Reality Check: What are the plans to boost council homes?

- Published

Theresa May, in her party conference speech, pledged to boost council house building. This would be achieved, the prime minister said, by scrapping the existing limits on councils' ability to borrow money.

What exactly is this cap and what impact has it had?

Put simply, it applies to something called a Housing Revenue Account (HRA) - the pot of money where councils in England manage their housing revenue and expenditure.

But since 2012, the rules around HRAs have been tightened to restrict the amount that local authorities can draw down to build new social housing.

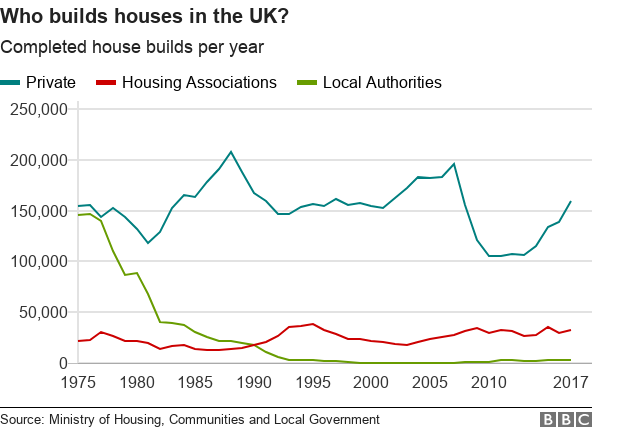

Forty years ago, local authorities were responsible for more than 40% of house builds.

Last year, it was less than 2%, according to government statistics, external.

However, the construction of homes by local councils had been falling for several decades before the borrowing cap was imposed.

How it works

The cap varies from council to council, it comes down to how much housing debt a local authority already has - so the more they have, the less they can borrow.

If you were to add up all the individual council caps together, the total across England would be about £30bn. But that's quite small when you consider the value of council homes is estimated to be in excess of £220bn.

The cap on borrowing applies only to residential properties and not commercial ones. So, at the moment, councils face no restrictions on borrowing to build things such as swimming pools or sports centres.

In last year's Budget, the government announced there would be a partial easing of the cap, with an extra £1bn to be shared between councils in "high demand areas".

But the deadline to bid has only just passed and so the extra cash hasn't been distributed yet.

Where does a council borrow to build in the first place?

Local authorities can access low-interest loans through a government body, the Public Works Loan Board (PWLB).

The PWLB does not need to know the reason a local authority needs a loan, provided it can afford the borrowing costs.

A council could also choose to borrow from a private bank - but it may not get as good an interest rate.

Theresa May said: "Solving the housing crisis is the biggest domestic policy challenge of our generation"

Why was the cap brought in?

One reason, according to the Chartered Institute of Housing's policy adviser John Perry, was a fear that councils would go on a spending splurge and build lots of council houses, running up large debts.

Mr Perry argues that was always unlikely because there is already a code in place that governs how much debt a council can run up - it's known as prudential borrowing.

Critics also say the cap on residential property was never necessary in first place. They argue council house building is a "low risk" investment because it should generate a surplus over time through rental income.

Potential impact

If councils choose to build more, then eliminating the HRA cap may increase national debt. That's because any extra borrowing councils take on will be recorded by the public finances.

Many organisations in the house building sector, as well as local authorities, have already welcomed the announcement.

London Councils - which represents London's local authorities - says it plans to use its new freedom to borrow to deliver "housing that Londoners so desperately need".