Universal Credit: Single mums take government to court

- Published

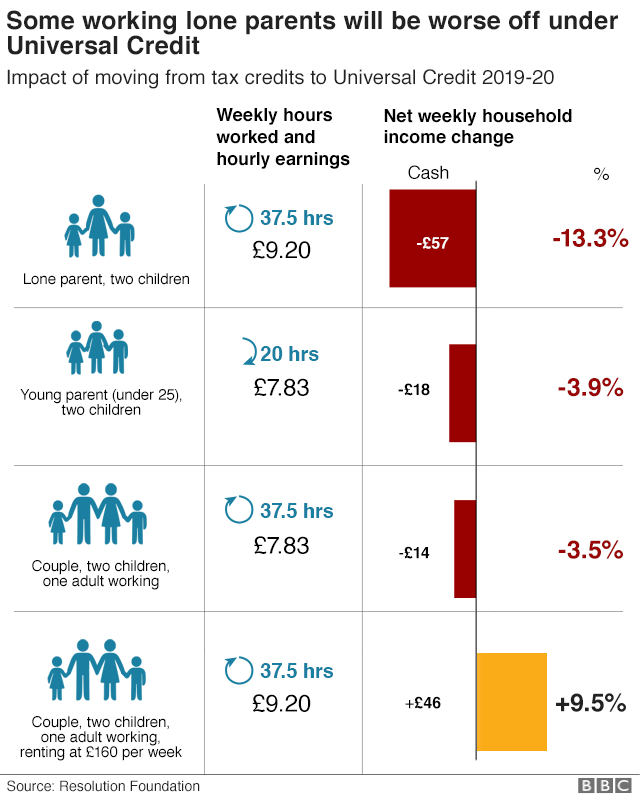

The mothers claim single parents are being disproportionately hit by the system (picture illustrated by models)

A single mum who relies on universal credit is challenging the government's benefits scheme for being "irrational".

Danielle Johnson, 25, from West Yorkshire, said: "I have never been this financially unstable before."

With three other single mums, she is claiming in the High Court that the benefit disproportionately affects single parents - most of them women.

But an official in charge of it told the court it would cost "hundreds of millions of pounds" to re-design.

Neil Couling, from the Department for Work and Pensions, said the system relied heavily on automation to process claims, and that less than 1% of claimants lost out as a result of the problem.

Universal credit is a means-tested benefit, rolling six separate benefits into one payment.

It has proved controversial almost from its inception, with reports of IT issues, massive overspends, administrative problems and delays to the scheme's roll-out.

Lawyers acting for the women will now argue there is a "fundamental problem" with universal credit, telling the court it discriminates against single parents and undermines government legislation - where the new benefit system was meant to encourage people into work.

What is the problem?

The DWP sets assessment periods for each person to look at how much they earn - from the 1st of the month to the end of the month, for example.

The department then calculates how much benefit they are entitled to by how much they are paid in that time.

Ms Johnson, like many employees, is paid on the last working day of the month and relies on universal credit to top up her income.

If she is paid on 31st of one month and the 31st of the next, she is assessed as being paid her salary once a month and her universal credit is calculated correctly.

But her lawyers argue that if she is paid on the 31st and the next month her payment day is a few days early - due to the last day falling on a weekend or Bank Holiday - her universal credit assessment shows she has been paid twice in a month.

For example:

In August, the last working day of the month was Friday 31st, so she would be paid as normal

In September, the last working day of the month was Friday 28th, as the 30th fell on a Sunday

Under the assessment period of universal credit, this would show her as being paid twice in a one month

This assessment, essentially doubling what she earns in one month in the eyes of the DWP, would see her benefit entitlement reduced.

Why would this affect single parents more?

The amount of universal credit a person gets gradually reduces as they earn more, but working parents are entitled to get what is called a "work allowance" of £198.

This means the benefit you are entitled to is calculated on what you earn after that £198 - much like the personal tax allowance, where you don't have to pay tax on the first £11,850 you earn.

The allowance is paid once in each universal credit assessment period.

So, for Ms Johnson, she would get £198 for a month where her assessment shows she has been paid twice, but not get it the next month, as she has not been paid for work in that assessment period.

Ms Johnson's lawyers, Leigh Day, said the system left her £500-a-year worse off and she struggled to budget in months when she received no benefit because of the way the system operated.

Ms Johnson said: "I'm doing my best working part-time to make ends meet so that I can look after my daughter.

"I have never been this financially unstable before, to the point of being unable to afford my rent and having to go into my overdraft when buying food.

"It is getting me into a vicious cycle of debt," she said.

Spiralling debts

Claire Woods, another single mum involved in the case, said wildly fluctuating income from month to month has forced her to turn down a promotion, use a food bank and incur debts.

In a previous job working for a county council, Ms Woods was paid at the end of every month which would clash with her universal credit assessment period.

As a result, she lost money, could not meet her monthly outgoings and lived with the anxiety of a fluctuating income.

When the council offered her a promotion, she knew the payment clash would remain, so did not take it up.

"I had to go to a food bank and I took out an advance that I am still paying back," she said.

"I took two jobs - as a PA and a waitress - which I could do without the education I invested in, but which had paydays which don't clash with my assessment period.

"I invested £40,000 in higher education studies so that I could become an occupational therapist and it's great that I've got my degree but I have had to put my career hopes on hold because of universal credit."

Erin Barrett, who works as a healthcare assistant at a local hospital, said the problems with the benefit had led to spiralling debts.

"Life would be more manageable if I didn't work," she said. "But I've always worked and so I want to work."

The fourth woman in the case, mum-of-one Katie Stewart, said she had to give up work due to the problems created by the system.

Child Poverty Action Group's solicitor Carla Clarke, who is representing Ms Woods, Ms Barrett and Ms Stewart, said: "Our clients have been left repeatedly without money for family essentials simply because of the date of their paydays.

"This is a fundamental defect in universal credit and an injustice to hard-working parents and their children that must be put right for our clients and everyone else affected."

A DWP spokesman said he could not comment on an ongoing legal case.

But on universal credit, he said: "Universal credit adjusts automatically to people's earnings so if someone's earnings are higher one month their universal credit payment decreases, but they may receive an increased universal credit amount the following month.

"People can see how much universal credit is due to be paid into their account online, and budget support is available to those who need it."

The two-day hearing is under way at the Royal Courts of Justice. Judges are not expected to make a judgment until later in the year.

- Published26 October 2018

- Published13 May 2024

- Published19 November 2018