Holidaybreak was allowed to pay just a quarter of the rate.

The company would be able to shift between 6 and 7 million euros a year into the Isle of Man, according to the tax advice.

Other documents show meetings of the finance company were held in Appleby's office in the island's capital, Douglas, to satisfy the UK tax authorities that the new company was being managed and controlled from the Isle of Man.

'Tax haven of the world'

Holidaybreak became part of Cox & Kings, an India-registered company and one of the world's longest established travel businesses, in 2011.

A draft report in the Appleby documents outlines how the new company structure would work

In a statement, Holidaybreak said: "All our business affairs are conducted within the tax regulations and disclosure requirements as set out in the law of the countries we operate in, including the UK where Holidaybreak is headquartered.

"Where appropriate, we seek advice from third party advisers in order to help ensure this compliance with local law and regulations."

Fabio De Masi sat on the European Parliament's Panama Papers committee as an MEP and is now a German MP.

He said: "The Holidaybreak tax structure is exactly the sort of scheme the EU Commission will be looking at. The investigation could lead to the company being asked to pay some of the avoided tax back.

"The UK does have the option of objecting to the EU Commission's investigation through the European Court of Justice. However, this would mean the UK government doesn't want the money back," he added.

Labour MP Margaret Hodge, the former chair of the Commons Public Accounts Committee, sees the CFC rule amendment in 2013 as evidence the coalition government "were constantly introducing new rules to make Britain the tax haven of the world".

She said: "This was a deliberate change brought in by the government to help global companies do nothing other than avoid paying their fair share of tax."

A Treasury spokesperson said: "We do not believe these rules are incompatible with EU law but will co-operate with the European Commission's investigation.

"We are clear that all multinationals must pay tax on any profits they make in the UK, and our rules prevent these profits from being artificially diverted overseas."

In a statement on the Paradise Papers leak, Appleby said, external it was a law firm which "advises clients on legitimate and lawful ways to conduct their business. We operate in jurisdictions which are regulated to the highest international standards".

The papers are a huge batch of leaked documents mostly from offshore law firm Appleby, along with corporate registries in 19 tax jurisdictions, which reveal the financial dealings of politicians, celebrities, corporate giants and business leaders.

The 13.4 million records were passed to German newspaper Süddeutsche Zeitung, external and then shared with the International Consortium of Investigative Journalists, external (ICIJ). Panorama has led research for the BBC as part of a global investigation involving nearly 100 other media organisations, including the Guardian, external, in 67 countries. The BBC does not know the identity of the source.

Paradise Papers: Full coverage, external; follow reaction on Twitter using #ParadisePapers; in the BBC News app, follow the tag "Paradise Papers"

Watch Panorama on the BBC iPlayer (UK viewers only)