Brexit: What does it mean for UK pensioners living in Europe?

- Published

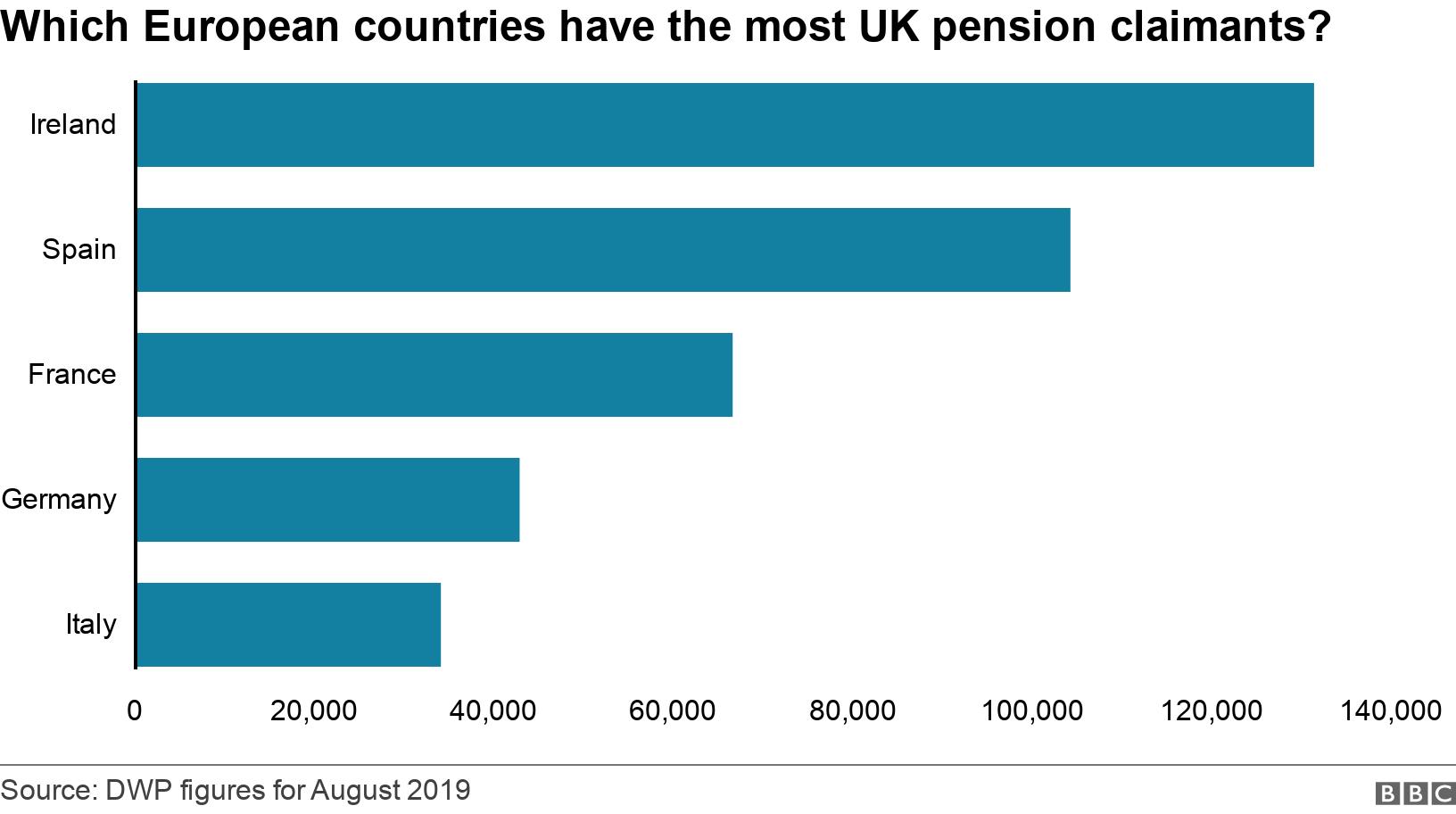

If you are entitled to a UK state pension, you can claim it wherever you live in the world.

If you live in the UK, your state pension is uprated every year in line with the triple lock, which means it rises by whichever is highest of average earnings, inflation or 2.5%.

That is also the case if you live in the 27 other EU countries as well as Iceland, Liechtenstein, Norway and Switzerland.

Under the terms of the withdrawal agreement, that is continuing, external for anyone eligible for a UK state pension who is living in one of those countries before the end of 2020.

But for people who move to one of those countries from 2021, it will depend on the outcome of negotiations on the UK's future relationship with the EU.

The UK will only continue to uprate pensions if it has an agreement either with the whole of the EU or with the individual countries so that their state pensioners living in the UK also receive annual upratings.

The Department for Work and Pensions told Reality Check: "Insisting on reciprocal arrangements has been government policy for over 70 years and will continue to be so."

This is not a problem for people claiming the UK state pension in the Republic of Ireland, Gibraltar and Switzerland, who will benefit from uprating whether or not there is a deal - because agreements are already in place.

The UK already has reciprocal arrangements with a number of countries, external outside the EU, including the US, Turkey, Jamaica and Israel, which mean that UK state pensions get uprated for people living there.

There are also places where lots of people claim UK state pensions but do not benefit from uprating such as Australia, Canada, New Zealand and South Africa.

Another complication is that when the UK was part of the EU, external someone could work for 10 years in the UK, 10 years in France and 10 years in Italy, and when they came to retire could apply for their state pension in the last country where they lived or worked, and the single claim would then be co-ordinated by that country's authorities.

The withdrawal agreement keeps that co-ordination going for those living in Europe until the end of 2020, but after that it will depend on negotiations on the future relationship.

Similarly, in order to claim the UK state pension at the moment, you have to have made National Insurance contributions for a minimum of 10 years.

But, if you have worked in the UK for seven years, for example, and another European country for at least three years, then you can still claim a UK state pension - your work in another European country gets you over the line.

You would only be paid based on your seven years of eligibility, but you would be able to claim it, which you would not otherwise have been able to do.

Again, under the withdrawal agreement this continues to be the case, but not for those who move to an EU country after 2020 - again, it will depend on further negotiations.