Social care: Plans for reform in England likely this week - sources

- Published

Nadhim Zahawi: "You're being presumptuous" on National Insurance rise.

Plans to overhaul England's social care system are likely to be unveiled this week following government talks this weekend, the BBC has been told.

Boris Johnson promised to fix the social care system when he became PM.

But the prime minister is facing pressure from his own MPs not to increase National Insurance to pay for it - an idea that is being considered.

Vaccines minister Nadhim Zahawi refused to say if taxes would be raised in order to pay for social care.

During the last election, the Conservatives made a manifesto commitment, external not to raise National Insurance, income tax or VAT.

Asked if the government would break that pledge in order to pay for social care, Mr Zahawi said he was "not going to engage in a hypothetical discussion" but added he would defend the plans once they have been published.

Speaking to the BBC's Andrew Marr, Mr Zahawi said his party was committed to reforming social care and that the chancellor would set out the government's proposals.

Many Conservative MPs are against tax rises to fund any reforms, and ex-Conservative Chancellor Lord Philip Hammond told Times Radio increasing National Insurance could provoke a "very significant backlash".

Government sources said meetings have been going on throughout the weekend.

Plans to reform social care and give extra funding to the NHS should become clear this week, they said.

It is widely accepted that major changes are needed to the social care system, which helps older and disabled people with day-to-day tasks such as washing, dressing, eating and medication.

The current system is under pressure after past governments failed to fund it properly or bring in reforms. But bringing in a shake-up would cost billions of pounds.

Earlier this week, the government did not deny newspaper reports that it was considering increasing National Insurance contributions by at least 1% to improve social care and tackle the NHS backlog.

National Insurance is paid by workers until they reach the state pension age. For someone on average earnings of £29,536 a year, a 1% increase in National Insurance would cost them £199.68 annually. Employers also pay NI.

It is probably the biggest domestic policy challenge Boris Johnson inherited when he became prime minister.

A challenge he promised to face up to and solve - sorting out social care in England.

In Scotland, there is free personal care, but accommodation costs have to be paid for.

Some care costs are capped in Wales, and home care is free in Northern Ireland.

The big questions are: Should the state have a bigger role? Should care costs be capped? And how should that be paid for?

The talk of putting up National Insurance is already proving controversial: Not only do Labour not like it, plenty of Conservatives don't either, including a former Prime Minister Sir John Major and a former Chancellor, Philip Hammond.

For some, the very idea of raising taxes makes them squeamish, for others raising National Insurance simply isn't fair, as the burden falls disproportionately on poorer people in work.

Among the Conservatives who have come out publicly against the idea is MP Marcus Fysh, who said he was "alarmed at the apparent direction of travel" of the government, and calling it a "socialist approach to social care".

He wrote in the Sunday Telegraph:, external "I do not believe it is Conservative to penalise individuals of working age and their employers with higher taxes on their employment when our manifesto promised not to."

Many other Tories accept that a tax rise is needed - but say it should not be National Insurance because that could hit younger and lower income workers harder, while pensioners would not have to pay.

On Saturday, former Conservative Prime Minister Sir John Major backed this view, telling the FT Weekend Festival: "I don't think they should use National Insurance contributions, I think that's a regressive way of doing it.

"I would rather do it in a straightforward and honest fashion and put it on taxation."

What are the challenges facing social care?

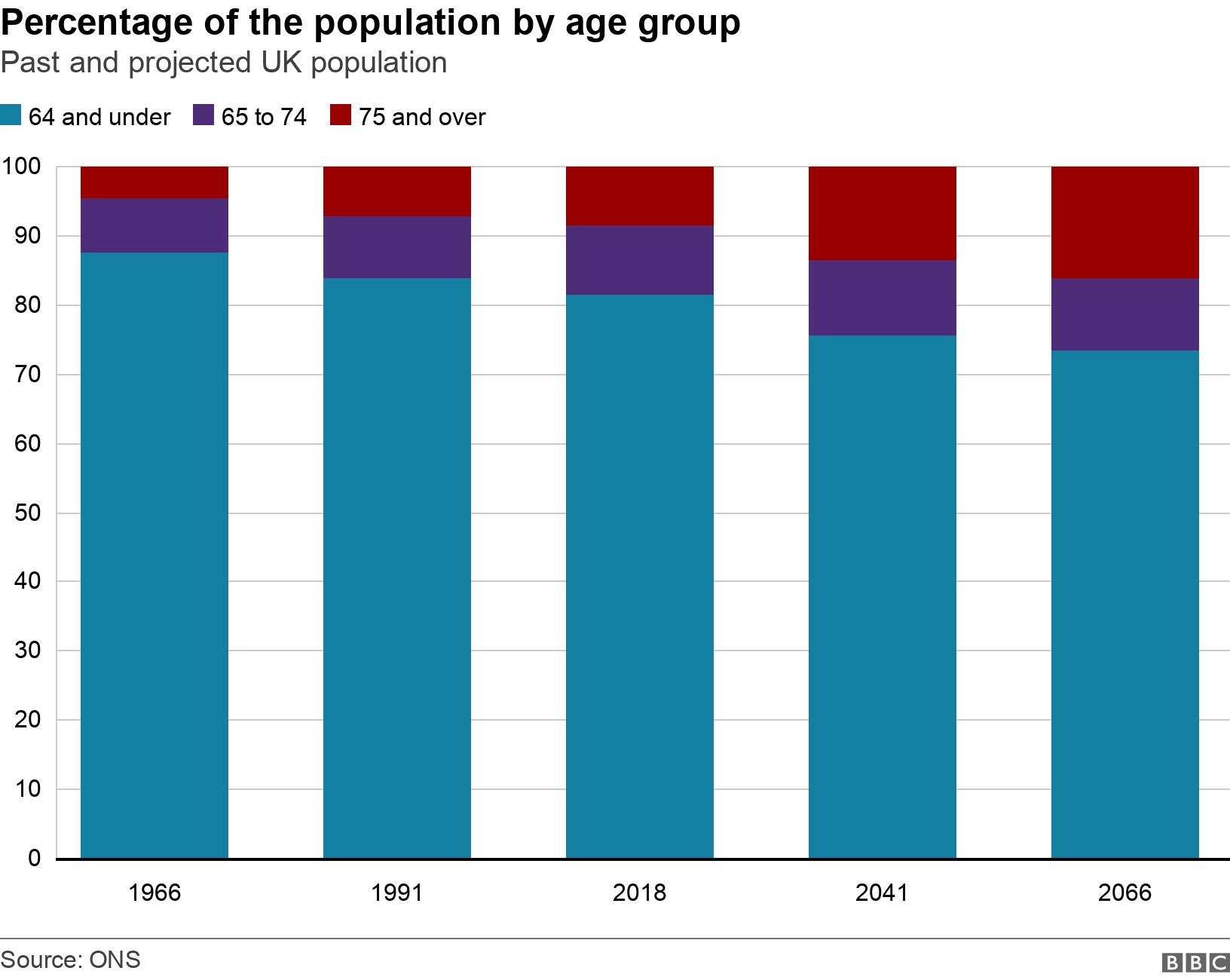

An ageing population means growing demand

However, council spending in England is about 3% lower than in 2010

Age UK estimates 1.5 million people in England don't get the help they need

The fees local authorities pay for care - in a person's own home or a care home - vary hugely

People who don't qualify for free care are often charged more, with no maximum limit on costs

There are huge staff shortages - Age UK estimates there are about 45,000 vacancies

Earlier this week former Health Secretary Jeremy Hunt said there should be a new "health and care premium" added to tax, rather than raising National Insurance or income tax, while Lord Hammond said "the only fair and workable answer is insurance scheme... if necessary government backed."

Labour has also voiced its opposition to an increase to National Insurance, with shadow foreign secretary Lisa Nandy arguing that the "burden of the social care crisis" shouldn't fall on "supermarket workers and delivery drivers".

Party leader Sir Keir Starmer is expected to come under pressure to set out how he would fund the reforms in the coming weeks.

The social care system is devolved across the four nations, meaning governments need to develop solutions unique to their own region.

Have you needed to sell your home to fund social care for a loved one? Share your experiences by emailing haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

ROE V. WADE EXPLAINED: What do the new laws mean for women in Texas?

TWO BODIES AND NO SUSPECTS: Brand new Swedish crime drama streaming now on BBC iPlayer

- Published3 September 2021

- Published8 February 2017

- Published28 June 2021