Zamira Hajiyeva: How the wife of a jailed banker spent £16m in Harrods

- Published

Zamira Hajiyeva: Centre of NCA investigation

It is perhaps the shopping bill to end all shopping bills.

Documents disclosed to the BBC have revealed how a woman married to a jailed banker managed to spend £16m in Harrods without raising suspicions.

Zamira Hajiyeva, currently fighting the UK's first Unexplained Wealth Order (UWO), used 54 credit cards - many of which were linked to her husband's bank - to go on a massive spending spree in the west London department store over a decade.

Mrs Hajiyeva risks losing her £15m home near Harrods - plus a Berkshire golf course worth millions more on top - if she fails to explain the source of her wealth to the High Court.

Her husband is serving a 15-year sentence in their native Azerbaijan for stealing millions from his state-controlled bank.

Last year, the BBC and its media partners won a legal battle to name the mother of three after the High Court ordered her to disclose how she had become so inexplicably wealthy despite having no income other than interest on her British bank accounts. If she cannot account for her riches, she risks losing her property.

The papers in the battle against the National Crime Agency, now seen for the first time, reveal the painstaking investigation into Mrs Hajiyeva's day-to-day spending and complicated off-shore property arrangements.

The permanent UK resident lives less than a five-minute walk from Harrods. Not only was it her local shop, she owned two bays in its private car park.

And one of the key documents in the case is a 93-page statement from the store's loyalty card scheme: in effect a record of her extraordinary shopping spree.

Spending begins

That spending began shortly after she sought to settle in the UK - having been kidnapped in Azerbaijan the year before.

She began modestly at first - spending £842 on children's books and £140 on perfume.

Before the year was out, she had discovered the Cartier jewellery counter - which would become one of her favourite locations - where a till recorded she spent £181 on 1 October.

Later came £1,600 of Miu Miu designer clothes and a further £1,539 on Ferragamo shoes.

In March 2007, she was back at Miu Miu and spent £10,616 on one of her 25 American Express cards.

Then the amounts began to soar. There was an unspecified payment to Harrods of more than £66,000 and more than £17,000 for goods from the designer Tom Dixon.

Zamira Hajiyeva's spending in Harrods

Boucheron jewellery: £3.5m

Cartier jewellery: £1.4m

Dennis Basso, US fashion designer: £402,000

Sandwich by Tom: £332,000

(This spending may be a combination of cafe stops and high-end designer furniture by Tom Dixon)

The Harrods perfume counters: £160,000

Total spending: £16,309,077.87

Source: High Court papers

Just after midday on 20 June 2008 she paid £925 at the underwear and socks counter.

One hour and three minutes later, the Cartier jewellery till received a payment for £433,389.79 - the largest clearly identifiable spend on the schedule

Then, rounding off the day, she paid £374 for a "men's designer" item.

Days later she was back to spend £8,387 on the Israeli designer Elie Tahari, and £847 on perfume. Having taken a day or so off, she returned on 26 June to spend £17,000 in three purchases at a luxury watches counter.

Disney makeovers?

The most curious payment is £99,000, which went through the till at "Bibbidi Bobbidi Boo" - Disney's then exclusive boutique in the store.

It's not clear what this is for, given that the boutique charged £1,000 an hour for a prince or princess children's make-over.

That mystery aside, she was not short of credit that particular day - another £160,000 went on Boucheron jewellery.

And so it went on - six figure spends at Cartier and Boucheron, five figure outlays to top designers and then visits to Harrods' cafes, restaurants and food halls.

Not all of the spending was on herself - she once paid £1,371 on gift-wrapping in a single trip (and almost £6,200 over all) and would regularly buy men's luxury goods. The mother of three also spent £250,000 in the Harrods toy department - where the gifts are so exclusive they may not be on sale anywhere else in the world.

The grand total? She blew £16,309,077.87 in Harrods between 29 September 2006 and 14 June 2016 - and almost £6m of it could be directly linked back to 35 credit cards issued by the bank her husband is accused of ripping off. She apparently used 54 credit cards.

More on the UK's first Unexplained Wealth Order:

Did Harrods have any suspicions?

In her statement to the court, NCA financial investigator Nicola Bartlett said Mrs Hajiyeva's spending was "significant" in light of the allegations that Mr Hajiyev abused his position at the International Bank of Azerbaijan by issuing credit cards to relatives which would ultimately never be repaid.

So did any of this raise the alarm at Harrods? Did the store have suspicions?

In a statement Harrods told the BBC that it "assisted and co-operated fully with the investigation" and "goes above and beyond" in implementing stringent anti-money laundering policies.

"Harrods compliance with, and adherence to, the strongest anti-money laundering policies is a fundamental principle of the company's operations," said a spokesman.

"There has never been any suggestion that Harrods has operated in any way other than in full compliance with the highest regulatory and legal standards."

Mrs Hajiyeva's home in west London, a short walk from Harrods

The NCA's ultimate target is not the spending in Harrods, but Mrs Hajiyeva's London home and Berkshire golf course - both of which she stands to lose if she cannot prove how she became so wealthy.

In the agency's submissions to the court, Ms Bartlett said: "The manner in which the property has been obtained (and subsequently handled) is complex... [Mrs Hajiyeva's] relationship to the property is obscure."

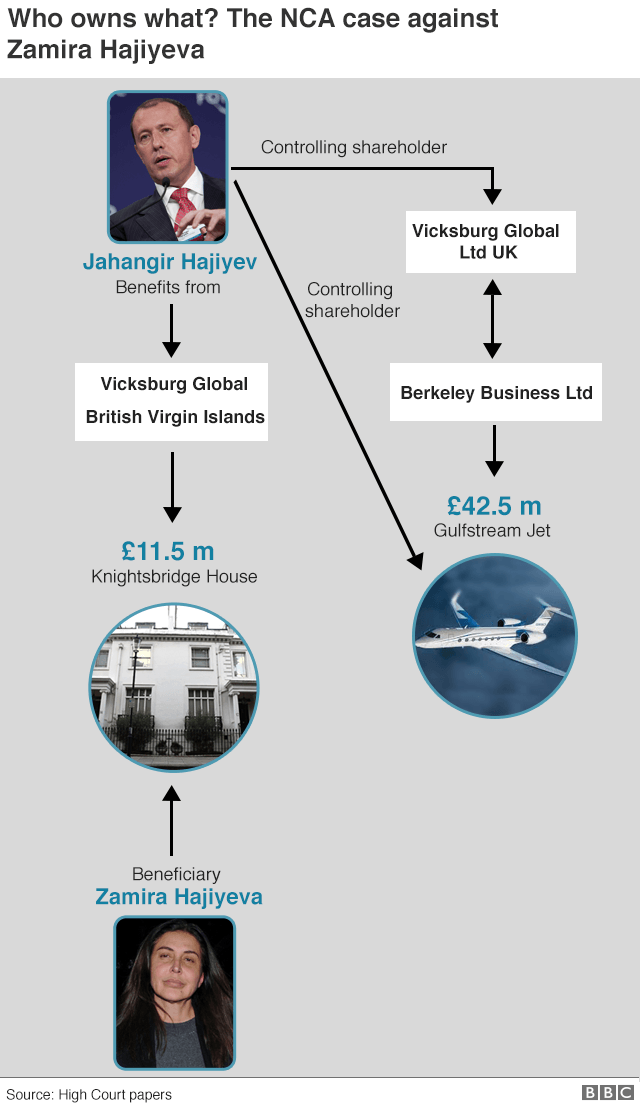

Mrs Hajiyeva's Knightsbridge home was bought in December 2009 by a company called Vicksburg Global Inc for £11.5m.

The documents show how the NCA ultimately linked this British Virgin Islands company to Mrs Hajiyeva.

Its director is a man from Azerbaijan called Elmar Baghirzade. He was also the director of a company registered in the UK called Berkeley Business Ltd, which bought a Gulfstream business jet for more than $42m (£33m).

British companies must declare who has "significant control" - meaning the person with more than a quarter of the voting shares.

And in the case of Berkeley, that person was Mrs Hajiyeva's husband, Jahangir.

The NCA also linked Vicksburg in the British Virgin Islands to the couple through Mrs Hajiyeva's own visa application. She told the Home Office that she was the beneficiary of the company that owns her home.

The ownership of the Mill Ride Golf Club in Berkshire was even more entangled.

The court documents show the club is owned by a British company with the same initials - MRGC Ltd.

It in turn is owned by Natura Ltd, which was incorporated in Guernsey.

In August 2016, Mrs Hajiyeva was declared in official papers as the person with significant control of MRGC Ltd. But that transparency lasted just for one day - as her name was subsequently removed.

"The manner in which the property has been obtained and subsequently handled is highly unusual, secretive and complex and, absent further and credible explanation, is indicative of money laundering," said the NCA in its court submissions.

"There is reason to believe that the subsequent cancellation of her Person with Significant Control interest was an attempt to conceal her association with the property."

The NCA papers reveal the existence of other properties. A further BVI company linked to Mr Hajiyev once owned the home next door to the property targeted by the Unexplained Wealth Order. And it's also believed by investigators that he owns a villa in Sardinia and property in Azerbaijan.

Mrs Hajiyeva and her adult daughter, Leyla Yuzbashova, also once lived in a £3m apartment that was owned by another of the companies he ultimately controlled.

Zamira Hajiyeva: Denies wrongdoing

And when she applied to live in the UK as a wealthy investor - a route into British life for the mega-rich - the NCA says she provided no evidence for any independent income. In support of her application, she bought more than £1m of UK government bonds in August 2010. This loan to the government came from her husband, the court records show.

And five years later, her husband assured the Home Office in a letter that "my wife and I have sufficient funds" for her to be granted indefinite leave to remain.

Months later he was arrested in Azerbaijan and charged with stealing from the bank he ran.

Mrs Hajiyeva has repeatedly denied wrongdoing, and is appealing against the NCA's action against her. She's also now fighting against extradition to Azerbaijan in a case that will be heard later this year.

In her statement to the court, also disclosed, she said that she has been unable to defend herself or her husband because he is in jail and is therefore unable to provide a detailed account of how he became a legitimate and successful businessman.